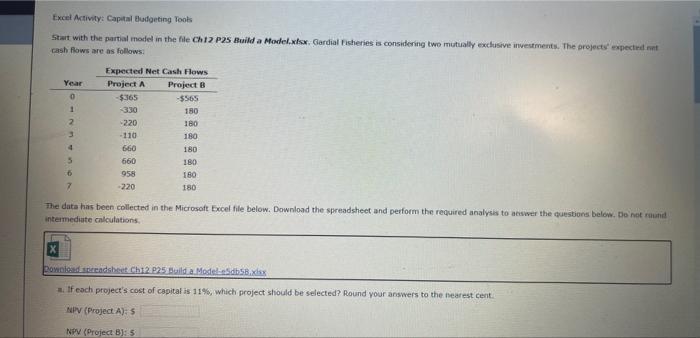

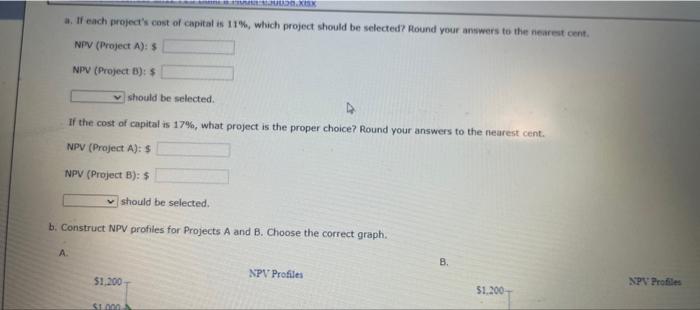

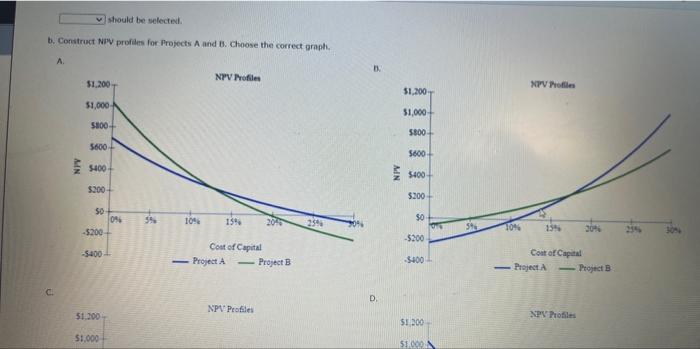

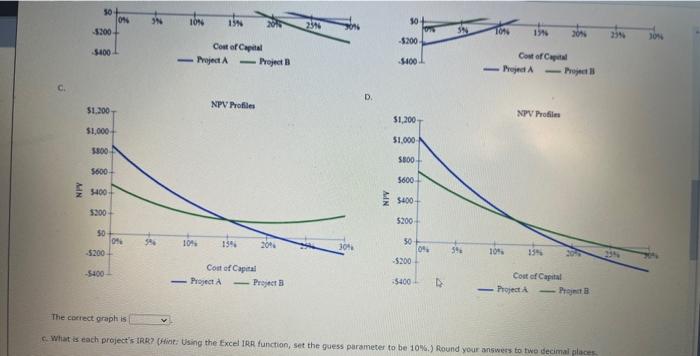

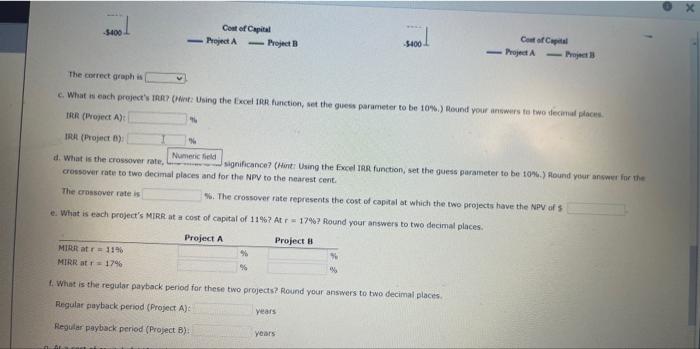

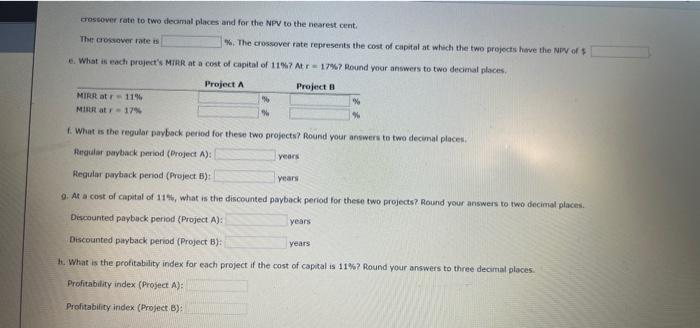

Excel Activiyz: Caputal budgeting Toots Start with the partial model in the file Ch 12 p2s Build a Model. xfor. Gardial ficheries is considering two mutually exclusive investments. The prejects' expectral mit cash flows are as follows: The data has been collected in the Microsoft Eocel file below. Download the spreadsheet and perform the required analysis to aciswer the questions below. Po not riund intermediate calculations. m. If each project's cost of capital is 1196 , which project should be selected? found your answers to the hearest cent. Hetv (Project A)+5 a. If each project's cost of capital is 11%, which project should be selected? Round your answers to the nearest cent. NiV (Project A):$ NPV (Project B):$ should be selected. If the cost of capital is 17%, what project is the proper choice? Round your answers to the nearest cent. NPV (Project A): 5 . NPV (Project B): 5 should be selected. b. Construct NPV profles for Projects A and B. Choose the correct praph. The cesiect graph is 6. What is each preject'stRR?? (Hine; USing the Excel IRR function, set the quess parameter to be 10-s.) found your answers to two secimal alaces The costect aroph is c. What is each project's Ines? (rime. Using the Lecel iga hanction, set the guess parameter to be 10\%.) Resind your answers ta two ifecimat places. Itic (Project A) ? 124 (Dropect B) 1. What is the crossover rate, ghificance? (Hinz Uaing the fxcel lag function, set the guess parameter to be 10\%6.) Hound your an wyer for the The crossover rate is W. The crossover rate represents the cost of cagmal at which the two projects have the NPV of 5 e. What is each project's MiRR at a cost of capital of 11% ? At r=17% ? found your answers to two decimal places. 1. What is the reguar payback peniod for thece two projects? Round your ansivers to two decimal places. Regular payback period (Project A)d years Regular paybsck period (Project B) rossover rate to two siecamal places and for the NPV to the nearest cent. The rossover rote is W.. The gossover rate represents the cost of capial at which the two projects have the NIN of s e. What is each preject's Mith at a cost of capital of 11% ? Atr=17% ? Round your answers to two decimal places. f. What is the regular paybock period for these two projects? Round your answers to two decinal places. Aenailar parback period (Droject A ): Pegular payback period (Project B): years 9. At a cost of capital of 114., what is the discounted payback period for these two projects? Round your answers to two decimial places. Discounted paybuck period \{Project A): years Biscounted piryback period (Project B): years 1. What is the profitablity index for each project if the cost of captal is 11% ? Round your answers to three decimal places. Profitability index (Project A): Profitability index (Project. B): Excel Activiyz: Caputal budgeting Toots Start with the partial model in the file Ch 12 p2s Build a Model. xfor. Gardial ficheries is considering two mutually exclusive investments. The prejects' expectral mit cash flows are as follows: The data has been collected in the Microsoft Eocel file below. Download the spreadsheet and perform the required analysis to aciswer the questions below. Po not riund intermediate calculations. m. If each project's cost of capital is 1196 , which project should be selected? found your answers to the hearest cent. Hetv (Project A)+5 a. If each project's cost of capital is 11%, which project should be selected? Round your answers to the nearest cent. NiV (Project A):$ NPV (Project B):$ should be selected. If the cost of capital is 17%, what project is the proper choice? Round your answers to the nearest cent. NPV (Project A): 5 . NPV (Project B): 5 should be selected. b. Construct NPV profles for Projects A and B. Choose the correct praph. The cesiect graph is 6. What is each preject'stRR?? (Hine; USing the Excel IRR function, set the quess parameter to be 10-s.) found your answers to two secimal alaces The costect aroph is c. What is each project's Ines? (rime. Using the Lecel iga hanction, set the guess parameter to be 10\%.) Resind your answers ta two ifecimat places. Itic (Project A) ? 124 (Dropect B) 1. What is the crossover rate, ghificance? (Hinz Uaing the fxcel lag function, set the guess parameter to be 10\%6.) Hound your an wyer for the The crossover rate is W. The crossover rate represents the cost of cagmal at which the two projects have the NPV of 5 e. What is each project's MiRR at a cost of capital of 11% ? At r=17% ? found your answers to two decimal places. 1. What is the reguar payback peniod for thece two projects? Round your ansivers to two decimal places. Regular payback period (Project A)d years Regular paybsck period (Project B) rossover rate to two siecamal places and for the NPV to the nearest cent. The rossover rote is W.. The gossover rate represents the cost of capial at which the two projects have the NIN of s e. What is each preject's Mith at a cost of capital of 11% ? Atr=17% ? Round your answers to two decimal places. f. What is the regular paybock period for these two projects? Round your answers to two decinal places. Aenailar parback period (Droject A ): Pegular payback period (Project B): years 9. At a cost of capital of 114., what is the discounted payback period for these two projects? Round your answers to two decimial places. Discounted paybuck period \{Project A): years Biscounted piryback period (Project B): years 1. What is the profitablity index for each project if the cost of captal is 11% ? Round your answers to three decimal places. Profitability index (Project A): Profitability index (Project. B)