Answered step by step

Verified Expert Solution

Question

1 Approved Answer

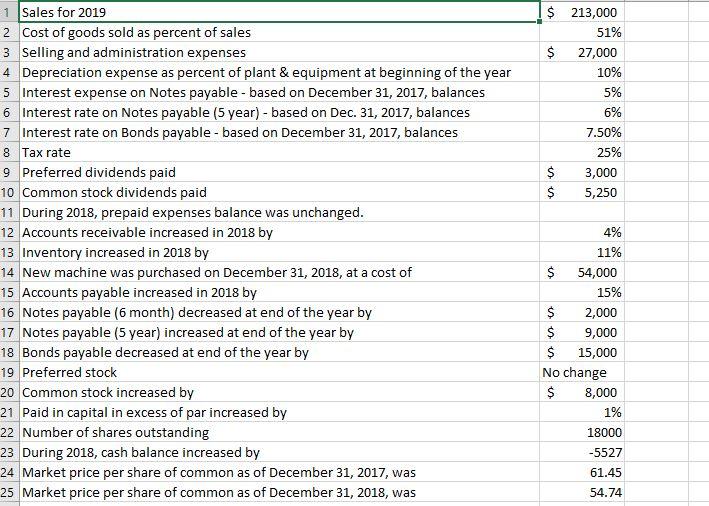

Excel file work: You must use cell referencing for the input data. You must use Excel for all calculations. You will be graded on accuracy

- Excel file work: You must use cell referencing for the input data. You must use Excel for all calculations. You will be graded on accuracy of your calculations, Excel use in calculations, formatting, and appearance. Be sure to remove grid lines.

- Financial Statements: Use the data sheet tab to create the following three statements.

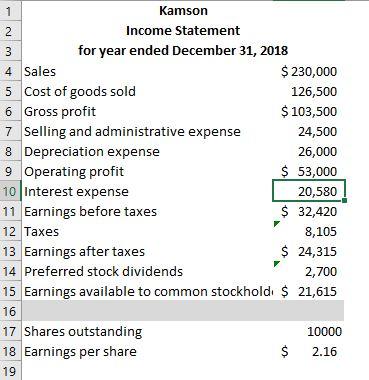

- Income Statement for Year ended 2019. *See Table 2.1 in text for example. Proper form excludes row numbers and all text is in black. See rubric for details. Check figure for Earnings Available to Common = $29,363

- Statement of Retained Earnings for Year ended 2019. *See Table 2.2 in text for example.

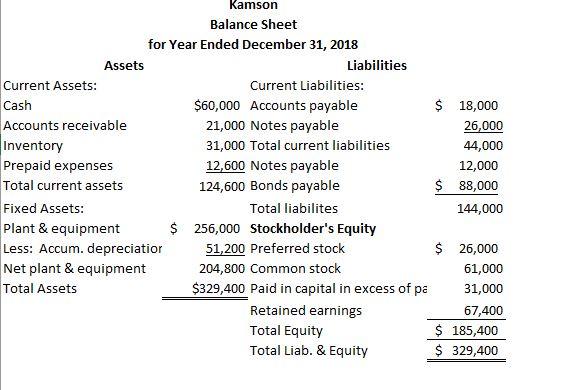

- Balance Sheet as of December 31, 2019. *See Table 2.4 in text for example

- Financial Statements: Use the data sheet tab to create the following three statements.

Check figure for Total Assets = $356523

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started