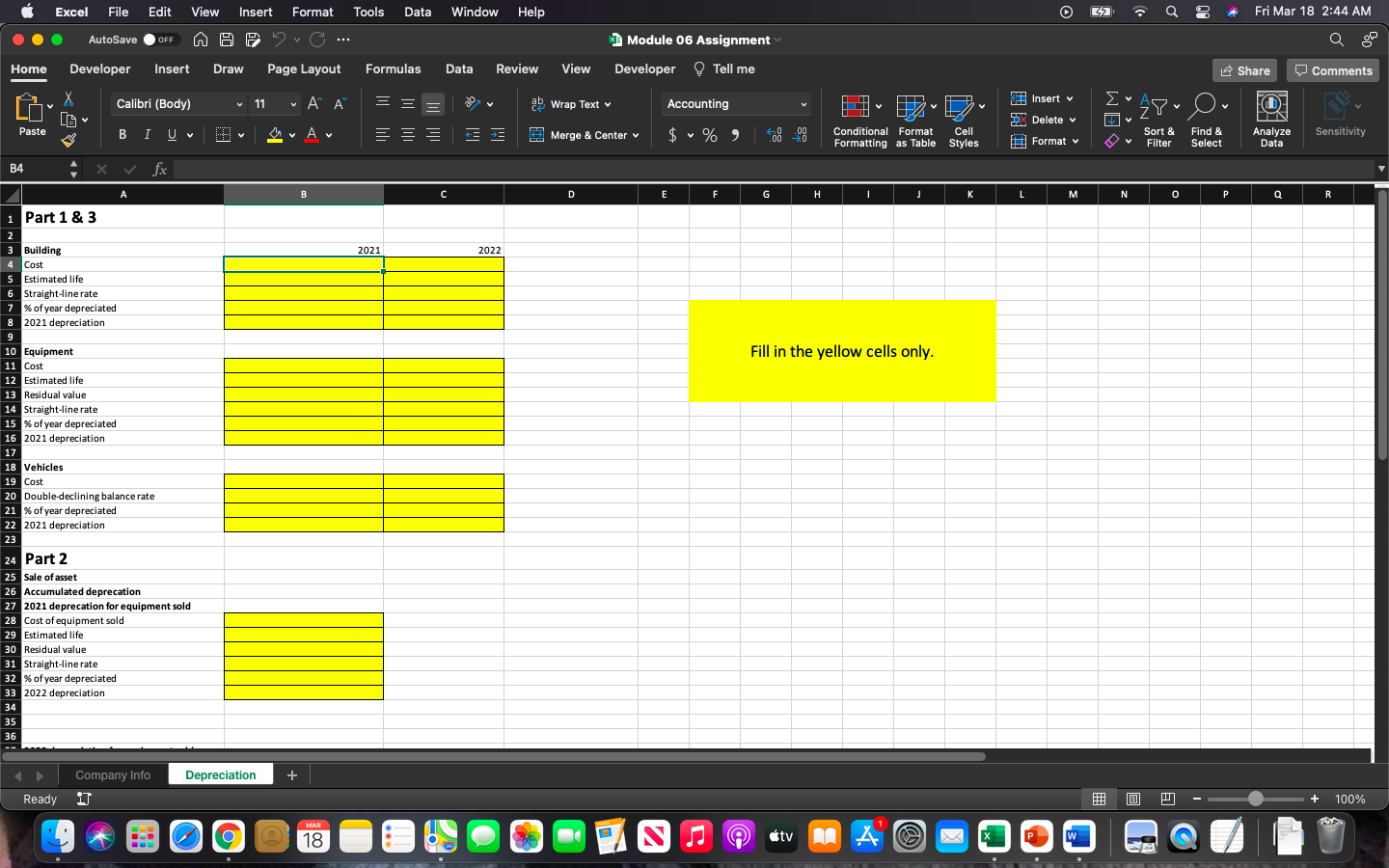

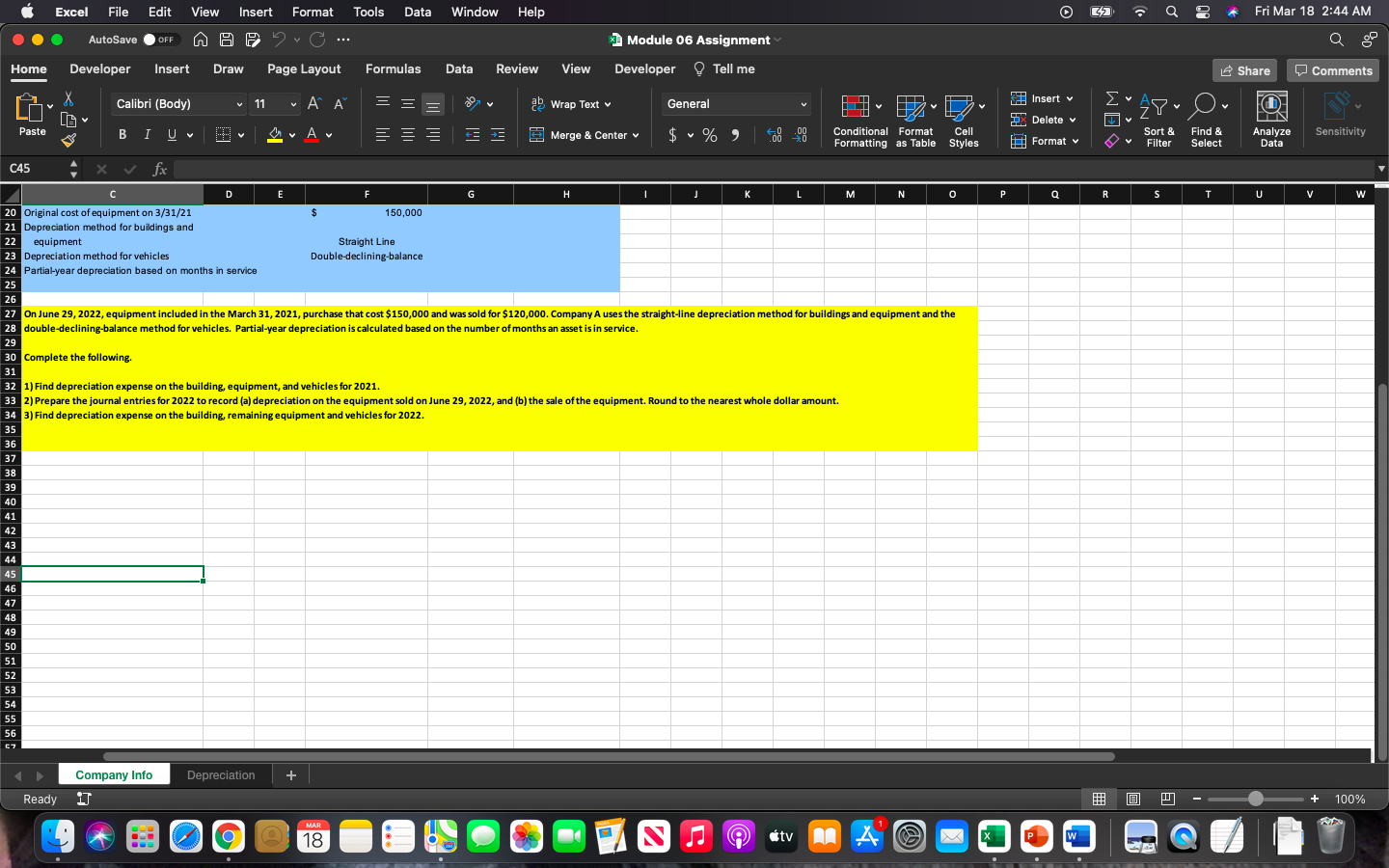

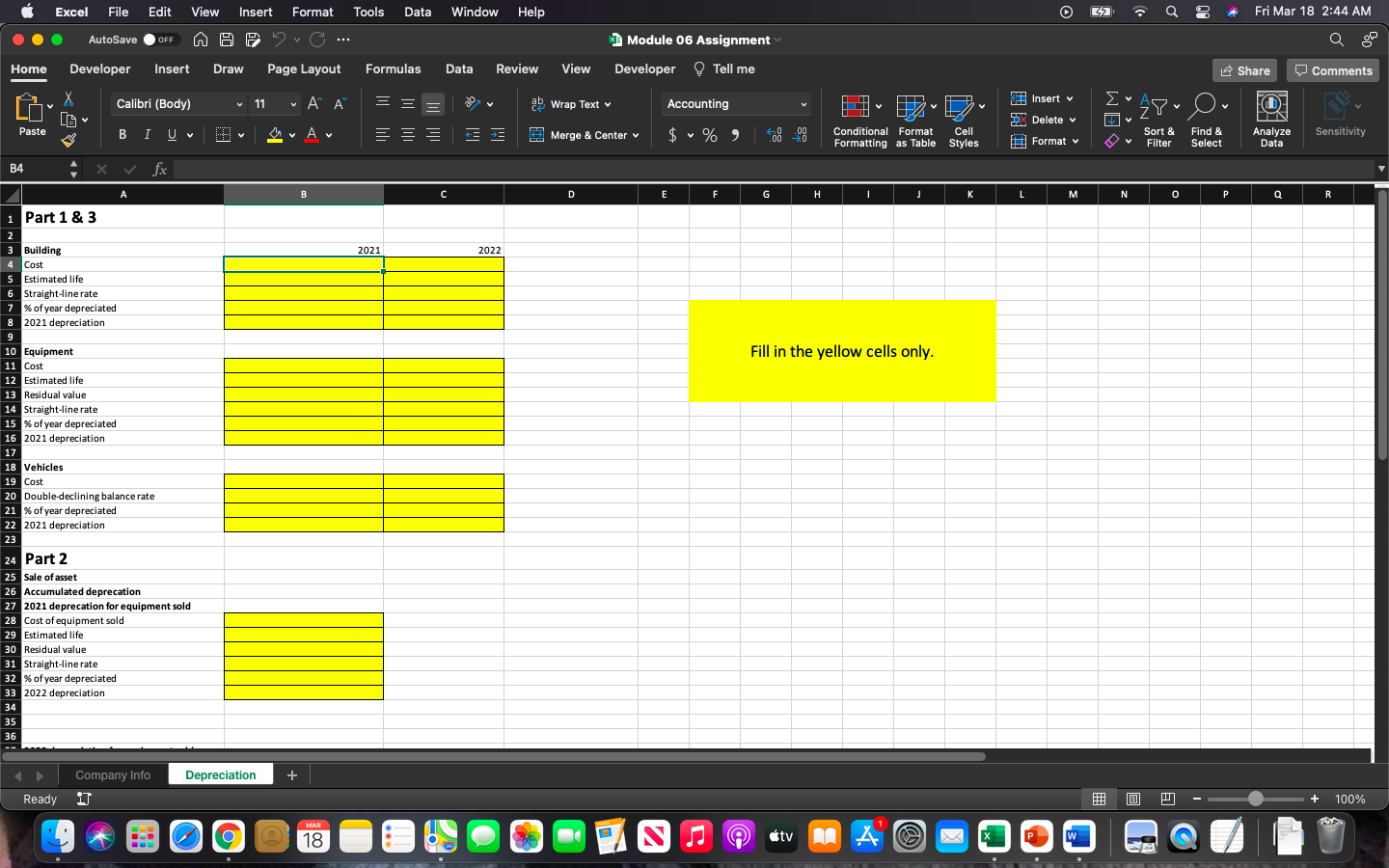

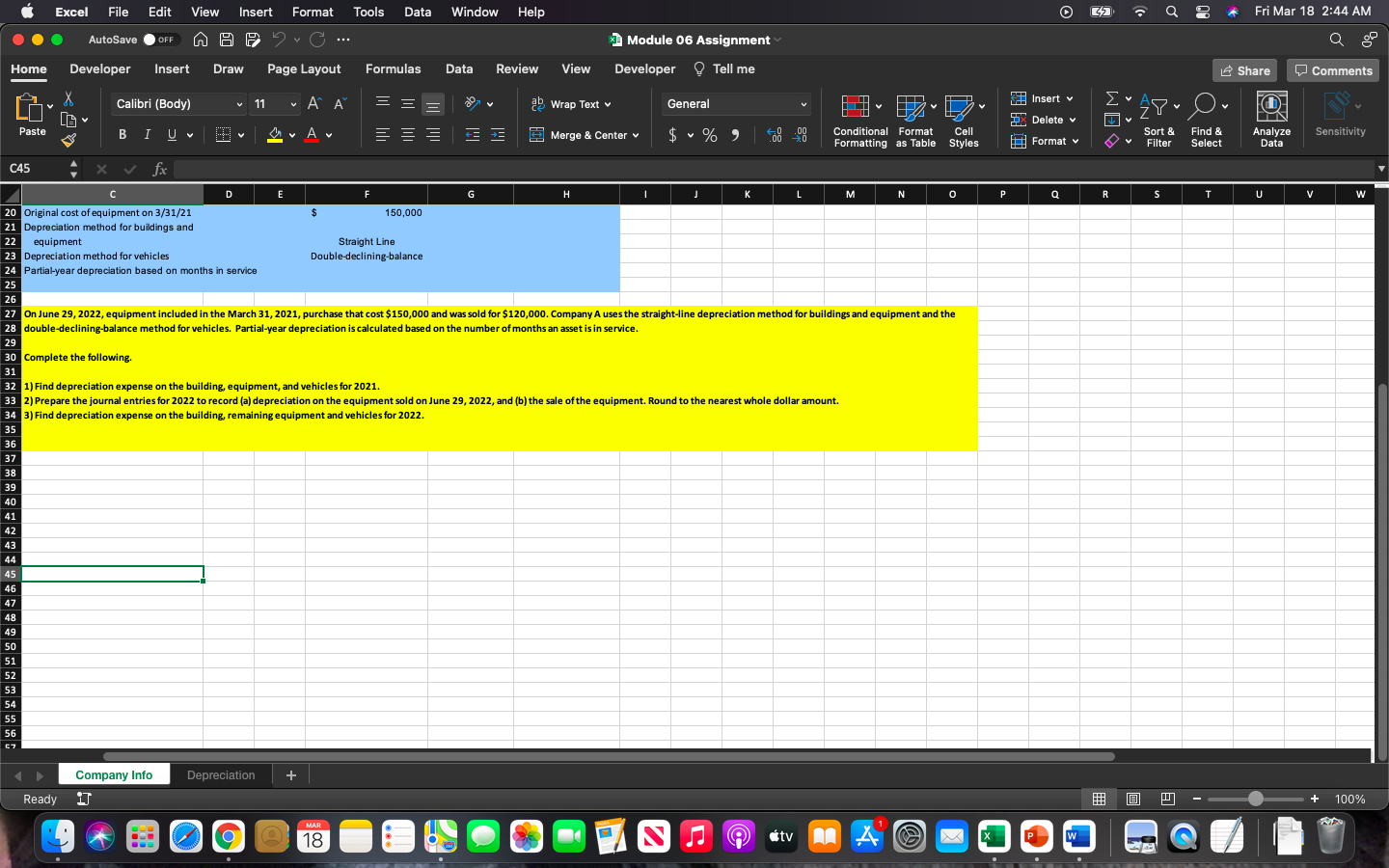

Excel File Insert Format Tools Data Window Help L2 Fri Mar 18 2:44 AM Edit View AO AutoSave OFF Module 06 Assignment a go Home Developer Insert Draw Page Layout Formulas Data Review View Developer Tell me Share Comments Insert v Calibri (Body) 11 LG = = c ab Wrap Text Accounting Tv V TH TV 28. O o DX Delete v V Paste BIU A == == = Merge & Center $ % ) HO .00 .00 7.0 Conditional Format Cell Formatting as Table Styles Sensitivity Sort & Filter Format Find & Select Analyze Data B4 - x fx A . B C D E E F G G . H T J K L L M . N 0 P P Q R 2021 2022 Fill in the yellow cells only. 1 Part 1 & 3 2 3 Building 4 Cost 5 Estimated life 6 Straight-line rate 7 % of year depreciated 8 2021 depreciation 9 10 Equipment 11 Cost 12 Estimated life 13 Residual value 14 Straight-line rate 15 % of year depreciated 16 2021 depreciation 17 18 Vehicles 19 Cost 20 Double-declining balance rate 21 % of year depreciated 22 2021 depreciation 23 24 Part 2 25 Sale of asset 26 Accumulated deprecation 27 2021 deprecation for equipment sold 28 Cost of equipment sold 29 Estimated life 30 Residual value 31 Straight-line rate 32 % of year depreciated 33 2022 depreciation 34 35 36 Depreciation + Company Info Ready 1T 100% MAR 18 tv MA P W Tools Data Window Help L2 Fri Mar 18 2:44 AM Excel File Edit View Insert Format AutoSave A ava Developer Insert Draw Page Layout OFF Module 06 Assignment a go Home Formulas Data Review View Developer Tell me Share Comments = = = Insert v V 28" O Or V TH DX Delete v V F IN Analyze Data V Sort & Filter Find & Sensitivity Format v Select P Q R S S T U V W X Calibri (Body) 11 ~ ab Wrap Text General Tv LO Paste BIU av Av E HO = = .00 v Merge & Center $ % ) Cell Conditional Format O .00 0 Formatting as Table Styles C45 xv fx C D D E F G H j J K L M N 0 O 20 Original cost of equipment on 3/31/21 $ 150,000 21 Depreciation method for buildings and 22 equipment Straight Line 23 Depreciation method for vehicles Double-declining-balance 24 Partial-year depreciation based on months in service 25 26 27 On June 29, 2022, equipment included in the March 31, 2021, purchase that cost $150,000 and was sold for $120,000. Company A uses the straight-line depreciation method for buildings and equipment and the 28 double-declining balance method for vehicles. Partial-year depreciation is calculated based on the number of months an asset is in service. 29 30 Complete the following. 31 32 1) Find depreciation expense on the building, equipment, and vehicles for 2021. 33 2) Prepare the journal entries for 2022 to record (a) depreciation on the equipment sold on June 29,2022, and (b) the sale of the equipment. Round to the nearest whole dollar amount. 34 3) Find depreciation expense on the building, remaining equipment and vehicles for 2022. 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 67 Depreciation + Company Info 17 Ready 100% MAR 18 tv A P W