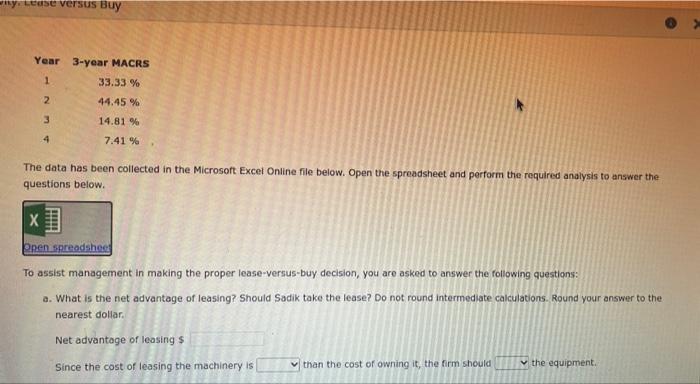

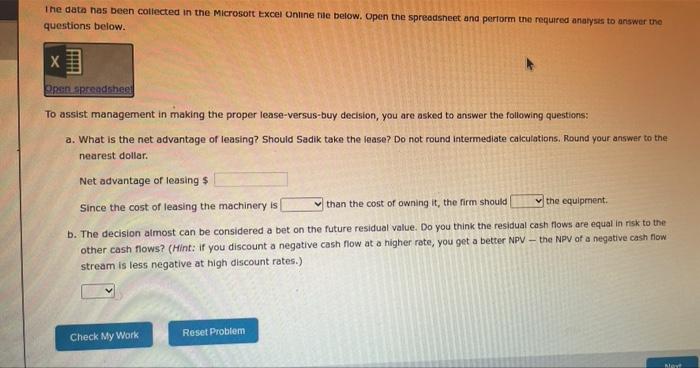

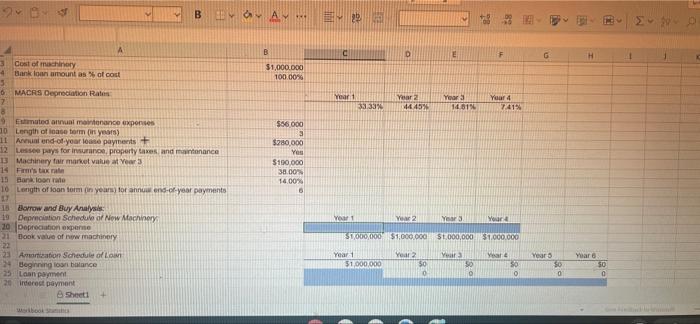

Excel Online Structured Activity: Lease versus Buy Sadik Industries must install $1 million of new machinery in its Texas plant. It can obtain a bank loan for 100% of the required amount Alternatively, a Texas investment banking firm that represents a group of investors believes that it can arrange for a lease financing plan. Assume that these facts apply: AZ 1. The equipment falls in the MACRS 3-year class. 2. Estimated maintenance expenses are $56,000 per year. 3. The firm's tax rate is 38%. 4. If the money is borrowed, the bank loan will be at a rate of 14%, amortized in six equal installments at the end of each year. 5. The tentative lease terms call for payments of $280,000 at the end of each year for 3 years. The lease is a guideline lease. 6. Under the proposed lease terms, the lessee must pay for insurance, property taxes, and maintenance. 7. Sadik must use the equipment if it is to continue in business, so it will almost certainly want to acquire the property at the end of the lease. If it does, then under the lease terms it can purchase the machinery at its fair market value at Year 3. The best estimate of this market value is $190,000, but it could be much higher or lower under certain circumstances. If purchased at Year 3, the used equipment would fall into the MACRS 3-year class. Sadik would actually be able to make the purchase on the last day of the year (i.e., Slightly before Year 3), so Sadik would get to take the first depreciation expense at Year 3 (the remaining depreciation expenses would be at Year 4 through Year 6). On the time line, Sadik would show the cost of the used equipment at Year 3 and its depreciation expenses starting at Year 3. Year 3-year MACRS - versus Buy Year 3-year MACRS 1 33.33% 2 44.45 % 3 14.81 % 4 7.41 % The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. HHI Open spreadsheed To assist management in making the proper lease-versus-buy decision, you are asked to answer the following questions: a. What is the net advantage of leasing? Should Sadik take the lease? Do not round Intermediate calculations. Round your answer to the nearest dollar. Net advantage of leasing $ Since the cost of leasing the machinery is than the cost of owning it, the firm should the equipment The data has been collected in the Microsoft Excel Online Tile below. Open the spreadsheet and perform the required analysis to answer the questions below. x pen spreadshee To assist management in making the proper lease-versus-buy decision, you are asked to answer the following questions: a. What is the net advantage of leasing? Should Sadik take the lease? Do not round intermediate calculations. Round your answer to the nearest dollar. Net advantage of leasing $ Since the cost of leasing the machinery is than the cost of owning it, the firm should the equipment b. The decision almost can be considered a bet on the future residual value. Do you think the residual cash flows are equal in risk to the other cash flows? (Hint: if you discount a negative cash flow at a higher rate, you get a better NPV -- the NPV of a negative cash flow stream is less negative at high discount rates.) Reset Problem Check My Work le B 24 E 29 B D E F G H A 3 Cost of machinery 4 Bank loan amount as of cost 5 6 MACAS Depreciation Rates 7 $1,000,000 100 000 Year 1 Year 2 44 45% 33.33% Year 1481 Year 4 7419 $56.000 3 $280,000 Yes $190.000 38.00 14.00% 9 Emated annual maintenance exponses 20 Length of storm in years) 11 Aunt end of your love payments 12 Lesse prys for insurance property taxes and maintenance B Machinery four market value at Year 3 14 Farsta 15 Barkoon te 10 Length of foon form in year for anwend-of-year payments 18 Borrow and Buy Analysis 19 Ocation Schedule of Now Atachinery 20 Depreciation experte 21 Dook value of new machinery 22 23 Amortization Schedule of LOM 24 Beginning on balance 25 Loan payment 20 Inderst payment Sheet Yeart 2 Years Your 31000000 $1.000 a $1.000,00 31.000.000 Year 2 Ver wal Year Year1 51.000.000 SO $0 0 SO 0 Years 30 0 SO 0 wsbook