Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excel calculations are ok 1. A company is considering choosing between two mutually exclusive projects. The first project (project A) requires an upfront investment of

Excel calculations are ok

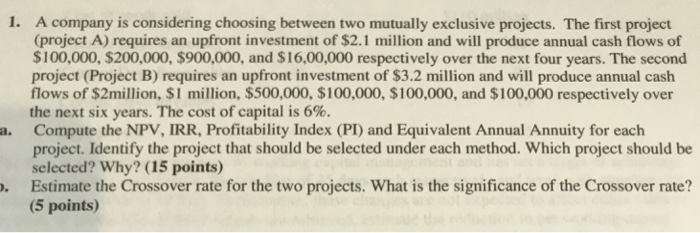

1. A company is considering choosing between two mutually exclusive projects. The first project (project A) requires an upfront investment of $2.1 million and will produce annual cash flows of $100,000, $200,000, $900,000, and $16,00,000 respectively over the next four years. The second project (Project B) requires an upfront investment of $3.2 million and will produce annual cash flows of $2million, $1 million, $500,000, $100,000, $100,000, and $100,000 respectively over the next six years. The cost of capital is 6%. Compute the NPVV, IRR, Profitability Index (PI) and Equivalent Annual Annuity for each a. project. Identify the project that should be selected under each method. Which project should be selected? Why? (15 points) Estimate the Crossover rate for the two projects. What is the significance of the Crossover rate? (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started