Answered step by step

Verified Expert Solution

Question

1 Approved Answer

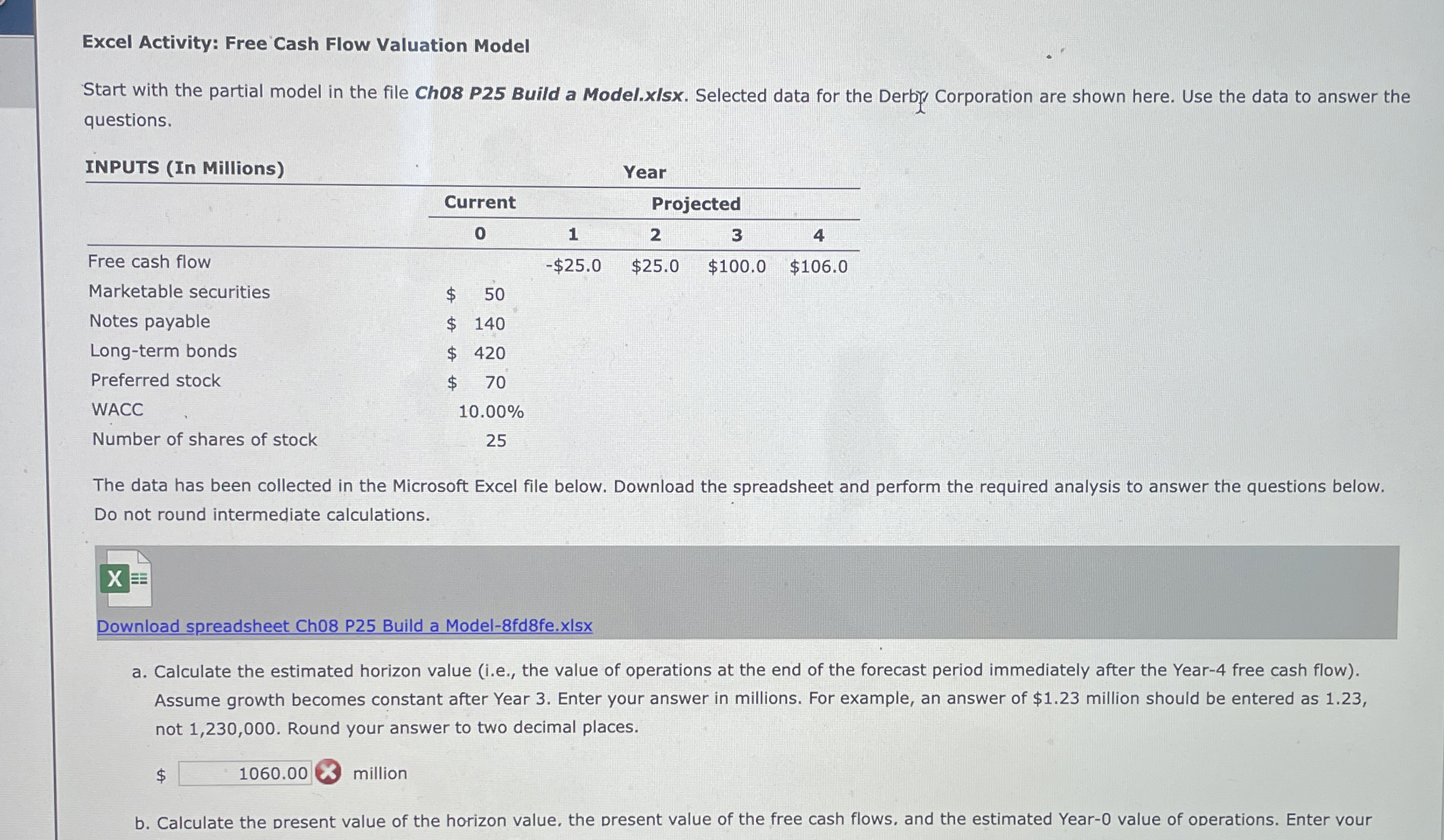

Excel Activity: Free Cash Flow Valuation Model Start with the partial model in the file Ch 0 8 P 2 5 Build a Model.xlsx .

Excel Activity: Free Cash Flow Valuation Model

Start with the partial model in the file Ch P Build a Model.xlsx Selected data for the Derby Corporation are shown here. Use the data to answer the

questions.

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below.

Do not round intermediate calculations.

a Calculate the estimated horizon value ie the value of operations at the end of the forecast period immediately after the Year free cash flow

Assume growth becomes constant after Year Enter your answer in millions. For example, an answer of $ million should be entered as

not Round your answer to two decimal places.

$

million

b Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year value of oderations. Enter vour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started