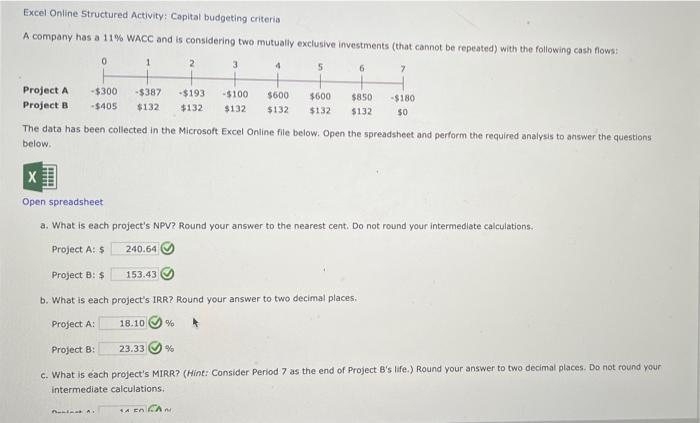

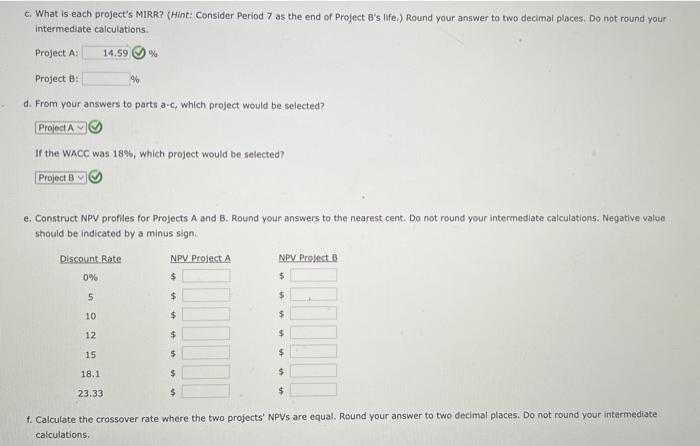

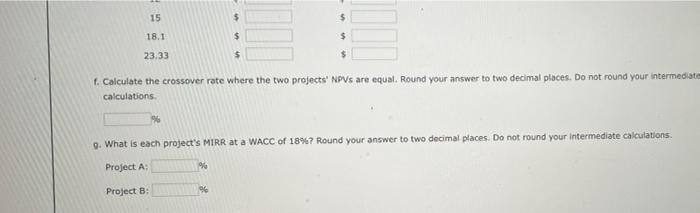

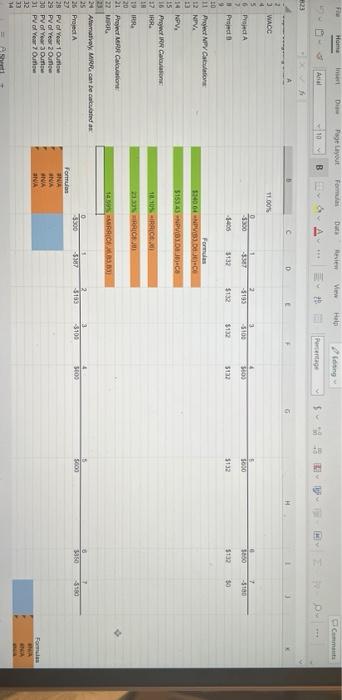

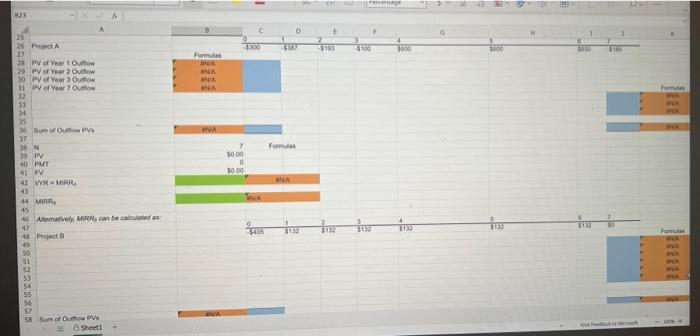

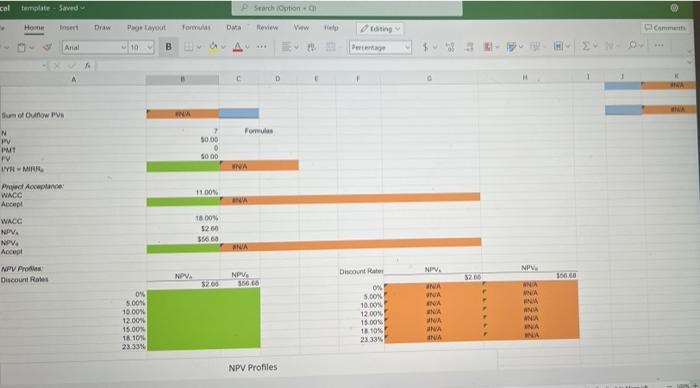

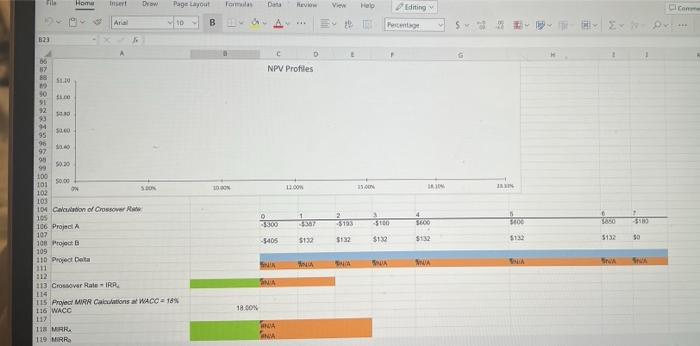

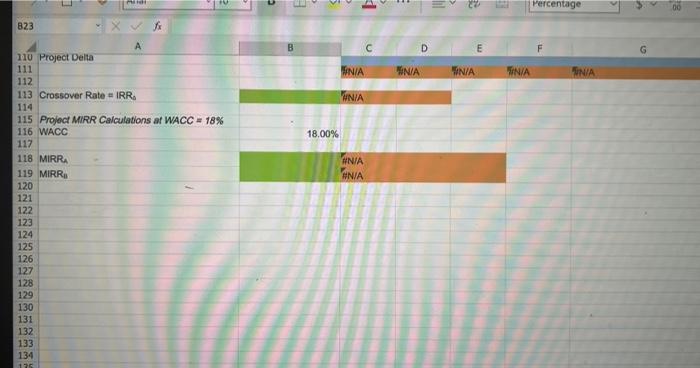

Excel Online Structured Activity: Capital budgeting criteria A company has a 11% WACC and is considering two mutually exclusive investments (that cannot be repeated with the following cash flows: 0 1 2 3 4 5 6 2 Project A -$300 - $387 -$193 -$100 $600 $600 $850 $180 Project B -$405 $132 $132 $132 $132 $132 $132 30 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X 11111 Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ 240.64 Project B: $ 153.43 b. What is each project's IRR? Round your answer to two decimal places Project A: 18.10 % Project B: 23.33 c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. SA EN GA c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: 14.59% Project B: % d. From your answers to parts a-c, which project would be selected? Project A If the WACC was 18%, which project would be selected? Project By e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. Discount Rate NPV Project A NPV Project B 0% $ 5 5 $ $ 10 $ $ 12 $ $ 15 $ $ 18.1 $ $ 23.33 $ $ f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations, 15 $ $ 18.1 $ $ 23:33 $ $ f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations % Q. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: 96 Project B: % F Home Ini Page Layout For weiten Wew Hole Game Anel 10 B Percentage R 323 6 D + H WACC 11.00% PA 0 3300 -3795 5100 4 900 1030 5850 -5790 -3405 5132 $132 $132 $132 5132 30 # Project 9 ID 11 Project NFV Cabo 12 NAV Formas 174004NDVIDEO $15343 NUB-C 14 NPV, 15 16 FR Calon 17 RR 18 10.30 RICE 19 RICE 20 -21 Project MRR Calculation 22 MRR SERICE. 2331 5 3100 BROD 3000 3350 Formulas 24 AY MRR can be called as 25 26 Project 27 29 PV of Year 1 Out 39 PV of Year Outlow 30 PV of Year Our 31 PV of Year Out 32 33 14 ht INA NA NA Fores 823 25 26 Project 300 1967 1000 28 PV of Year 1 Outlow 29 PV of Year Outlow 30 of Year Outlow 31 PV of Year Outlow Formas NA NA ANA NA A 3000 10.00 36 of Outs 17 N 39 PV 40 PM 41FV 41 WR-MIRR 43 4 MER 45 46 Alively MIRR, can be called at 22 Project $ %m%n% 55 56 57 58 Sum Outlow us Sheet cel template-Saved P search optional Home Draw Form Data Review Vw roting Cam Arial 919 BA $ A D H holow PV INA Formules N PV PMT FV IV-MIRR $0.00 . 5000 UNA 11.00 Prijed Acceptance WACC Accept WACC NPV. 18.00% 5260 $5660 NPV Accept ANA NPVA NPV NPV Pro Discount Rates Discount Rate NPV NPVA 160.00 0% 5.00% 10 001 12.00% 15.00% 18 10 23331 06 5.00 10.00 12.00 15.00 18 10% 23.33% WA NA INA NA WA UNA NA WNIA NINA NA ANA ANIA NA NPV Profiles File Home Insert Drow Tommi Data View Halo Editing Clic Page Layout B Ara A. Per SO*** B23 c D BY NPV Profiles $1.10 . 130 DON 15.00 IN 1 3300 313 3120 SO SEO 14.00 95 . 97 09 50.30 100 10.00 101 102 ON SON 100 104 Calculation of Crossover 10 106 Project 102 106 Project 109 110 Project Delta 111 112 113 Crossover Rale - IRALE 114 115 Project MRR Calculations WACC = 18% 116 WACC 117 118 MRR 119 MRR $130 $122 $132 -3405 $123 $132 5132 30 SA NA NA SNA 18.00 WA NA 5 1 02 Percentage 00 823 D E UNA WNIA NA NA NA WNIA 18.00% #N/A #N/A 110 Project Delta 111 112 113 Crossover Rate IRR. 114 115 Project MIRR Calculations at WACC - 18% 116 WACC 117 118 MIRRA 19 MIRR 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 175