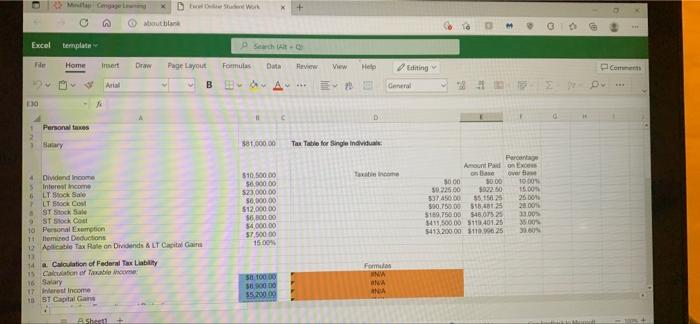

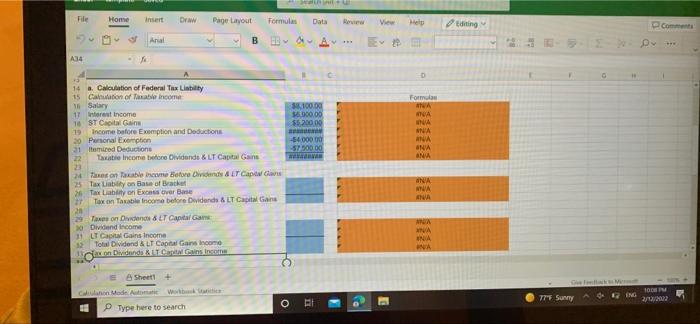

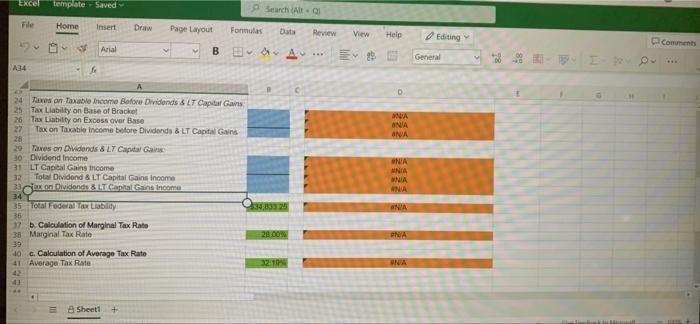

Excel Online Structured Activity: Personal taxes Mary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information: . She received $81,000 in salary. She received $10,500 of dividend income. She received $6,900 of interest income on Home Depot bonds. She received $23,000 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,900. . She received $12,000 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $6,800. Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. TI nnan endast Open.spreadsheet a. What Is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermediate calculations b. What is her marginal tax rate? Round your answer to 1 decimal place. % bout 3 Excel template Search File Home insert Draw Formulas Data Review View Peto Com Page Layout B Aria BOA - General 90 30 4 C D Personal takes Salary 581.000.00 Tax Table for single individuals Income Dividend Income 5 Interest income 6 LT Stock Sale LT Stock Cout ST Stock Sale ST stock Cost 10 Personal Exemption 11 Tomcred Deductions Aplicable Tax Role on Dividends & LT Capital Gains 13 14 Calculation of Federal Tax Liability 15 Caion of a com 16 Salary IT Wrest Income 10 ST Capital Game $10.500.00 50,000.00 523,000.00 $6,000.00 $12.000.00 $6,500.00 $4,000.00 57 500.00 1500 Parco Amount Paid on Exo on base $0.00 5000 1000 50.225.00 $3250 337 450.00 55.15625 2500 10.750.00 18.45 200 $189.750 001607525 33.00 415,500 DO 5119.401.25 38.00 5413.200.00 119 99625 0.00 Formulas MNA 100.00 500000 35.2000 ANA Shesti + File Home Insert Draw Page Layout Formulas Data Row View Editing Com Anal B w dwA... A34 D Form 100.00 5.000.00 $5,200.00 14 - Calculation of Federal Tax Libility 15 Cantation of Table income Salary 11 stores income 16 ST Capital Gain 19 Income before Exemption and Doductions 20 Personal Exemption 31 amired Deductione 22 Teatre Income before Dividendi & LT Catalans 20 24 souble income before Dividend & LT Capa Gar 25 Tax Liability on Base of racket 26 Tax Labil on Exons Over Base Toxon Taxable income before Dividends & LT Capital Gans MA NA NA ANA ANA 5400000 57300.00 NA MA ANA Taxes on D8 LT Capital Game Dividend income 11 LT Capital Gains Income Total Dividend & LT Capital Gains hoone ADA WA NA con Dividends & Cana Gans.com Sheet1 Canon Mode wait Type here to search 77Sunny RE ANG 100 22 o Excel template Saved Search File Home Insert Draw Page Layout Formulas Review View Help Editing Comments 17 Arial B A... General 134 D ANA ANA ONA NA MNIA 24 Taxes on Table income Before Dividends & LT Capital Gains 25 Tax Liability on Base of Bracket 26 Tax Liability on Excess over Base 22 Tax on Taxable income before Dividends & LT Capital Gains 28 29 Taxes on Dividends 8 LT Capital Gain 30 Dividend Income 31 LT Capital Gains Income 32 Total Dividend & LT Capital Gains Income 33 convidats & LT Capital Gans Income 34 35 Total Tax Liability 35 37 b. Calculation of Marginal Tax Rate 38 Marginal Tax Rate 40 C. Calculation of Average Tax Rate 41 Average Tax Rate 42 43 ANA ANA 2000W NA 3211 Sheet1 +