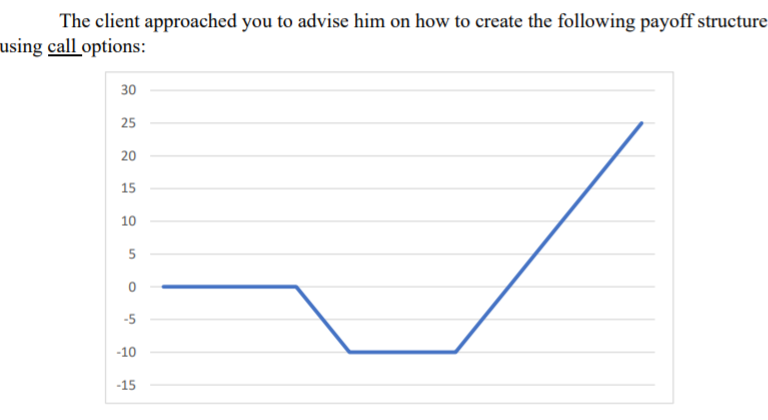

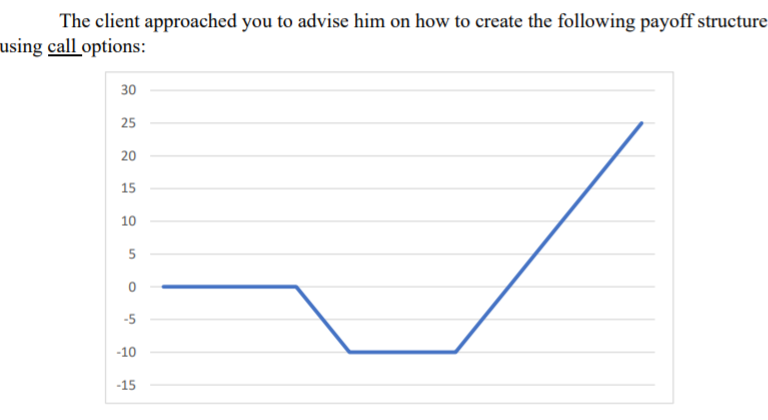

Excel Applications Section 1 BRK-b stock we selected as an underlying. In Bloomberg, Go to the stock page by entering the ticker of your stock. For example, if the company you chose is Ford Motors, you should type in Bloomberg: F US

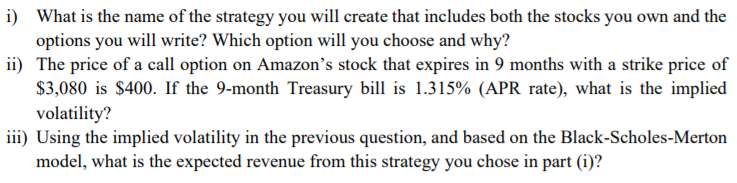

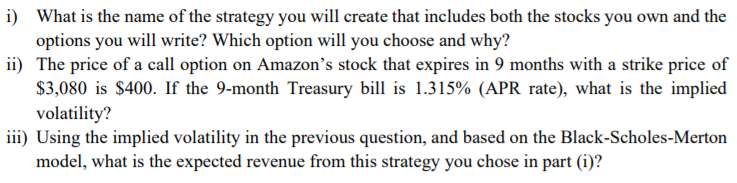

. Once the main screen for your stock is loaded, go to the option monitor page that displays the most active options available for your stock: Type OMST 1. Once the new screen is loaded, export the page to Excel and include it in the Excel file you must 1 OMST refers to most active options (Single Security). submit with your final project. Answer the following questions by writing the option's ticker as it shows under the name column: i) Which option is the most active option contract? ii) Which option has the highest open interest? iii) How can you create a synthetic long position in the underlying stock using the options available in the list? Which options will you choose? iv) How can you create a synthetic short position in the underlying stock using the options available in the list? Which options will you choose? A client came to you asking for your advice to create an option strategy that will provide the payoff structure using certain options on the stock you chose above. The options should expire in 1 month. The payoff structure The client approached you to advise him on how to create the following payoff structure using call options: 30 25 20 15 10 5 -5 -10 -15 In Bloomberg, use the GV for the loaded stock to evaluate its historical volatility and the implied volatility. Get a copy of the volatility chart and use the historical volatility as an input for the questions below. Using the FIT screen and Bills tab, select a Treasury yield with maturity closest to the option's expiration. Note that the yield is a simple annual rate (APR). Your task is to create a strategy that meets the client's needs using a combination of the options from the list you got from Bloomberg. v) Explain how your client can create the required strategy using options (i.e., what is the mix of options you need for this strategy). vi) Paste a clear copy of the volatility chart. vii) Using a five-step binomial tree approach and showing the inputs you used in your calculation, calculate this strategy's cost. viii)Draw the payoff and profit (loss) diagram. ix) At what price (or prices) of the underlying stock the strategy will breakeven? x) What assumptions did the client make that motives the creation of this strategy? Section 2 You own 100 stocks of Amazon's stock. The current stock price is $3,120. You believe that the stock price will double in two years, but you have a strong feeling that the stock price will drop in the next six months due to the current economic conditions. Therefore, based on your expectations, you want to benefit from the stock price movement by writing options without giving up your stock. The options available in the CBOE are as follows: Option Type Strike Price Maturity Call $3,080 3 Months Call $3,100 3 Months Call $3,120 3 Months Put $3,080 3 Months Put $3,100 3 Months Put $3,120 3 Months i) What is the name of the strategy you will create that includes both the stocks you own and the options you will write? Which option will you choose and why? ii) The price of a call option on Amazon's stock that expires in 9 months with a strike price of $3,080 is $400. If the 9-month Treasury bill is 1.315% (APR rate), what is the implied volatility? iii) Using the implied volatility in the previous question, and based on the Black-Scholes-Merton model, what is the expected revenue from this strategy you chose in part (1)? Excel Applications Section 1 BRK-b stock we selected as an underlying. In Bloomberg, Go to the stock page by entering the ticker of your stock. For example, if the company you chose is Ford Motors, you should type in Bloomberg: F US . Once the main screen for your stock is loaded, go to the option monitor page that displays the most active options available for your stock: Type OMST 1. Once the new screen is loaded, export the page to Excel and include it in the Excel file you must 1 OMST refers to most active options (Single Security). submit with your final project. Answer the following questions by writing the option's ticker as it shows under the name column: i) Which option is the most active option contract? ii) Which option has the highest open interest? iii) How can you create a synthetic long position in the underlying stock using the options available in the list? Which options will you choose? iv) How can you create a synthetic short position in the underlying stock using the options available in the list? Which options will you choose? A client came to you asking for your advice to create an option strategy that will provide the payoff structure using certain options on the stock you chose above. The options should expire in 1 month. The payoff structure The client approached you to advise him on how to create the following payoff structure using call options: 30 25 20 15 10 5 -5 -10 -15 In Bloomberg, use the GV for the loaded stock to evaluate its historical volatility and the implied volatility. Get a copy of the volatility chart and use the historical volatility as an input for the questions below. Using the FIT screen and Bills tab, select a Treasury yield with maturity closest to the option's expiration. Note that the yield is a simple annual rate (APR). Your task is to create a strategy that meets the client's needs using a combination of the options from the list you got from Bloomberg. v) Explain how your client can create the required strategy using options (i.e., what is the mix of options you need for this strategy). vi) Paste a clear copy of the volatility chart. vii) Using a five-step binomial tree approach and showing the inputs you used in your calculation, calculate this strategy's cost. viii)Draw the payoff and profit (loss) diagram. ix) At what price (or prices) of the underlying stock the strategy will breakeven? x) What assumptions did the client make that motives the creation of this strategy? Section 2 You own 100 stocks of Amazon's stock. The current stock price is $3,120. You believe that the stock price will double in two years, but you have a strong feeling that the stock price will drop in the next six months due to the current economic conditions. Therefore, based on your expectations, you want to benefit from the stock price movement by writing options without giving up your stock. The options available in the CBOE are as follows: Option Type Strike Price Maturity Call $3,080 3 Months Call $3,100 3 Months Call $3,120 3 Months Put $3,080 3 Months Put $3,100 3 Months Put $3,120 3 Months i) What is the name of the strategy you will create that includes both the stocks you own and the options you will write? Which option will you choose and why? ii) The price of a call option on Amazon's stock that expires in 9 months with a strike price of $3,080 is $400. If the 9-month Treasury bill is 1.315% (APR rate), what is the implied volatility? iii) Using the implied volatility in the previous question, and based on the Black-Scholes-Merton model, what is the expected revenue from this strategy you chose in part (1)