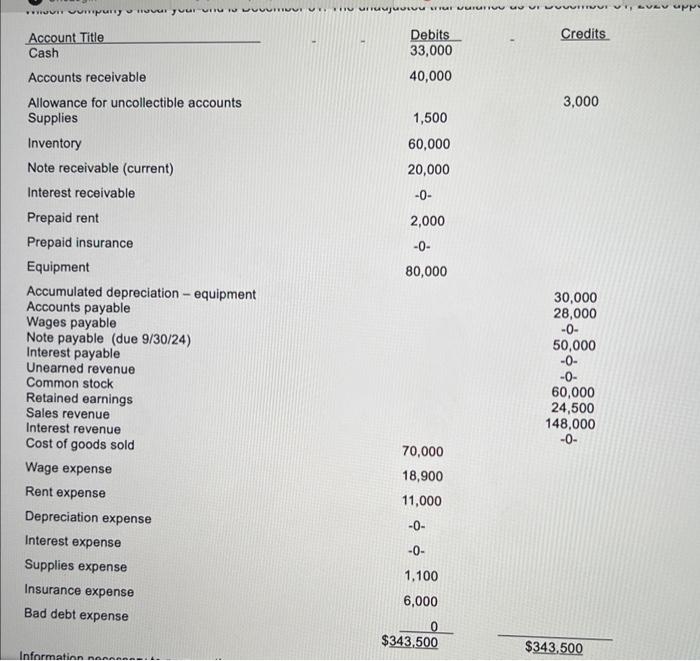

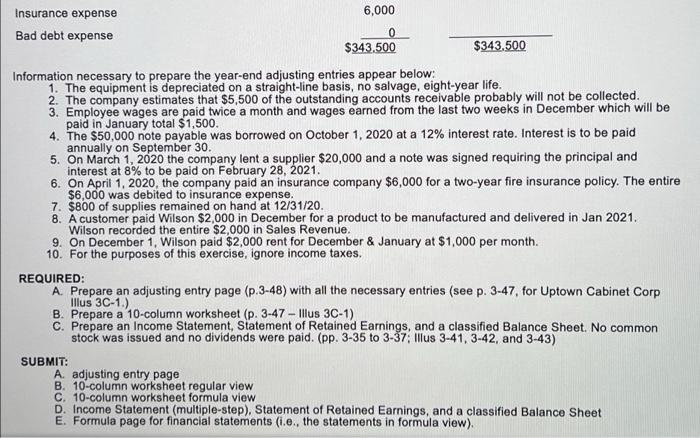

I Wury Hour wivu wa MUTU Wur worri VV UP Credits Debits 33,000 40,000 3,000 1,500 60,000 20,000 -0- 2,000 -0- 80,000 Account Title Cash Accounts receivable Allowance for uncollectible accounts Supplies Inventory Note receivable (current) Interest receivable Prepaid rent Prepaid insurance Equipment Accumulated depreciation - equipment Accounts payable Wages payable Note payable (due 9/30/24) Interest payable Unearned revenue Common stock Retained earnings Sales revenue Interest revenue Cost of goods sold Wage expense Rent expense Depreciation expense Interest expense Supplies expense 30,000 28,000 -0- 50,000 -0- -0- 60,000 24,500 148,000 -0- 70,000 18,900 11,000 -0- -0- 1,100 Insurance expense 6,000 Bad debt expense $343,500 $343.500 Information nannnnn Insurance expense 6,000 Bad debt expense 0 $343.500 $343.500 Information necessary to prepare the year-end adjusting entries appear below: 1. The equipment is depreciated on a straight-line basis, no salvage, eight-year life. 2. The company estimates that $5,500 of the outstanding accounts receivable probably will not be collected. 3. Employee wages are paid twice a month and wages earned from the last two weeks in December which will be paid in January total $1,500. 4. The $50,000 note payable was borrowed on October 1, 2020 at a 12% interest rate. Interest is to be paid annually on September 30. 5. On March 1, 2020 the company lent a supplier $20,000 and a note was signed requiring the principal and interest at 8% to be paid on February 28, 2021. 6. On April 1, 2020, the company paid an insurance company $6,000 for a two-year fire insurance policy. The entire $6,000 was debited to insurance expense. 7. $800 of supplies remained on hand at 12/31/20. 8. A customer paid Wilson $2,000 in December for a product to be manufactured and delivered in Jan 2021. Wilson recorded the entire $2,000 in Sales Revenue. 9. On December 1. Wilson paid $2,000 rent for December & January at $1,000 per month. 10. For the purposes of this exercise, ignore income taxes. REQUIRED: A. Prepare an adjusting entry page (p.3-48) with all the necessary entries (see p. 3-47, for Uptown Cabinet Corp Illus 3C-1.) B. Prepare a 10-column worksheet (p. 3-47 - Illus 3C-1). C. Prepare an Income Statement, Statement of Retained Earnings, and a classified Balance Sheet. No common stock was issued and no dividends were paid. (pp. 3-35 to 3-37 Illus 3-41, 3-42, and 3-43) SUBMIT: A. adjusting entry page B. 10-column worksheet regular view C. 10-column worksheet formula view D. Income Statement (multiple-step), Statement of Retained Earnings, and a classified Balance Sheet E. Formula page for financial statements (ie., the statements in formula view)