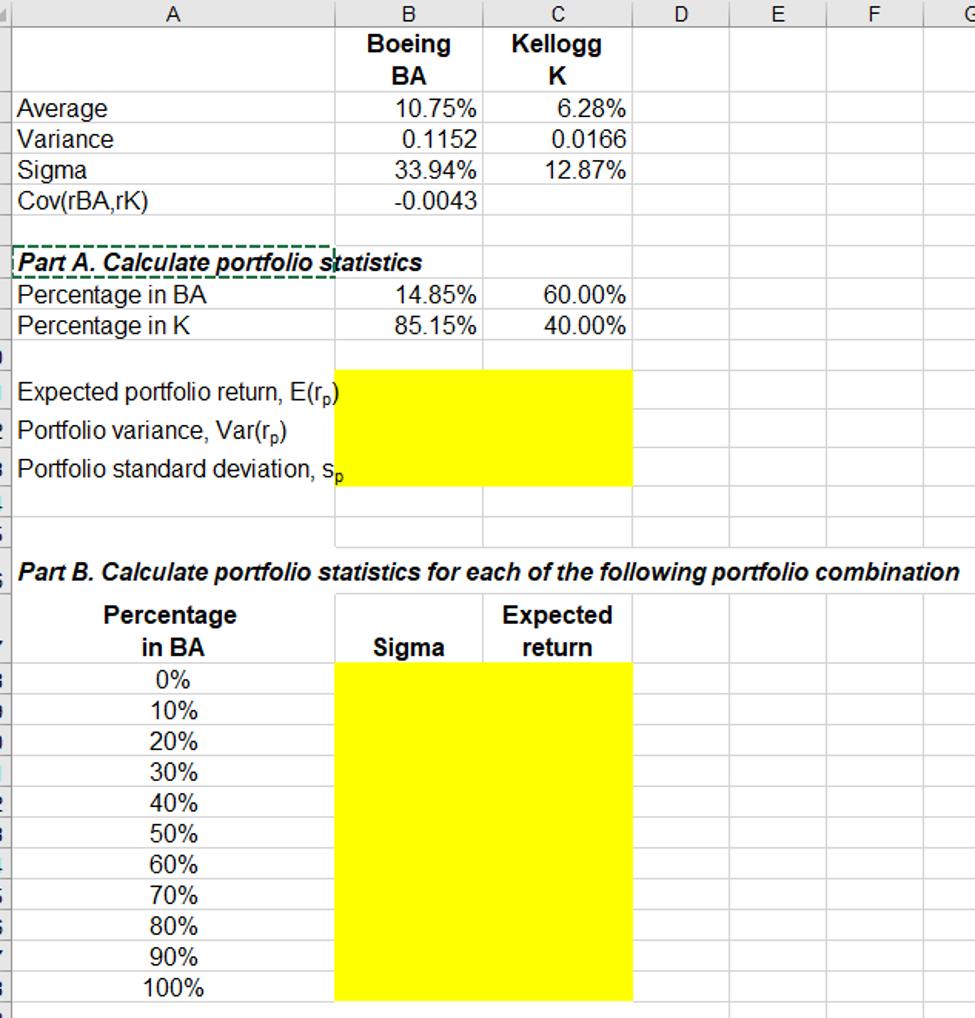

Question: EXCEL FORMULAS PLEASE Average Variance Sigma Cov(rBA,rK) A Expected portfolio return, E(rp) Portfolio variance, Var(rp) Portfolio standard deviation, sp B Boeing BA 10.75% 0.1152 Part

EXCEL FORMULAS PLEASE

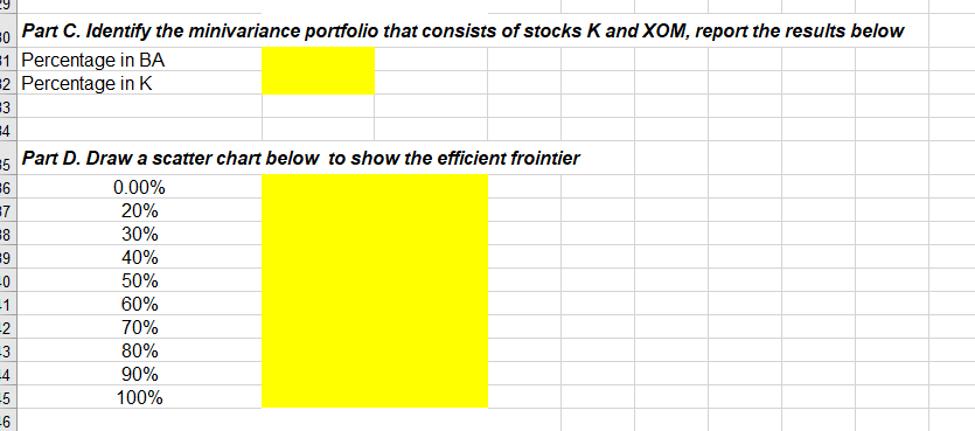

Average Variance Sigma Cov(rBA,rK) A Expected portfolio return, E(rp) Portfolio variance, Var(rp) Portfolio standard deviation, sp B Boeing BA 10.75% 0.1152 Part A. Calculate portfolio statistics Percentage in BA Percentage in K 33.94% -0.0043 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 14.85% 85.15% C Kellogg K Sigma 6.28% 0.0166 12.87% 60.00% 40.00% D E LL Part B. Calculate portfolio statistics for each of the following portfolio combination Percentage Expected return in BA F G

Step by Step Solution

There are 3 Steps involved in it

To calculate the portfolio statistics expected return variance and standard deviation for various allocations between Boeing BA and Kellogg K well go through each step in detail First well cover the g... View full answer

Get step-by-step solutions from verified subject matter experts