Answered step by step

Verified Expert Solution

Question

1 Approved Answer

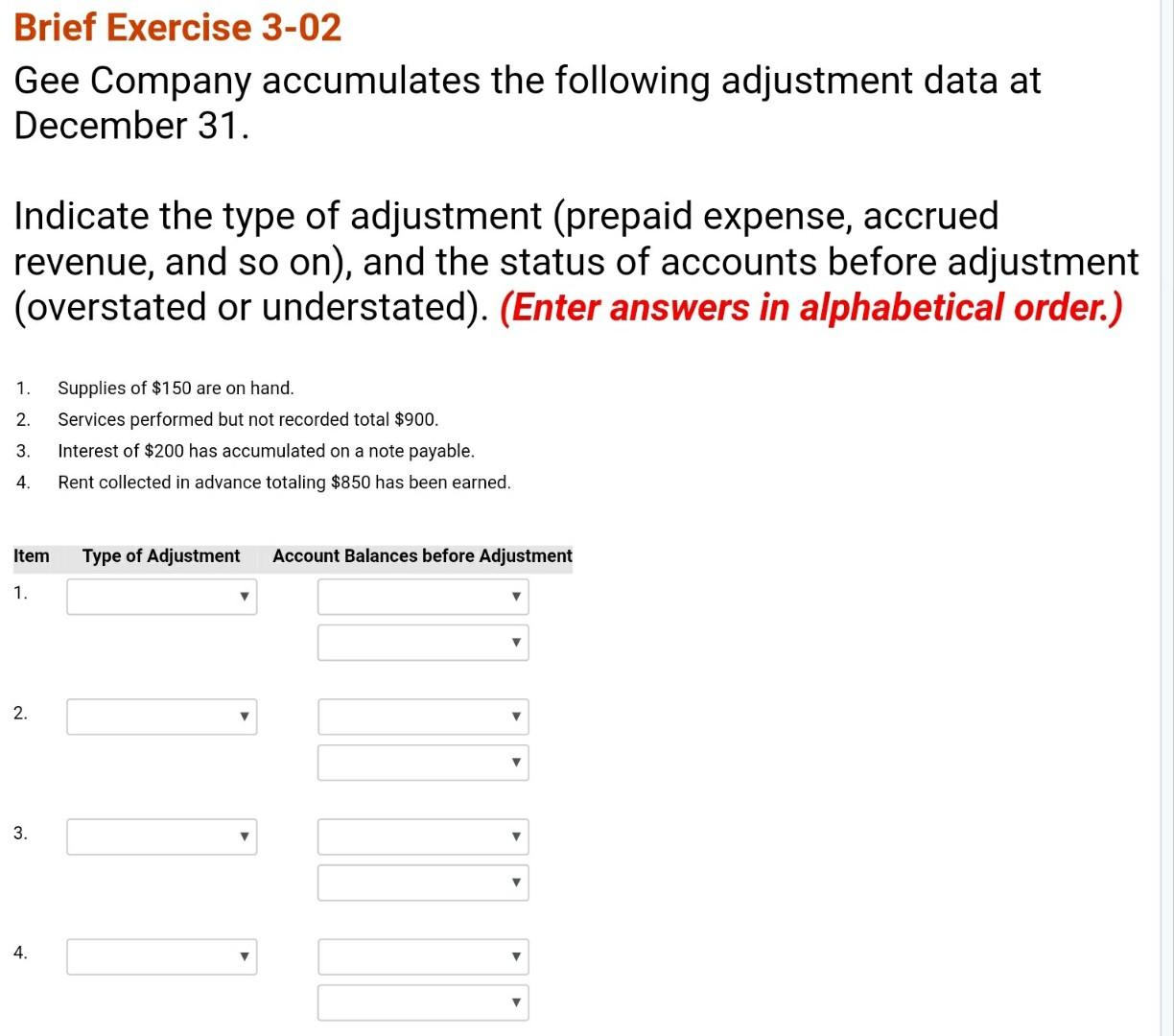

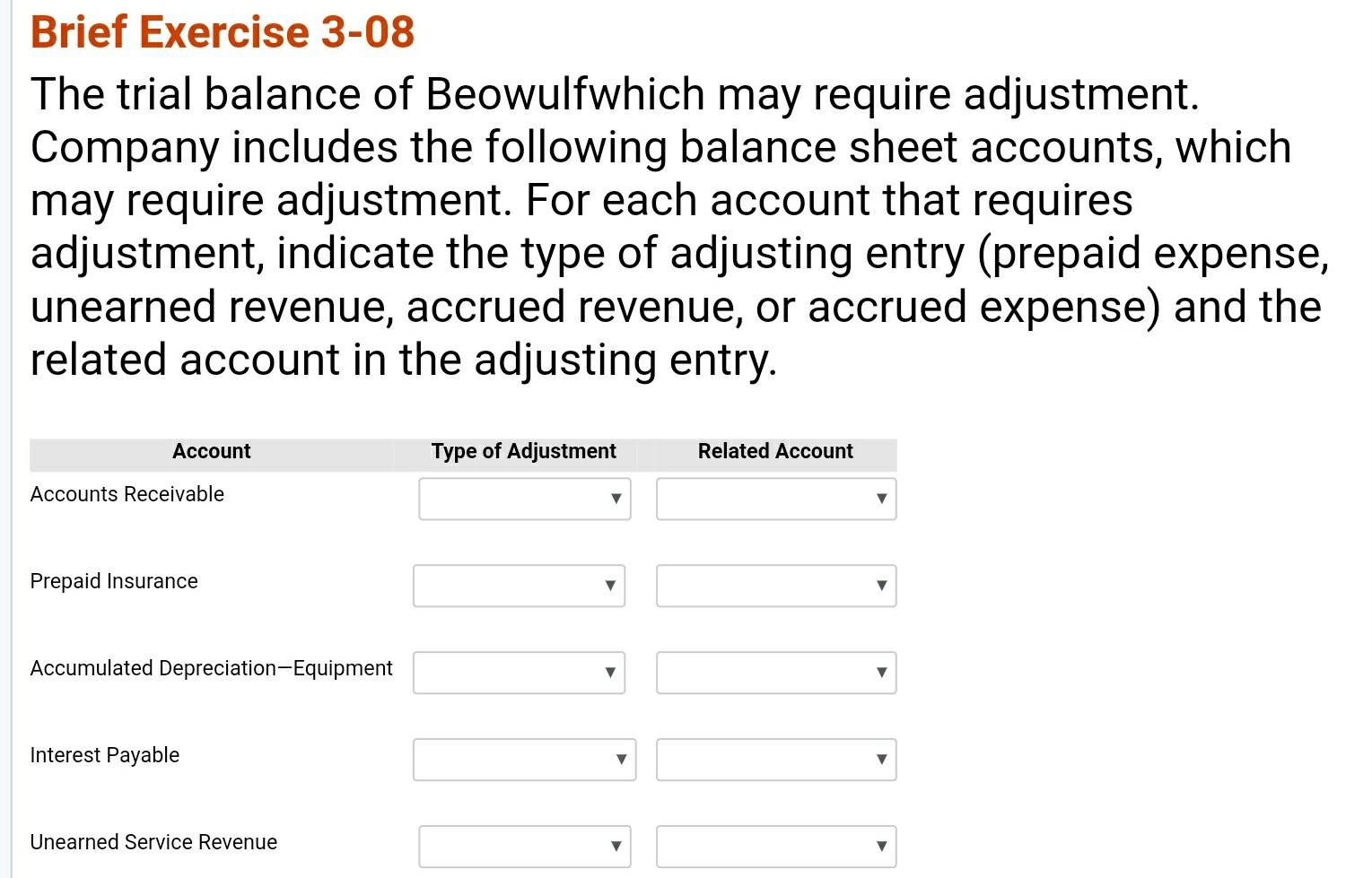

Excel format for answer, please Brief Exercise 3-02 Gee Company accumulates the following adjustment data at December 31. Indicate the type of adjustment (prepaid expense,

Excel format for answer, please

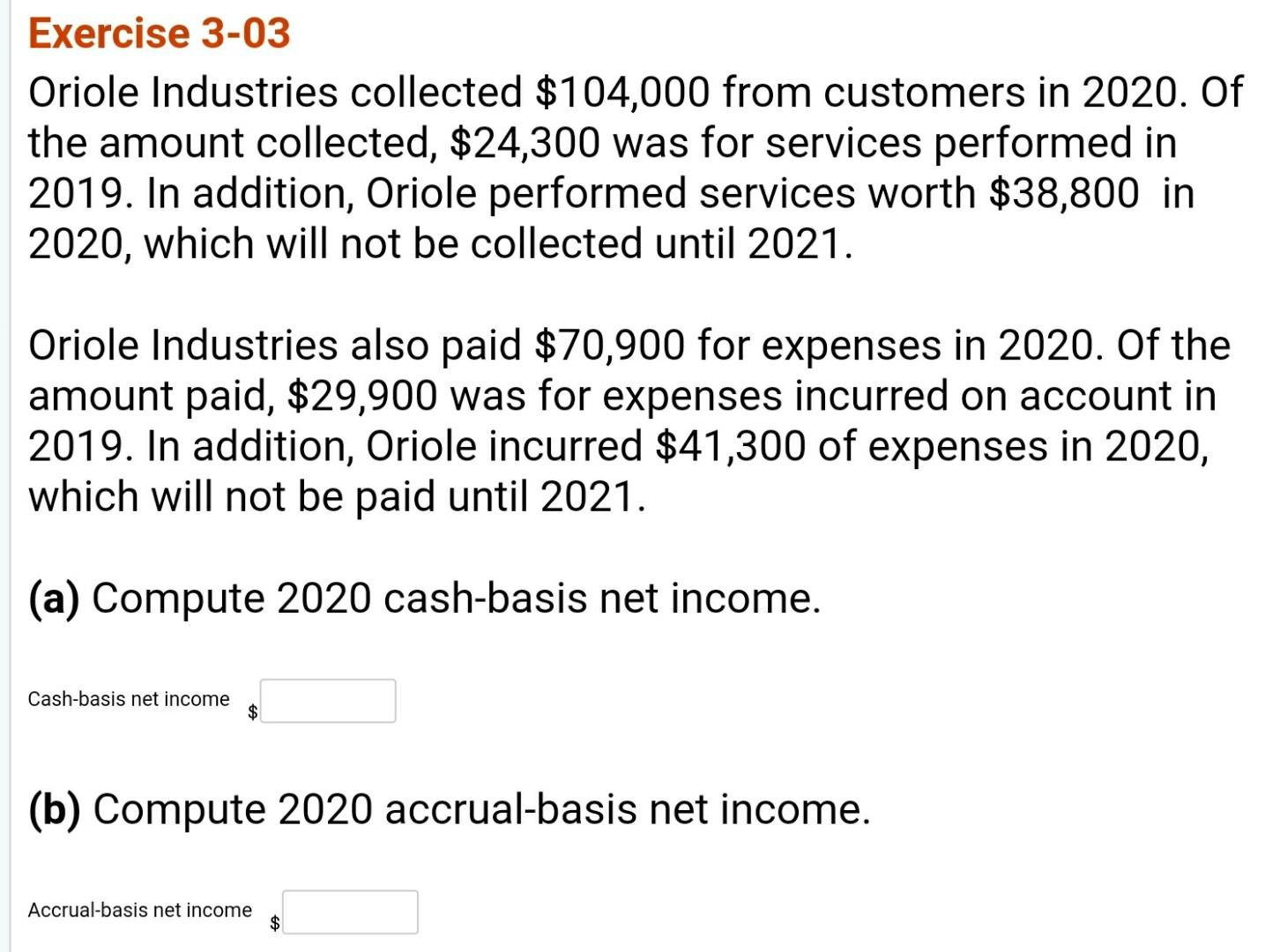

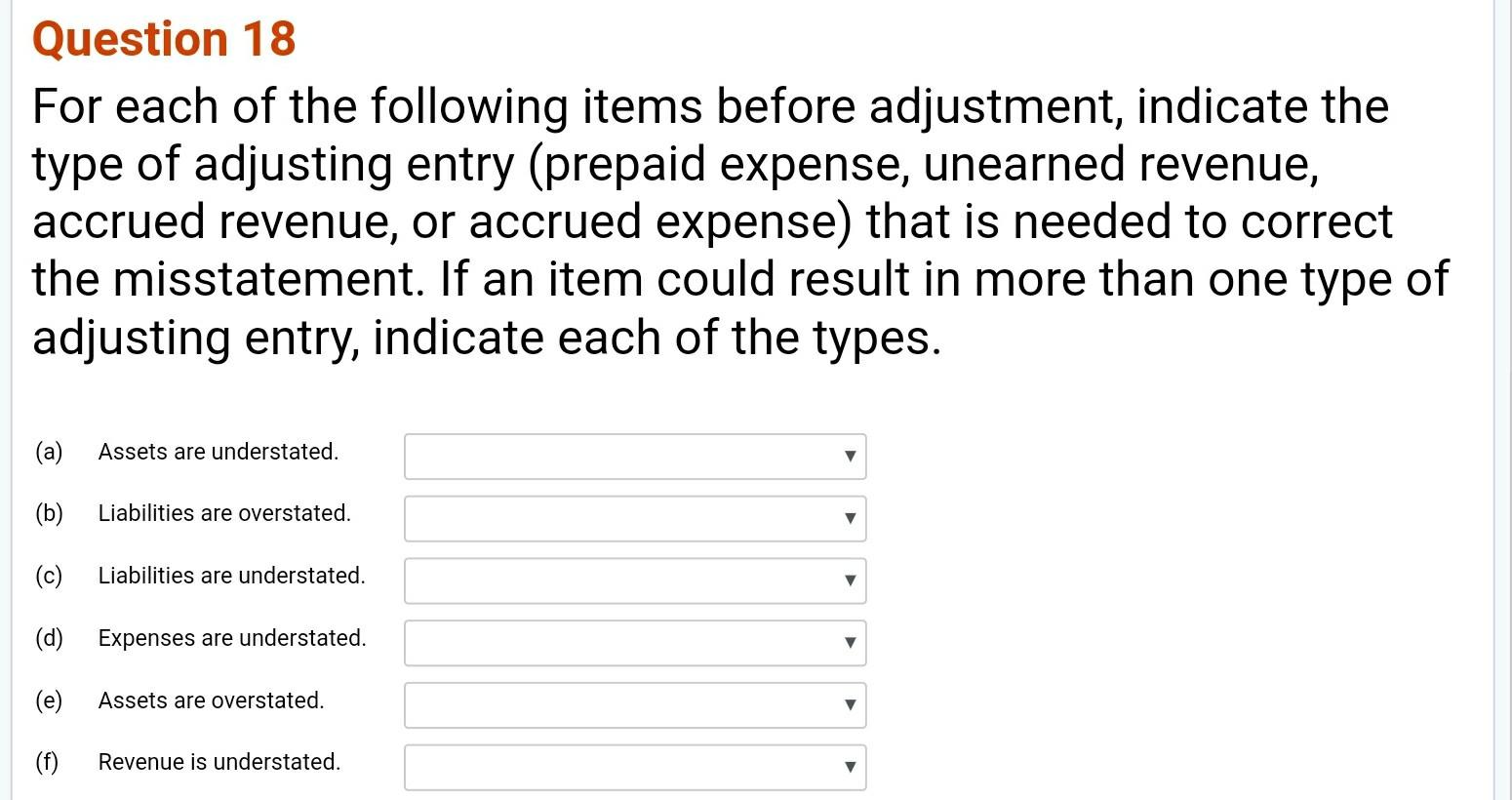

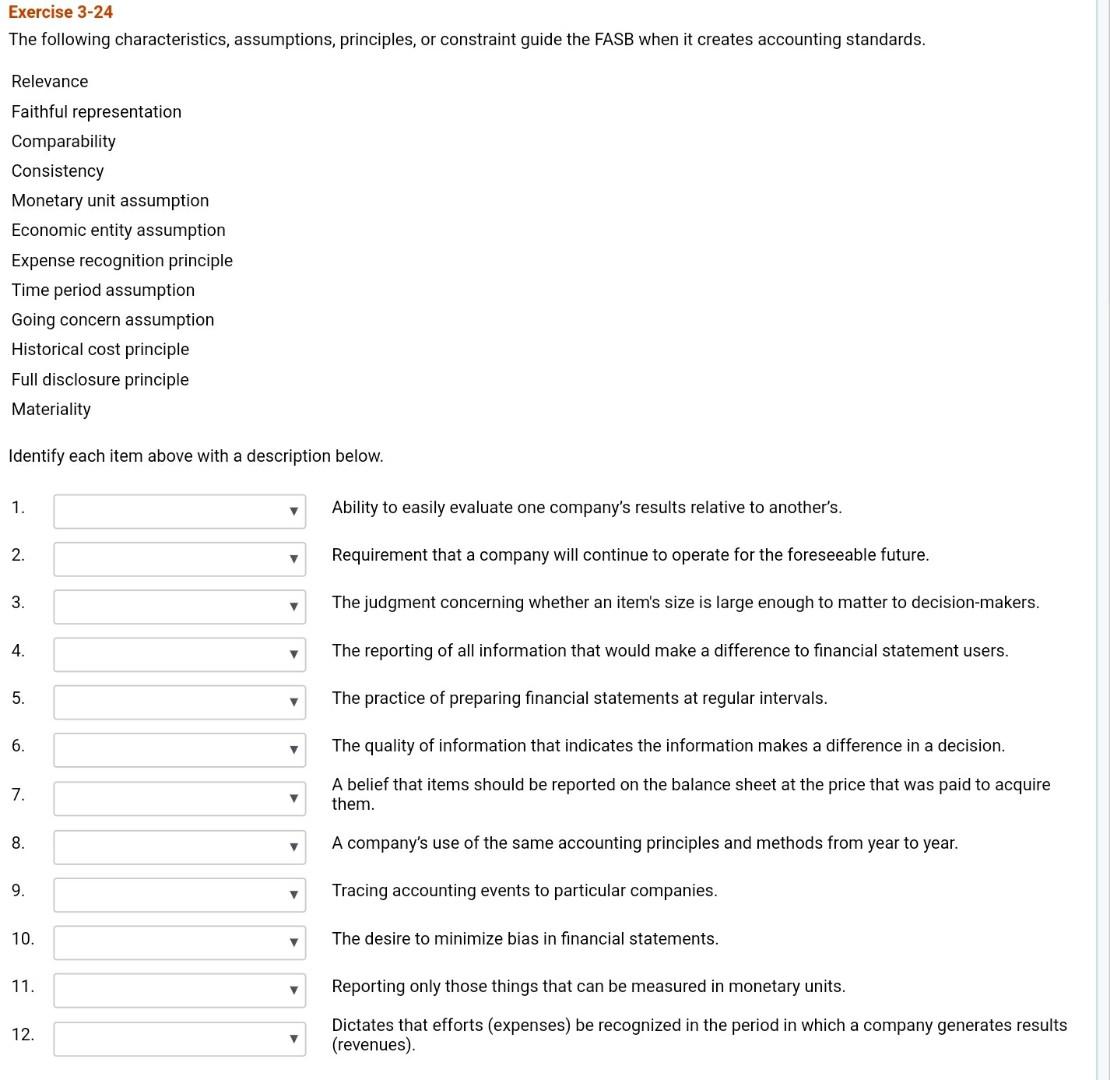

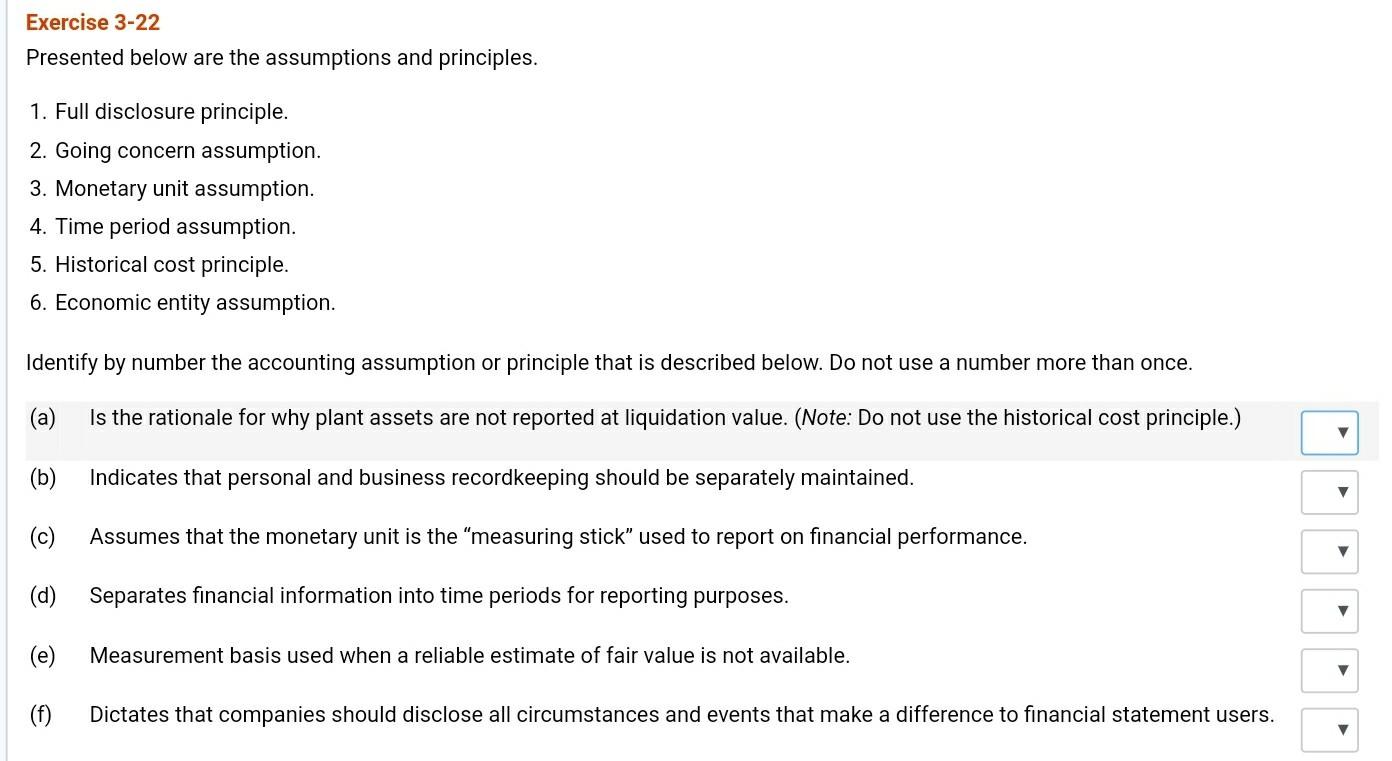

Brief Exercise 3-02 Gee Company accumulates the following adjustment data at December 31. Indicate the type of adjustment (prepaid expense, accrued revenue, and so on), and the status of accounts before adjustment (overstated or understated). (Enter answers in alphabetical order.) 1. 2. Supplies of $150 are on hand. Services performed but not recorded total $900. Interest of $200 has accumulated on a note payable. Rent collected in advance totaling $850 has been earned. 3. 4. Item Type of Adjustment Account Balances before Adjustment 1. 2. 3. 4. v Brief Exercise 3-08 The trial balance of Beowulfwhich may require adjustment. Company includes the following balance sheet accounts, which may require adjustment. For each account that requires adjustment, indicate the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or accrued expense) and the related account in the adjusting entry. Account Type of Adjustment Related Account Accounts Receivable Prepaid Insurance Accumulated Depreciation-Equipment Interest Payable Unearned Service Revenue v Exercise 3-03 Oriole Industries collected $104,000 from customers in 2020. Of the amount collected, $24,300 was for services performed in 2019. In addition, Oriole performed services worth $38,800 in 2020, which will not be collected until 2021. Oriole Industries also paid $70,900 for expenses in 2020. Of the amount paid, $29,900 was for expenses incurred on account in 2019. In addition, Oriole incurred $41,300 of expenses in 2020, which will not be paid until 2021. (a) Compute 2020 cash-basis net income. Cash-basis net income $ (b) Compute 2020 accrual-basis net income. Accrual-basis net income Question 18 For each of the following items before adjustment, indicate the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or accrued expense) that is needed to correct the misstatement. If an item could result in more than one type of adjusting entry, indicate each of the types. (a) Assets are understated. (b) Liabilities are overstated. (c) Liabilities are understated. v (d) Expenses are understated. (e) Assets are overstated. (f) Revenue is understated. Exercise 3-24 The following characteristics, assumptions, principles, or constraint guide the FASB when it creates accounting standards. Relevance Faithful representation Comparability Consistency Monetary unit assumption Economic entity assumption Expense recognition principle Time period assumption Going concern assumption Historical cost principle Full disclosure principle Materiality Identify each item above with a description below. 1. V Ability to easily evaluate one company's results relative to another's. 2. Requirement that a company will continue to operate for the foreseeable future. 3. The judgment concerning whether an item's size is large enough to matter to decision-makers. 4. V The reporting of all information that would make a difference to financial statement users. 5. The practice of preparing financial statements at regular intervals. 6. The quality of information that indicates the information makes a difference in a decision. 7. A belief that items should be reported on the balance sheet at the price that was paid to acquire them. V 8. v A company's use of the same accounting principles and methods from year to year. 9. v Tracing accounting events to particular companies. 10. The desire to minimize bias in financial statements. 11. v Reporting only those things that can be measured in monetary units. 12. Dictates that efforts (expenses) be recognized in the period in which a company generates results (revenues). Exercise 3-22 Presented below are the assumptions and principles. 1. Full disclosure principle. 2. Going concern assumption. 3. Monetary unit assumption. 4. Time period assumption. 5. Historical cost principle. 6. Economic entity assumption. Identify by number the accounting assumption or principle that is described below. Do not use a number more than once. (a) Is the rationale for why plant assets are not reported at liquidation value. (Note: Do not use the historical cost principle.) (b) Indicates that personal and business recordkeeping should be separately maintained. (c) Assumes that the monetary unit is the measuring stick used to report on financial performance. (d) Separates financial information into time periods for reporting purposes. (e) Measurement basis used when a reliable estimate of fair value is not available. (f) Dictates that companies should disclose all circumstances and events that make a difference to financial statement usersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started