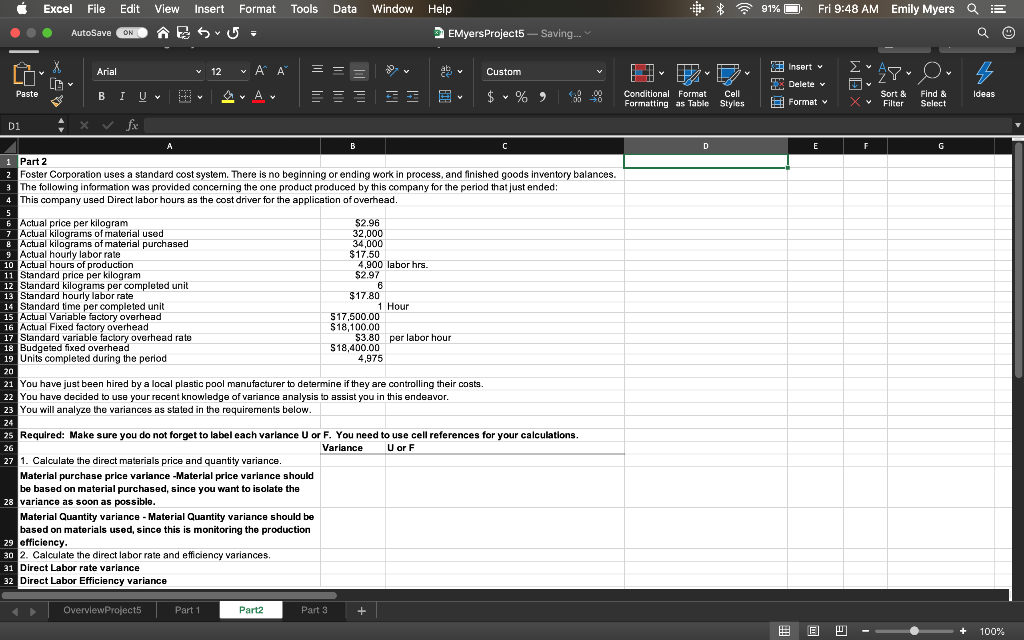

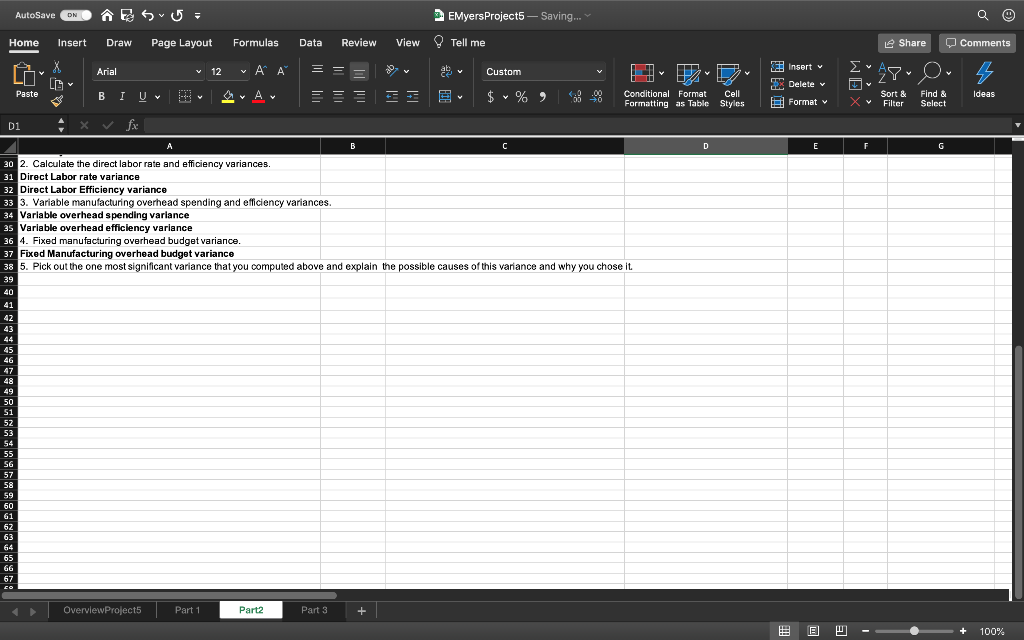

Excel File Edit View Insert Format Format Tools Data 91% Fri 9:48 AM Emily Myers Q Window Help EMyers Project - Saving... AutoSave ON v 12 ~ A Arial Custom Insert v 1 H Y 4 Delete v Paste B I U E $ % Conditional Format Cell Formatting as Table Styles Ideas Sort & Filter Format v Find & Select D E F D1 fx B 1 Part 2 2 Foster Corporation uses a standard cost system. There is no beginning or ending work in process, and finished goods inventory balances. 3 The following information was provided concerning the one product produced by this company for the period that just ended: 4 This company used Direct labor hours as the cost driver for the application of overhead. 5 Actual price per kilogram $2.96 7 Actual kilograms of material used 32,000 8 Actual kilograms of material purchased 34,000 Actual hourly labor rate $17.50 10 Actual hours of production 4,900 labor hrs. 11 Standard price per kilogram $2.97 Standard kilograms per completed unit 6 13 Standard hourly labor rate $17.80 Standard time per completed unit 1 Hour 15 Actual Variable factory overhead S17,500.00 16 Actual Fixed factory overhead $18,100.00 17 Standard variable factory overhead rate $3.80 por labor hour 18 Budgeted fixed overhead $18,400.00 19 Units completed during the period 4,975 20 21 You have just been hired by a local plastic pool manufacturer to determine if they are controlling their costs. 22 You have decided to use your recent knowledge of variance analysis to assist you in this endeavor. 23 You will analyze the variances as stated in the requirements below. 24 25 Required: Make sure you do not forget to label each variance U or F. You need to use cell references for your calculations. 26 Variance U or F 27 1. Calculate the direct materials price and quantity variance, Material purchase price variance - Material price variance should be based on material purchased, since you want to isolate the 28 variance as soon as possible. Material Quantity variance - Material Quantity variance should be based on materials used, since this is monitoring the production 29 efficiency. 30 2. Calculate the direct labor rate and efficiency variances 31 Direct Labor rate variance Direct Labor Efficiency variance Overview Projects Part 1 Part2 Part 3 m 100% AutoSave ON 5 Myers Projects Saving... Q Home Insert Draw Page Layout Formulas Data Review View Tell me e Share 0 Comments Arial v 12 Insert v = > 1 Custom H 27 0 5 Delete v Paste BI U = $ % Y Ideas Conditional Format Cell Formatting as Table Styles Sort & Filter Format v Find & Select Di fox A B C D E F 30 2. Calculate the direct labor rate and efficiency variances. 31 Direct Labor rate variance 32 Direct Labor Efficiency variance 33 3. Variable manufacturing overhead spending and efficiency variances 34 Variable overhead spending variance 35 Variable overhead efficiency variance 36 4. Fixed manufacturing overhead budget variance. 37 Fixed Manufacturing overhead budget variance 38 5. Pick out the one most significant variance that you computed above and explain the possible causes of this variance and why you chose it 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 Overview Projects Part 1 Part2 Part 3 100%