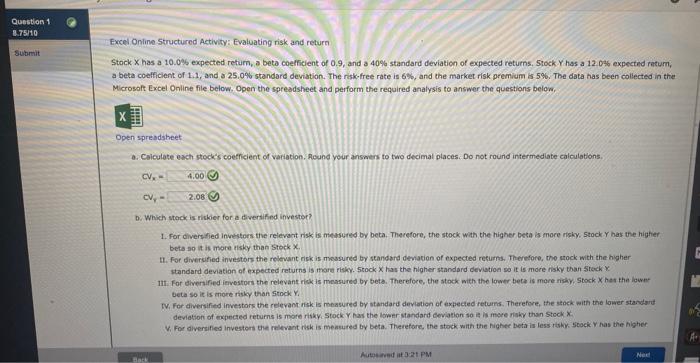

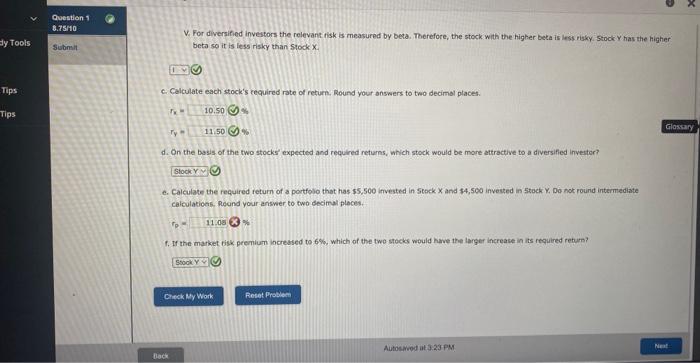

Excel Online Structured Activity: Evaluating risk and return Stock X has a 10.0 os expected return, a beta coefficient of 0.9, and a 40% standard deviaticn of expected returns, 5tock y has a 12.0% expected ratum, a beta coefficient of 1.1, and a 25.0% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions beliow. Open spreadsheet a. Caiculate each stock's coetficient of variation. Rlound yeur answers to two decimal places. Do not round intermediate calculations. CVx=CVy= b. Which stock is ritker for a diverifified investoe? 1. For diversfied investors the relevart risk is meassied by beta. Therefore, the stock with the higher beta is more risky. 5tock y has the higher beto so it is more nisky than stock x. tu. Fot diversitied investors the relevant risk is messured by standerd devation of expected retums. Therefore, the erock with the higher standard deviation of expected returns is mare risky. 5 tock x has the higher standard devistion so it is more nishy than 5 teck x IIt. For diveraifed ietestors the relevant rick is messured by beta. Therefore, the stock with the lower beta is more nisy. Stock X her tha lowet beta so it is more risky than stock Y, NV, For diversified investars the relevant insk is measured by standard deviation of expected returns. Therefore, the stack with the lower standard deviation of expected returns is more ritky, Stock y nas the lower standard cevatian so is is mere naky than stock x : V. For diversified investort the mevant risk is mentured by beta. Therefore, the stock with the nigher beta is less rithy. 500ck Y has the nigher V. For diversified investors the relevant tisk is measured by beta. Therefore, the stock with the higher beta is less risky. Stock y has the higher beta see it is liess risky than Stock X. 6. Gelculate each stock's cequired rate of retum. Round your answers to two decimsl places. d. On the basis of the two stocks expected and required returns, which stock would be more attractive to a diversified invester? () e. Calculate the required return of a portfolo that has 55,500 invested in 5 tock x and 54,500 invested in 5 tock y, Do nok round intermedate calculaticen. Pgond your ariswer to two decimal ploces