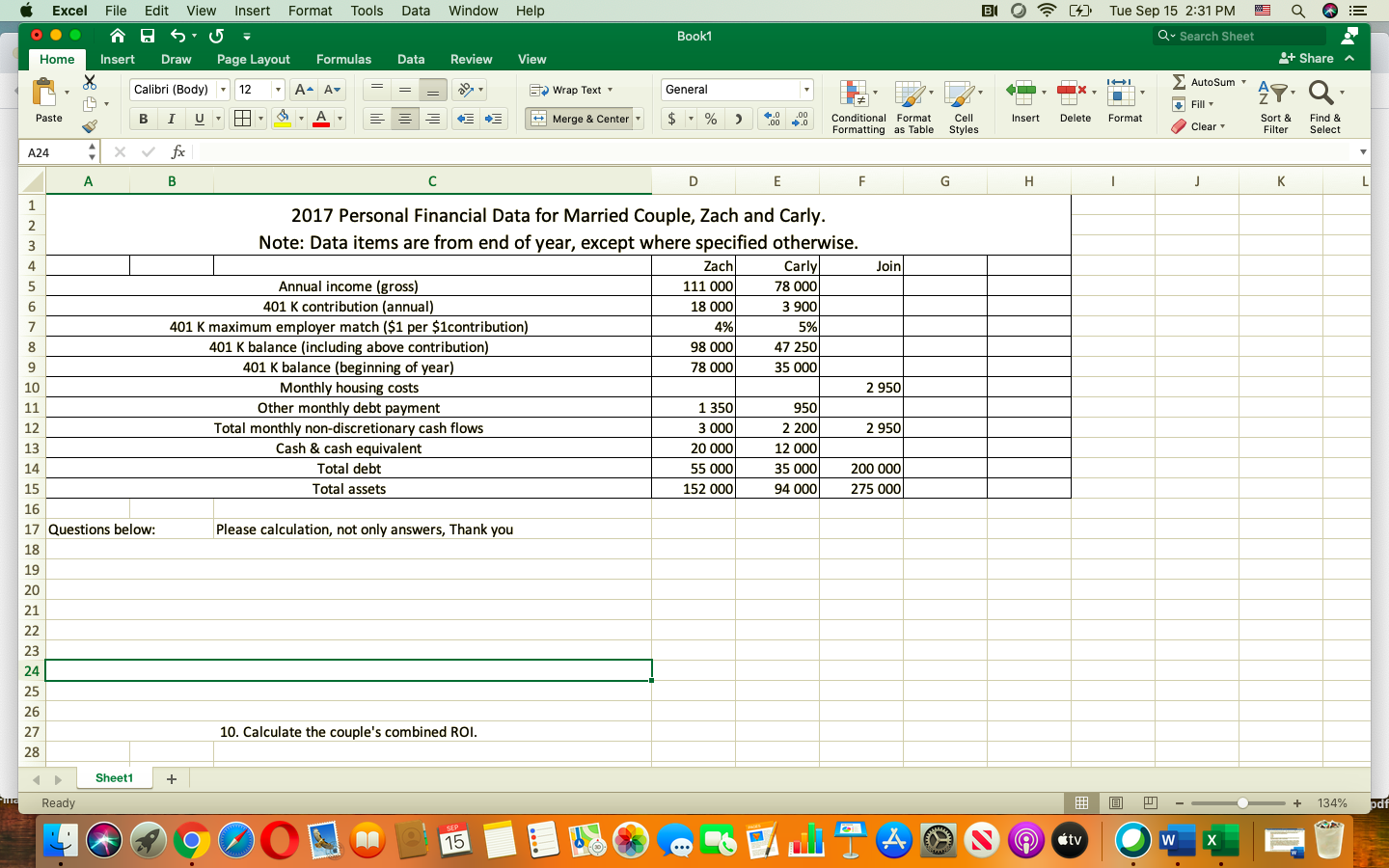

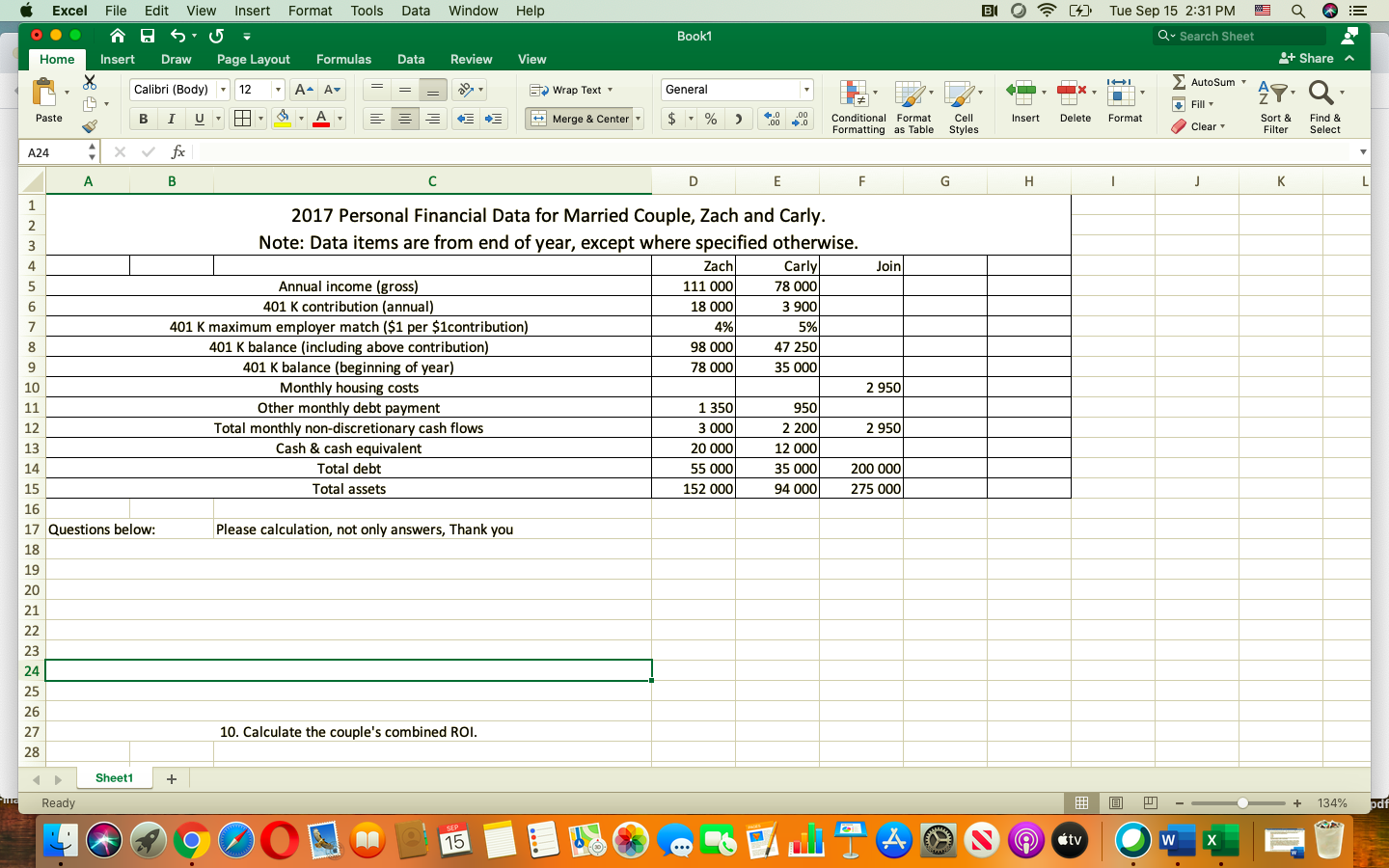

Excel File Edit View Insert Format Tools Data Window Help B a ! (4) Tue Sep 15 2:31 PM Q- Search Sheet Book1 Formulas Data Review View + Share a Home Insert Draw Page Layout Calibri (Body) 12 4 Paste B I U U H- A A 5 Wrap Text General AutoSum , 49. Q Fill - A, Merge & Center $ 4.0 .00 .00 .0 Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear Sort & Filter Find & Select A24 foc B D E F G H 1 j K. L 1 2 3 4 5 6 7 8 8 2017 Personal Financial Data for Married couple, Zach and Carly. Note: Data items are from end of year, except where specified otherwise. Zach Carlyl Join Annual income (gross) 111 000 78 000 401 K contribution (annual) 18 000 3 900 401 k maximum employer match ($1 per $1contribution) 4% 5% 401 K balance (including above contribution) 98 000 47 250 401 K balance (beginning of year) 78 000 35 000 Monthly housing costs 2 950 Other monthly debt payment 1 350 9501 Total monthly non-discretionary cash flows 3 000 2 200 2 9501 Cash & cash equivalent 20 000 12 000 Total debt 55 000 35 000 200 000 Total assets 152 000 94 000 275 000 9 10 11 12 13 14 15 16 17 Questions below: 18 19 20 Please calculation, not only answers, Thank you 21 22 23 24 25 26 27 28 10. Calculate the couple's combined ROI. Sheet1 + ung Ready B + 134% pdf SEP 90 15 tv w w Excel File Edit View Insert Format Tools Data Window Help B a ! (4) Tue Sep 15 2:31 PM Q- Search Sheet Book1 Formulas Data Review View + Share a Home Insert Draw Page Layout Calibri (Body) 12 4 Paste B I U U H- A A 5 Wrap Text General AutoSum , 49. Q Fill - A, Merge & Center $ 4.0 .00 .00 .0 Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear Sort & Filter Find & Select A24 foc B D E F G H 1 j K. L 1 2 3 4 5 6 7 8 8 2017 Personal Financial Data for Married couple, Zach and Carly. Note: Data items are from end of year, except where specified otherwise. Zach Carlyl Join Annual income (gross) 111 000 78 000 401 K contribution (annual) 18 000 3 900 401 k maximum employer match ($1 per $1contribution) 4% 5% 401 K balance (including above contribution) 98 000 47 250 401 K balance (beginning of year) 78 000 35 000 Monthly housing costs 2 950 Other monthly debt payment 1 350 9501 Total monthly non-discretionary cash flows 3 000 2 200 2 9501 Cash & cash equivalent 20 000 12 000 Total debt 55 000 35 000 200 000 Total assets 152 000 94 000 275 000 9 10 11 12 13 14 15 16 17 Questions below: 18 19 20 Please calculation, not only answers, Thank you 21 22 23 24 25 26 27 28 10. Calculate the couple's combined ROI. Sheet1 + ung Ready B + 134% pdf SEP 90 15 tv w w