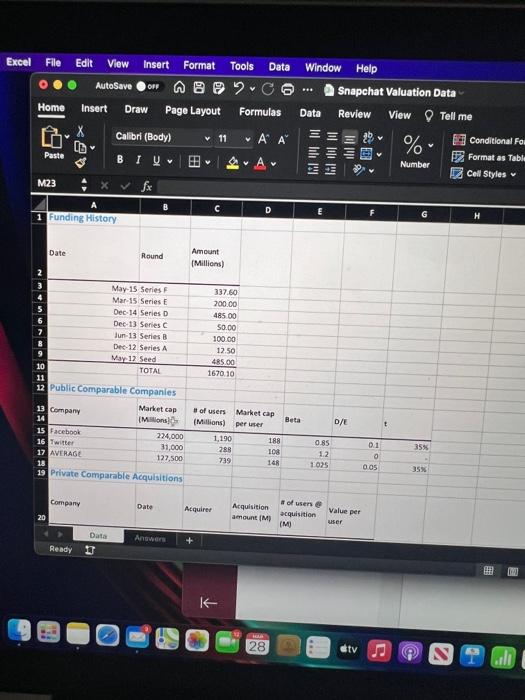

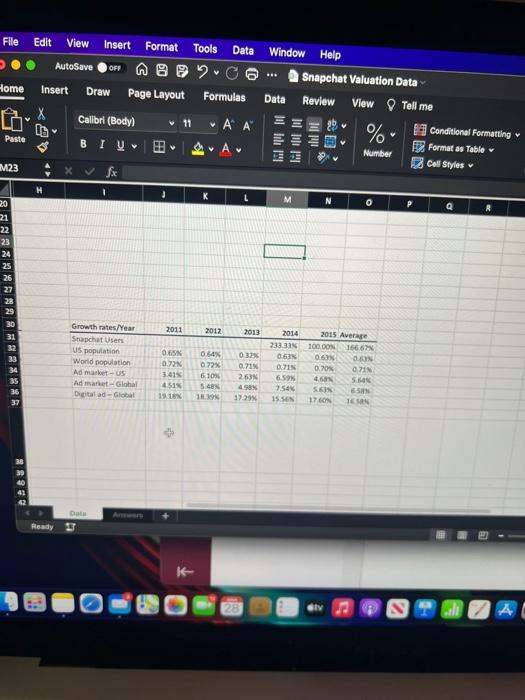

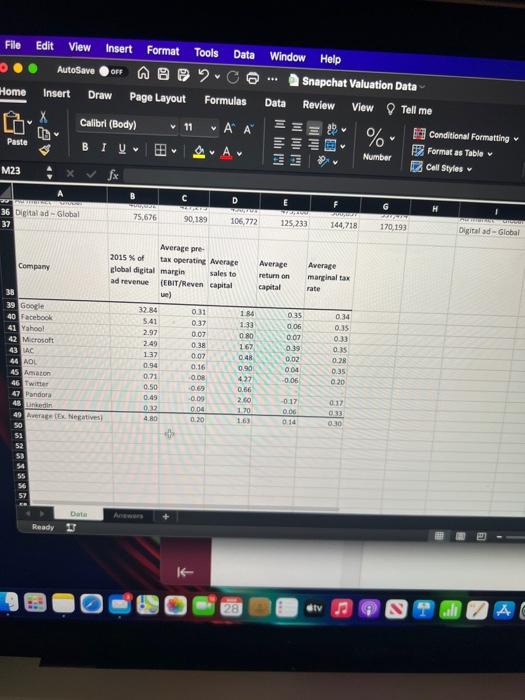

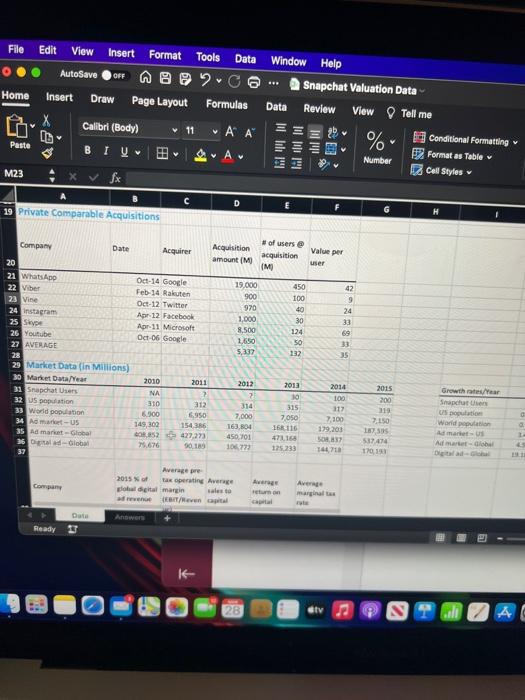

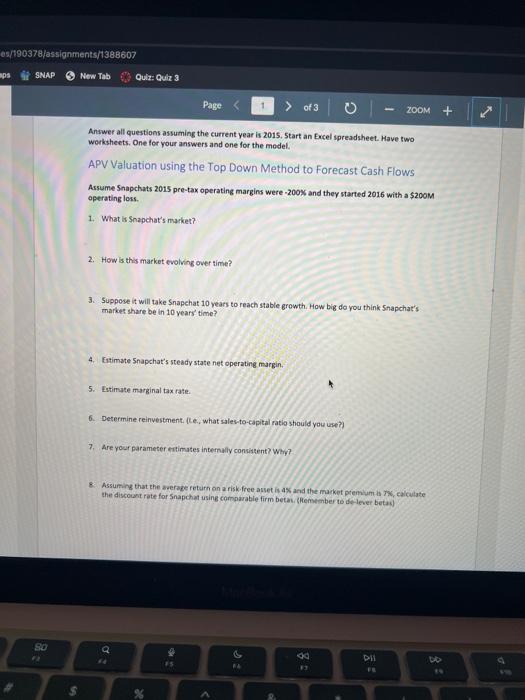

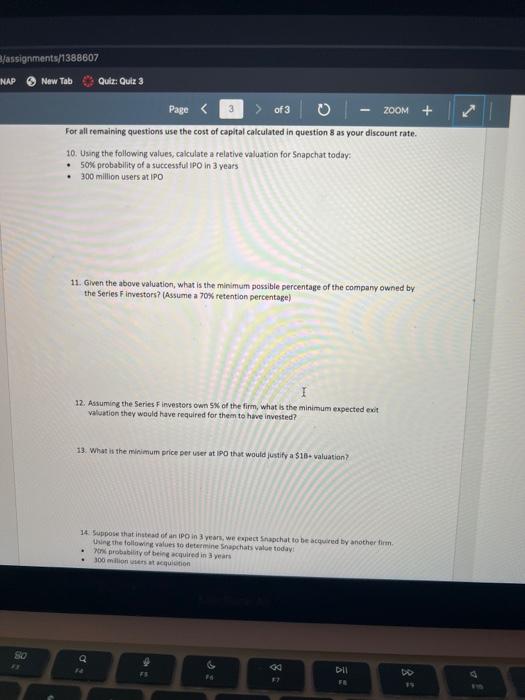

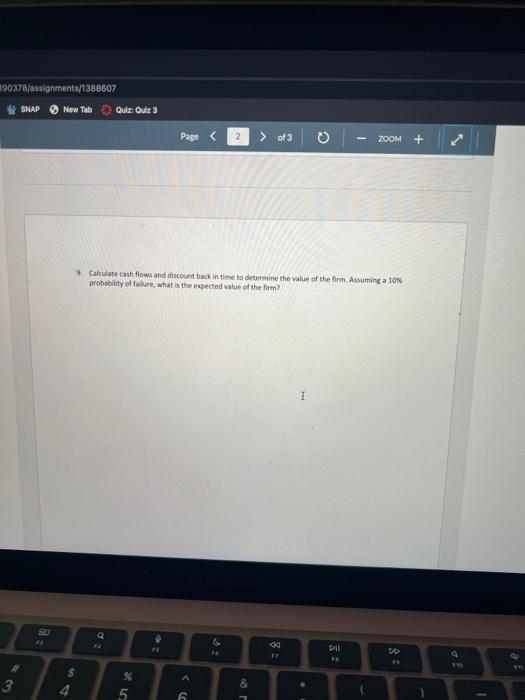

Excel File Edit View Insert Format Tools Data AutoSave OF ACO Home Insert Draw Page Layout Formulas Window Help Snapchat Valuation Data Data Review View Tell me Calibri (Body) v 11 A A % Paste BIU HYYTII A Conditional Fou Format as Table Cell Styles Number M23 x fx B A 1 Funding History D F G H Date Round Amount (Millions) 337.60 REBNOWN 200.00 485.00 S0.00 100.00 12.50 45.00 1670.10 May-15 Series Mar 15 Series Dec-14 Series Dec 13 Series Jun 13 Series B Dec 12 Series A May 12 Seed 10 TOTAL 11 12 Public Comparable Companies 13 Company Market cap 14 (Millons 15 Facebook 224,000 16 Twitter 31,000 17 AVERAGE 127,500 18 19 Private Comparable Acquisitions D/E t of users Market cap Beta (Millions) per user 1,190 188 288 108 739 148 0.85 12 0.1 35% . 1025 0.05 35% Company Date Acquirer Acquisition amount (M) of user acquisition (MI value per 20 user Data Ready 28 dtv F ule File Edit View Insert Format Tools Data AutoSave om a 2.0 Insert Draw Page Layout Formulas Home Window Help Snapchat Valuation Data Data Review View Tell me 29 % Conditional Formatting , Format as Table Number Col Styles Calibri (Body) 11 v Paste BIU v M23 H K o Q 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 2011 2012 2013 0.53 Growth rates/Year Snapchat Users US population World population Ad market - US Ad martGlobal Datalad-Global 07 0.6 0.72% 6.109 5.48 2014 2003 0.63 0.15 6.59% 7.54 15. SEN 032 0.71% 2.63 498 17.29 2015 Average 100 OON 1666 06 ON 0.70% 071N 4.50 5.16 6.SIN 17 N 16 3.415 4515 19 56 A 838 Dat Ready GIV A Fille Edit View Insert Format Tools Data AutoSave OFF @ @ C Insert Draw Page Layout Formulas Home Window Help Snapchat Valuation Data Data Review View Tell me 25 % Conditional Formatting Format as Table Number 2 Coll Styles b. Calibrl (Body V 11 ' ' Y Paste BIU V M23 X D E 36 Digitalad - Global 37 ECCE 75,676 90, 189 106,772 125.233 144,718 170,193 Digital ad-Global Company Average pre- 2015 % of tax operating Average global digital margin sales to ad revenue (EBIT/Reven capital Average return on capital Average marginal tax rate e) 32.84 38 39 Google 40 Facebook 41 Yahool 42 Microsoft 43 C 44 MDL 45 Amazon 46 Twitter 47 Pandora 031 0.37 0.07 0.38 0.07 034 0.35 0,33 S41 2.97 2.49 137 0.94 0.71 0.50 0.49 0.32 4.80 015 0.35 0.06 0.07 039 0.02 004 -0.06 186 1-33 0.80 167 0.4 0.90 427 0.56 260 120 1.63 0.16 0.28 0.35 0.20 0.08 -0.69 -0.09 0.04 0.20 -0.17 0.06 014 0.17 0.33 030 + 49 Avex Nectives SO 51 52 S3 54 55 56 57 Date Ready otv AC File Edit View Insert Format Tools Data AutoSave QC Insert Draw Page Layout Formulas . Home Window Help Snapchat Valuation Data Data Review View Tell me Conditional Formatting Format as Table Number Coll Styles to v 11 ' % v Calibrl (Body) BIU XV fx Paste A M23 D E 19 Private Comparable Acquisitions H of users @ Company Date Acquirer Acquisition Value per acquisition amount (MI 20 user (M) 21 WhatsApp Oct-14 Google 19.000 450 m th 42 Feb-14 Rakuten 900 100 9 23 Vine Oct-12 Twitter 970 40 24 Instagram 24 Apr 12 Facebook 1,000 30 33 25 Skype Apr 11 Microsoft 8,500 124 69 26 Youtube Oct-06 Google 1650 so 27 AVERAGE 5,337 132 35 28 23 Market Data (in Millions) 30 Market Dual 2010 2011 2012 2013 2014 31 Snapchat Users NA 2 2 10 100 32 US population 310 312 314 315 117 39 World population 6.900 6.950 7.000 7.050 7.300 34 Amart-US 149,302 154 386 163,804 160 116 179.203 35 Ad market Global 352427273 450.70 471165 SORT 26 Detal-Global 75.676 90.183 106223 125.233 14 37 2015 200 119 7.150 SUS 537494 100 Growth rates Sapeurser Uputio World mart Amato Company Average pre 2015 % of tax operating Average dital margin sales to T/even capital Aweg Human Antwer Ready 1 28 etv2 Geli A 03/190378/assignments/1388607 ps SNAP New Tab Quia: Quiz 3 Page > of 3 ZOOM + Answer all questions assuming the current year is 2015. Start an Excel spreadsheet. Have two worksheets. One for your answers and one for the model. APV Valuation using the Top Down Method to Forecast Cash Flows Assume Snapchats 2015 pre-tax operating margins were-200% and they started 2016 with a $200M operating loss. 1. What is Snapchat's market? 2. How is this market evolving over time? 3. Suppose it will take Snapchat 10 years to reach stable growth. How big do you think Snapchat's market share be in 10 years' time? Estimate Snapchat's steady state net operating margin. 5. Estimate marginal tax rate 6. Determine reinvestment (e. what sales-to-capital ratio should you use?) 7. Are your parameter estimates internally consistent? Why? & Assuming that the average return on a risk free assets and the market premium, calculate the discount rate for Snapchat using comparable firm betan (Remember to delever beta) SO go DO DI FE Bfassignments/1388607 INAP New Tab Quiz: Quiz 3 Page of 3 - 200M + For all remaining questions use the cost of capital calculated in question 8 as your discount rate. 10. Using the following values, calculate a relative valuation for Snapchat today: 50% probability of a successful IPO in 3 years 300 million users at IPO 11. Given the above valuation, what is the minimum possible percentage of the company owned by the Series Finvestors? Assume a 70% retention percentage) I 12. Assuming the Series Finvestors owns of the firm, what is the minimum expected edit valuation they would have required for them to have invested? 13. What is the minimum price per ser at IPO that would justify a $10+ valuation? 14. Suppose that instead of an IPO in 3 years, we expect Snapchat to be acquired by another tim Ung the following values to determine Snapchats value today probability of being cuired in years 300 milions quiction . 50 . 00 DII FE 190378/assignments/1389607 New Tab Qulz: Quiz 3 SNAP Page of 3 ZOOM + Answer all questions assuming the current year is 2015. Start an Excel spreadsheet. Have two worksheets. One for your answers and one for the model. APV Valuation using the Top Down Method to Forecast Cash Flows Assume Snapchats 2015 pre-tax operating margins were-200% and they started 2016 with a $200M operating loss. 1. What is Snapchat's market? 2. How is this market evolving over time? 3. Suppose it will take Snapchat 10 years to reach stable growth. How big do you think Snapchat's market share be in 10 years' time? Estimate Snapchat's steady state net operating margin. 5. Estimate marginal tax rate 6. Determine reinvestment (e. what sales-to-capital ratio should you use?) 7. Are your parameter estimates internally consistent? Why? & Assuming that the average return on a risk free assets and the market premium, calculate the discount rate for Snapchat using comparable firm betan (Remember to delever beta) SO go DO DI FE Bfassignments/1388607 INAP New Tab Quiz: Quiz 3 Page of 3 - 200M + For all remaining questions use the cost of capital calculated in question 8 as your discount rate. 10. Using the following values, calculate a relative valuation for Snapchat today: 50% probability of a successful IPO in 3 years 300 million users at IPO 11. Given the above valuation, what is the minimum possible percentage of the company owned by the Series Finvestors? Assume a 70% retention percentage) I 12. Assuming the Series Finvestors owns of the firm, what is the minimum expected edit valuation they would have required for them to have invested? 13. What is the minimum price per ser at IPO that would justify a $10+ valuation? 14. Suppose that instead of an IPO in 3 years, we expect Snapchat to be acquired by another tim Ung the following values to determine Snapchats value today probability of being cuired in years 300 milions quiction . 50 . 00 DII FE 190378/assignments/1389607 New Tab Qulz: Quiz 3 SNAP Page