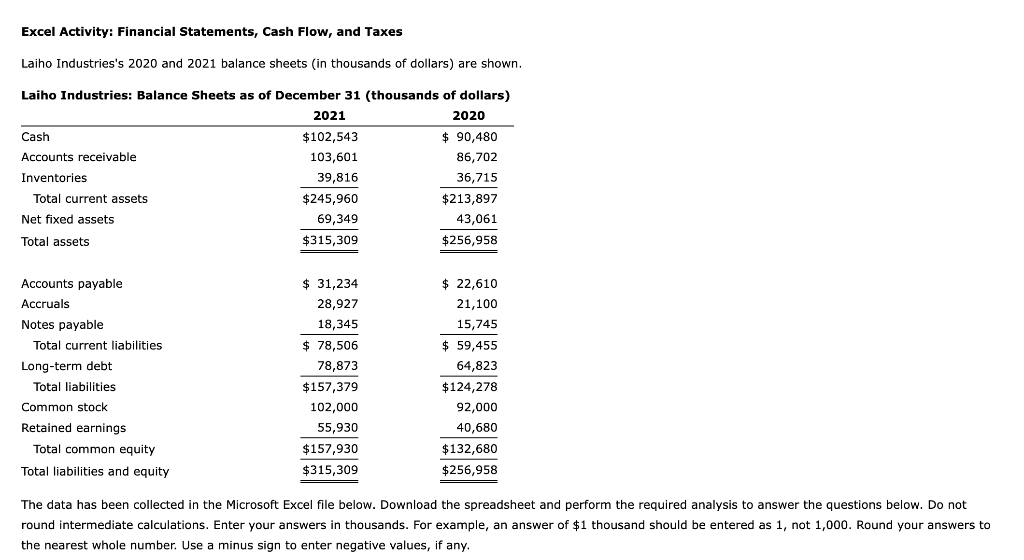

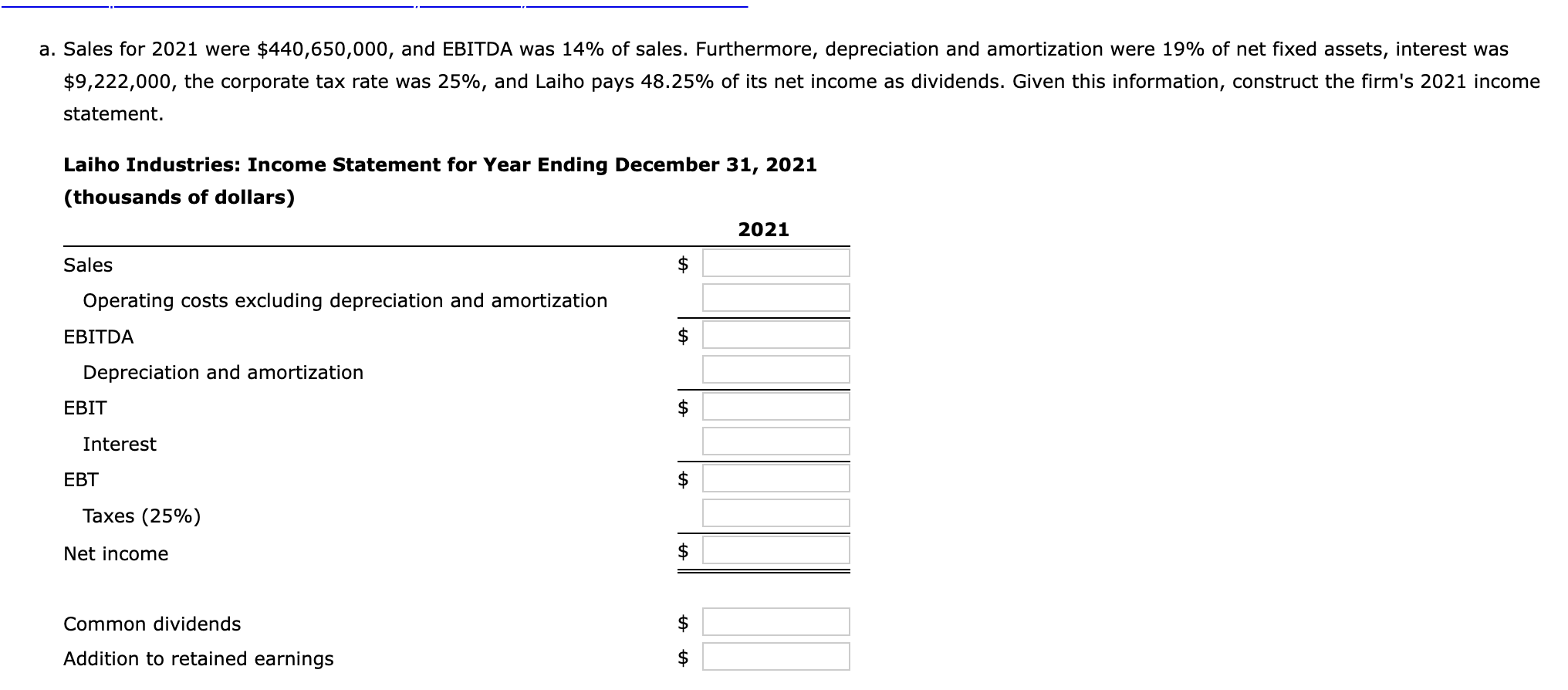

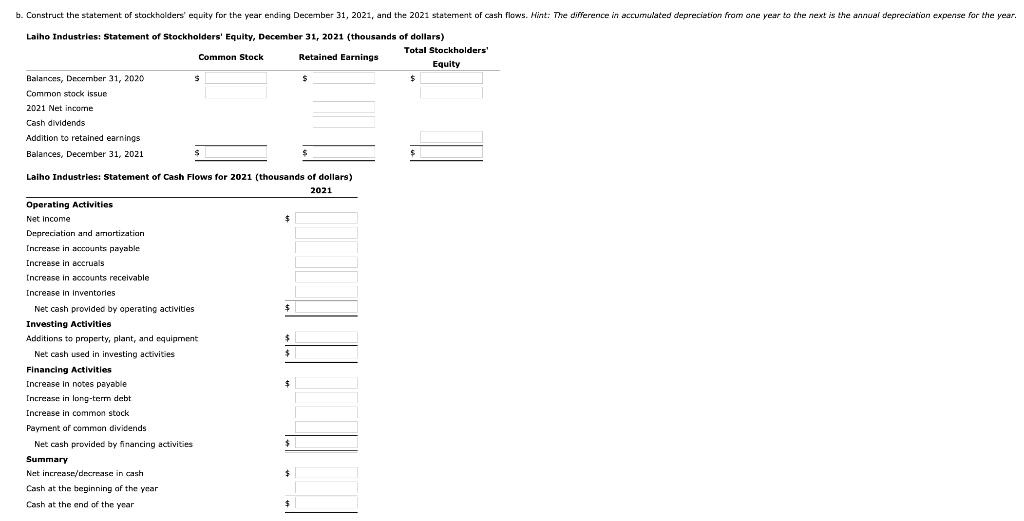

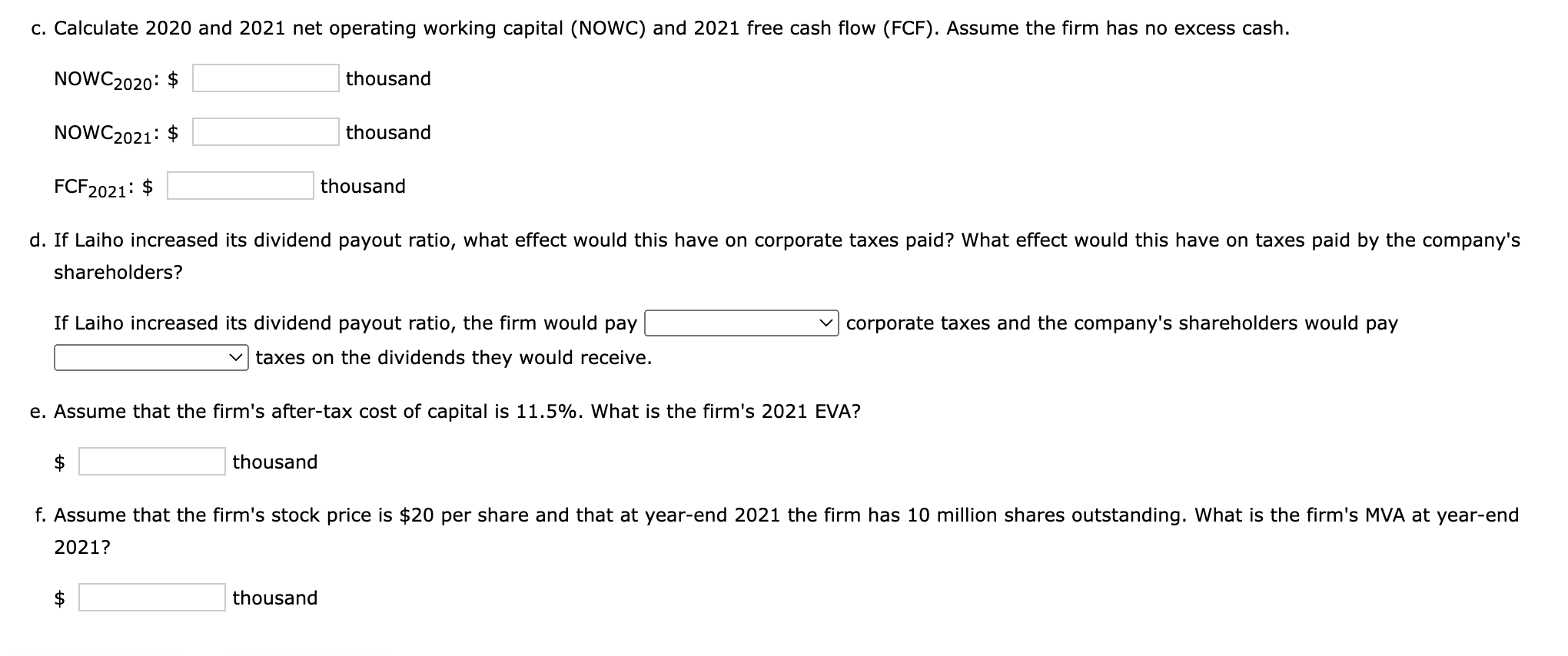

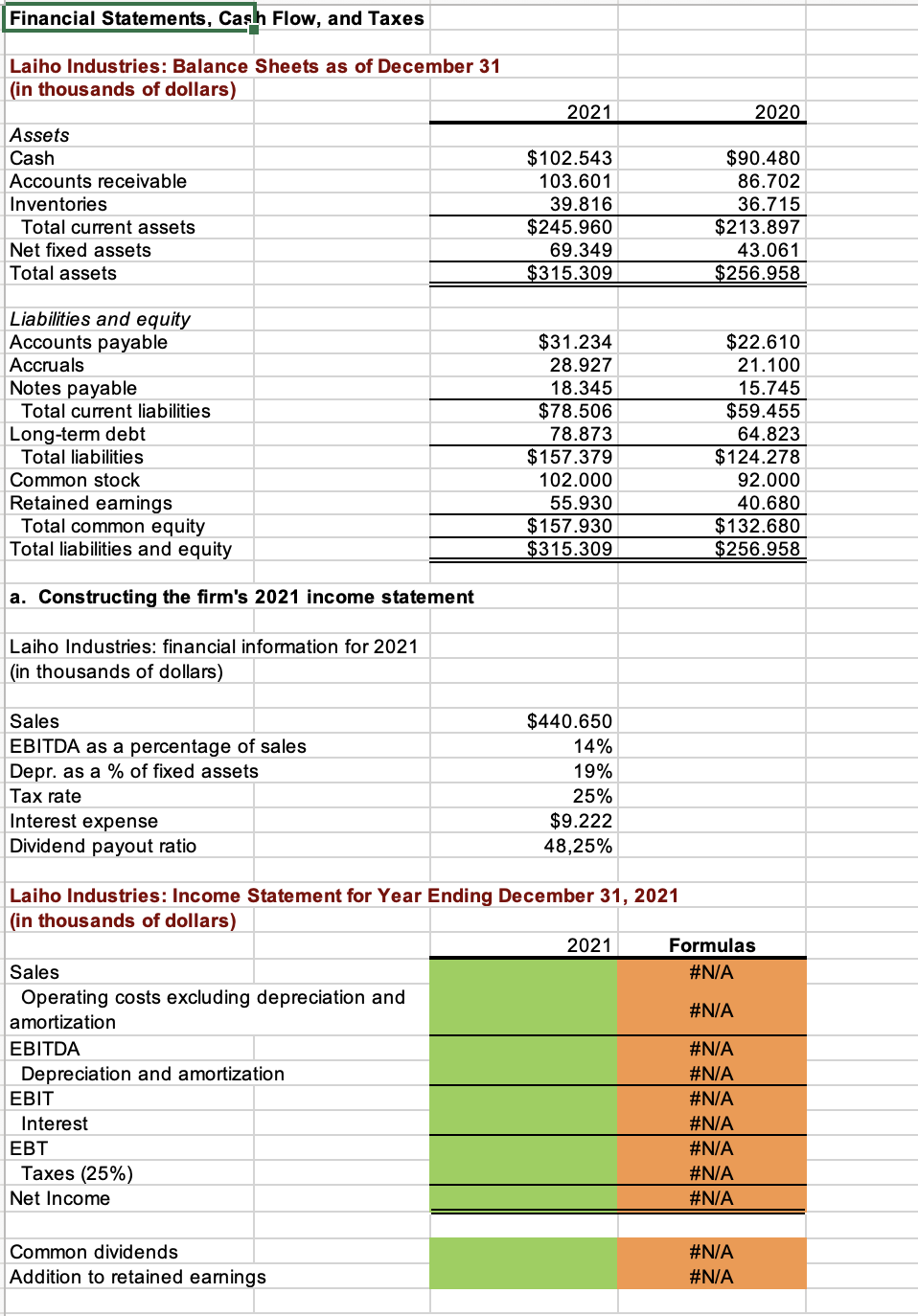

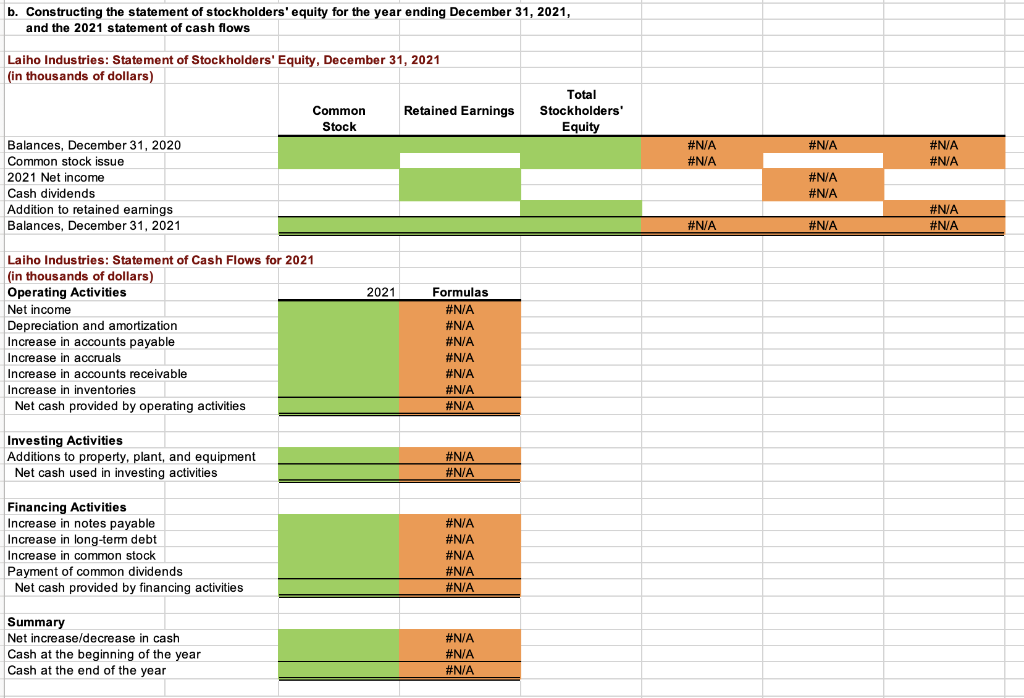

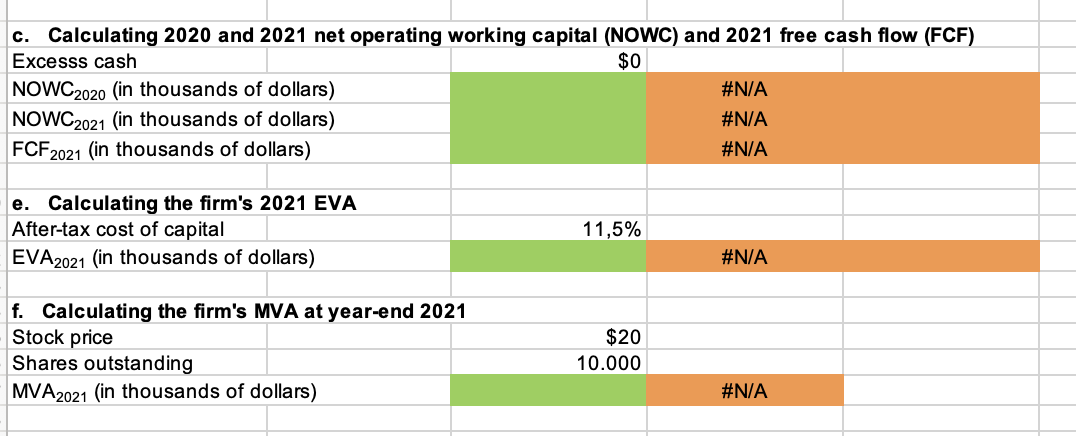

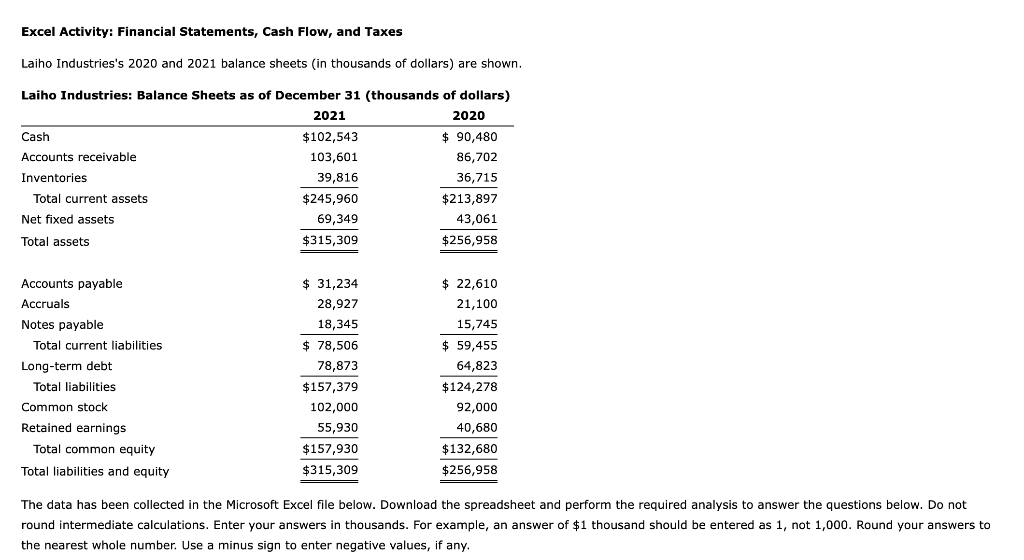

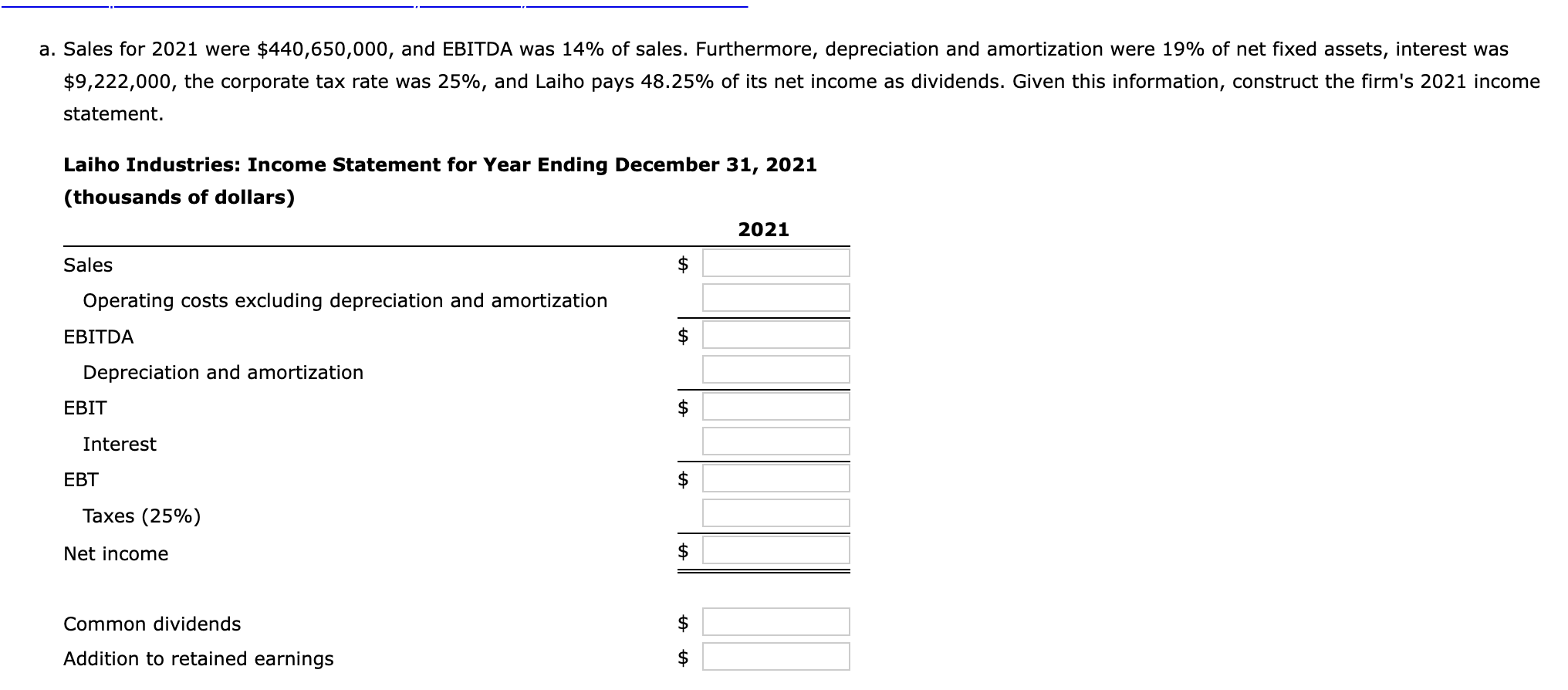

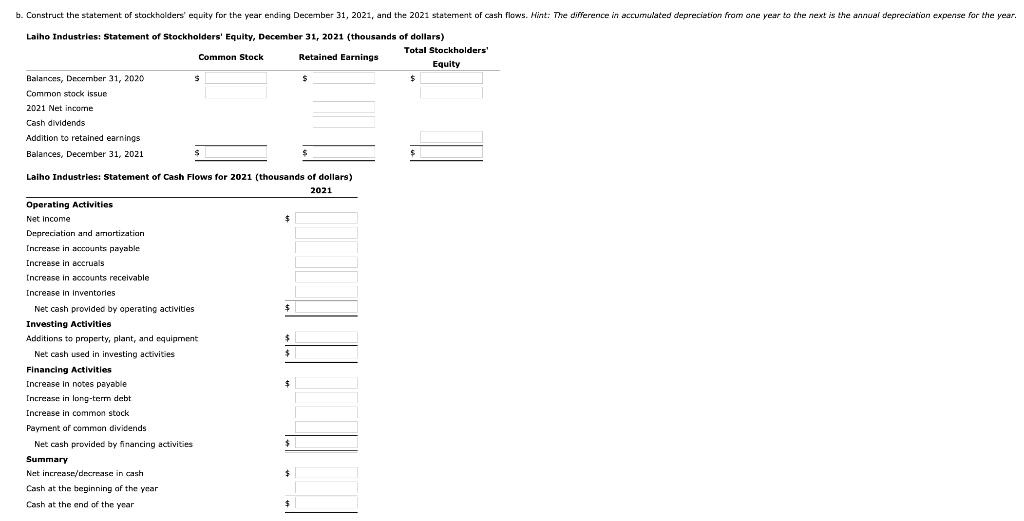

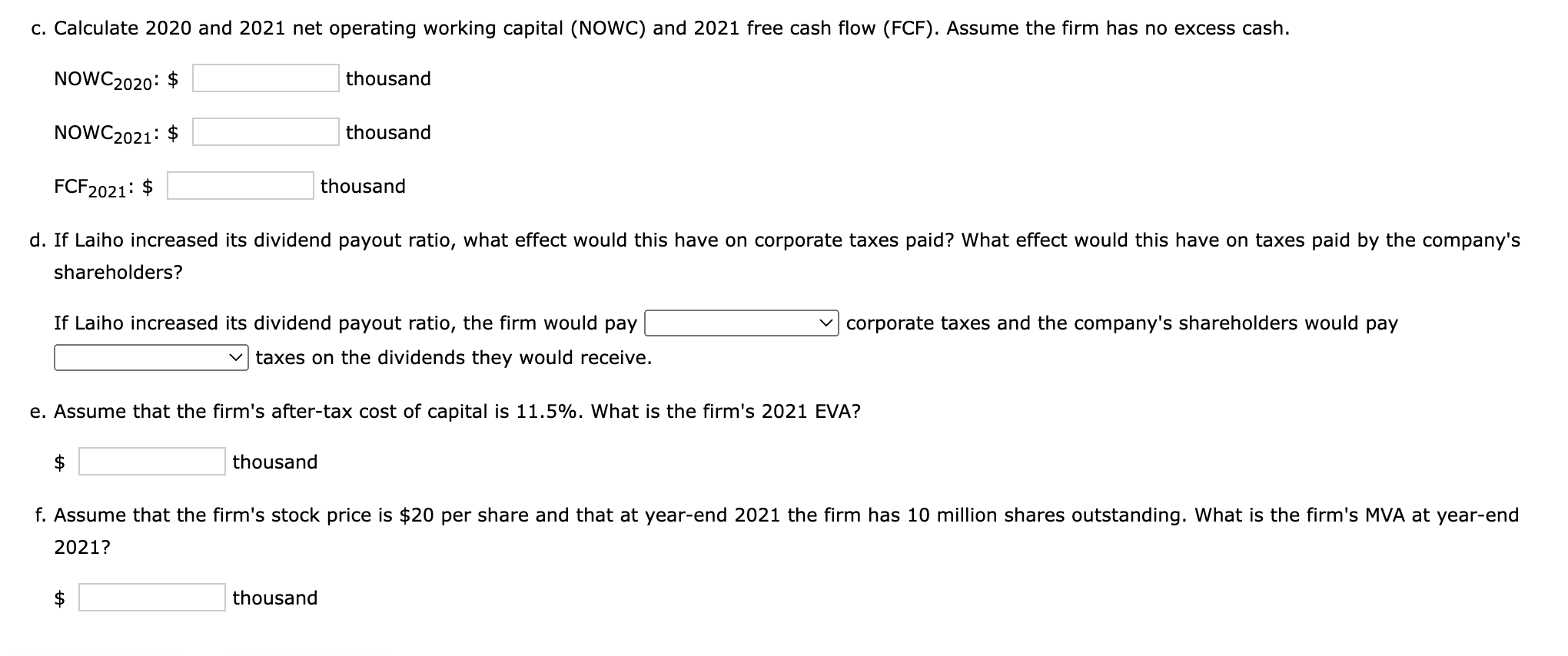

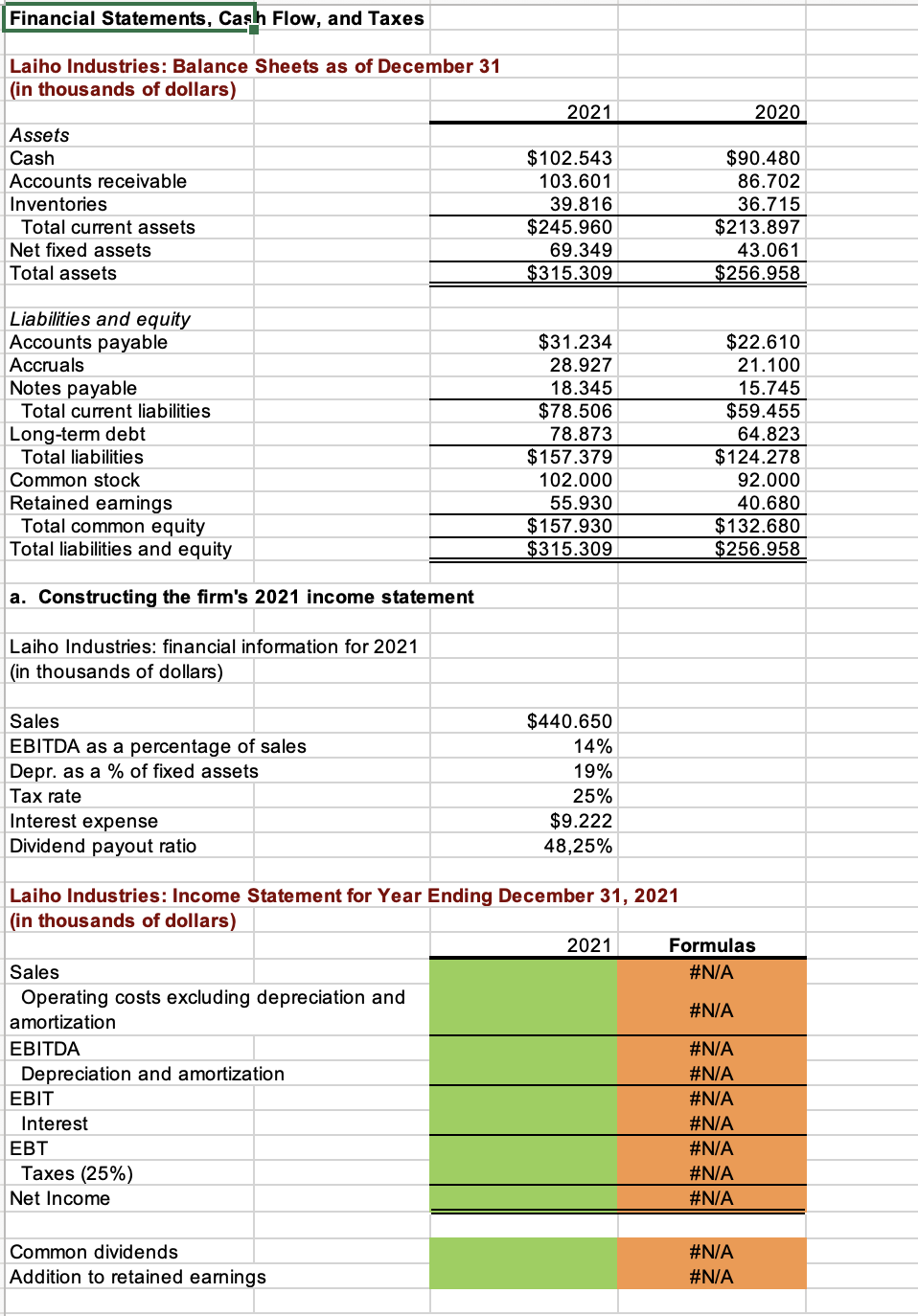

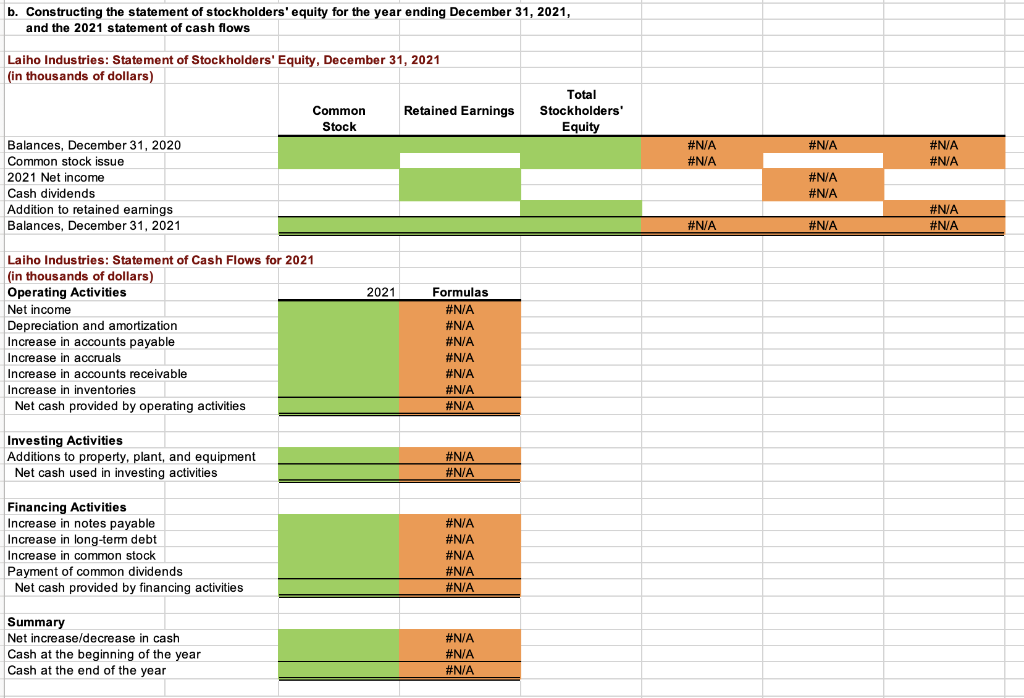

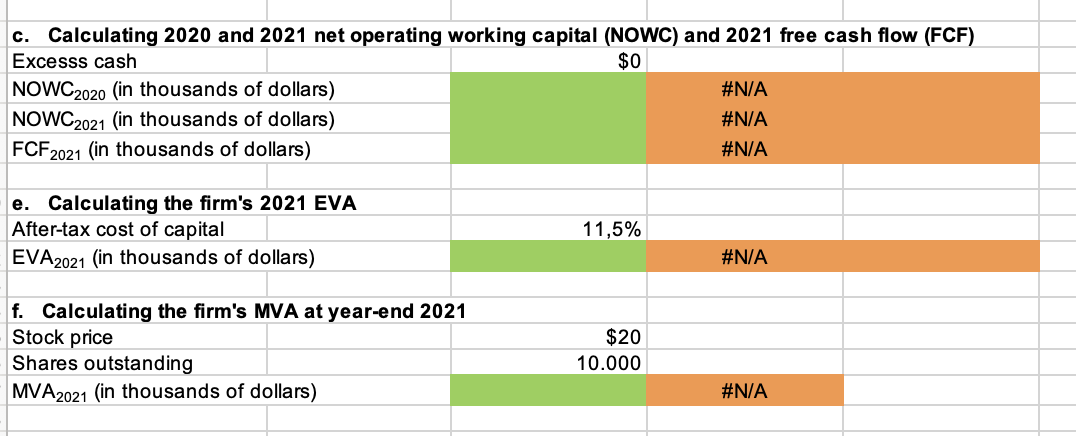

Excel Activity: Financial Statements, Cash Flow, and Taxes Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand should be entered as 1 , not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any. a. Sales for 2021 were $440,650,000, and EBITDA was 14% of sales. Furthermore, depreciation and amortization were 19% of net fixed assets, interest was $9,222,000, the corporate tax rate was 25%, and Laiho pays 48.25% of its net income as dividends. Given this information, construct the firm's 2021 income statement. Laiho Industries: Income Statement for Year Ending December 31, 2021 (thousands of dollars) Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (thousands of dollars) Laiho Industries: Statement of Cash Flows for 2021 (thousands of dollars) Operating Activities Net income Depreciatian and amortizatian Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in investing activities Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities Summary Net increase/decrease in cash Cash at the beginning of the year Cash at the end of the yoar c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC 2020:$ thousand NOWC 2021:$ thousand FCF2021:$ thousand d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 11.5%. What is the firm's 2021 EVA? $ thousand f. Assume that the firm's stock price is $20 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021? $ thousand Financial Statements, Cash Flow, and Taxes Laiho Industries: Balance Sheets as of December 31 (in thousands of dollars) a. Constructing the firm's 2021 income statement Laiho Industries: financial information for 2021 (in thousands of dollars) \begin{tabular}{lr|} Sales & $440.650 \\ \hline EBITDA as a percentage of sales & 14% \\ \hline Depr. as a \% of fixed assets & 19% \\ \hline Tax rate & 25% \\ \hline Interest expense & $9.222 \\ \hline Dividend payout ratio & 48,25% \\ \hline \end{tabular} Laiho Industries: Income Statement for Year Ending December 31, 2021 (in thousands of dollars) Common dividends Addition to retained earnings #N/A \#N/A b. Constructing the statement of stockholders' equity for the year ending December 31,2021 , and the 2021 statement of cash flows Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (in thousands of dollars) Laiho Industries: Statement of Cash Flows for 2021 (in thousands of dollars) Operating Activities Net income Depreciation and amortization Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities \begin{tabular}{lc} 2021 & Formulas \\ \hline & #N/A \\ & #N/A \\ & #N/A \\ & #N/A \\ & #N/A \\ & #N/A \\ \hline & #N/A \\ \hline \hline \end{tabular} Investing Activities Additions to property, plant, and equipment Net cash used in investing activities \begin{tabular}{l} #N/A \\ \hline N/A \\ \hline \hline \end{tabular} Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities \begin{tabular}{l} #N/A \\ #N/A \\ #N/A \\ #N/A \\ \hline N/A \\ \hline \hline \end{tabular} Summary Net increase/decrease in cash Cash at the beginning of the year Cash at the end of the year \begin{tabular}{l} #N/A \\ #N/A \\ \hline N/A \\ \hline \hline \end{tabular} c. Calculating 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF) Excesss cash NOWC2020 (in thousands of dollars) NOWC 2021 (in thousands of dollars) FCF2021 (in thousands of dollars) #N/A#N/A#N/A e. Calculating the firm's 2021 EVA After-tax cost of capital EVA 2021 (in thousands of dollars) 11,5% f. Calculating the firm's MVA at year-end 2021 Stock price Shares outstanding #N/A MVA2021 (in thousands of dollars) \#N/A