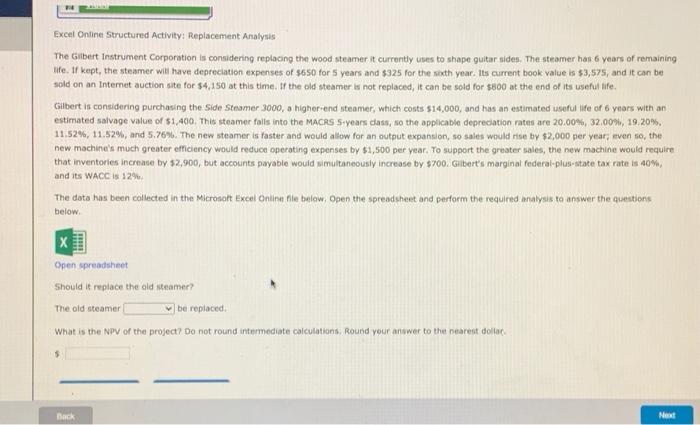

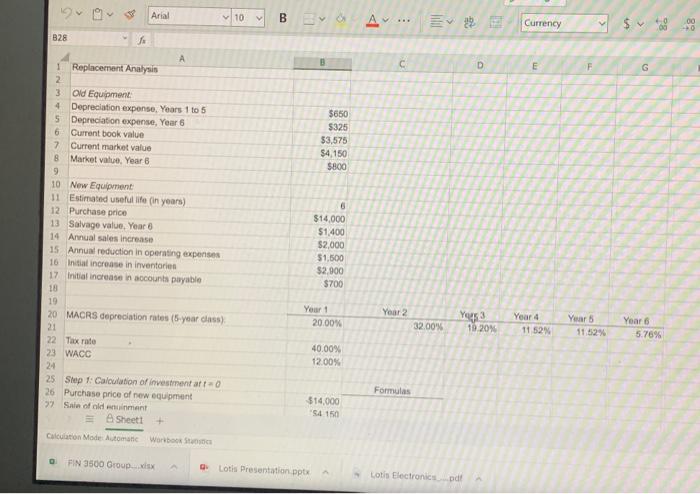

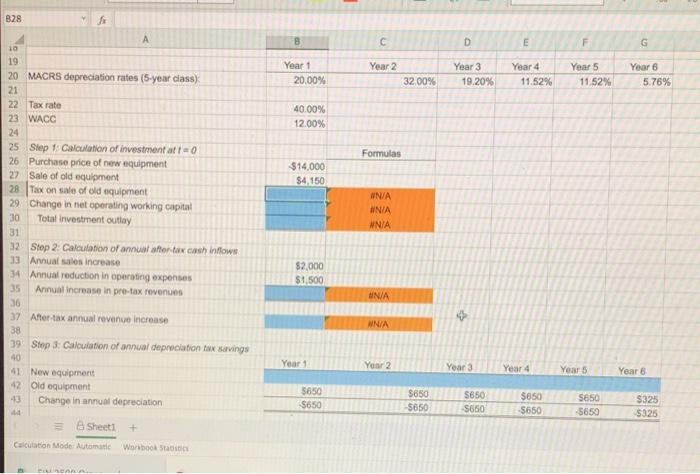

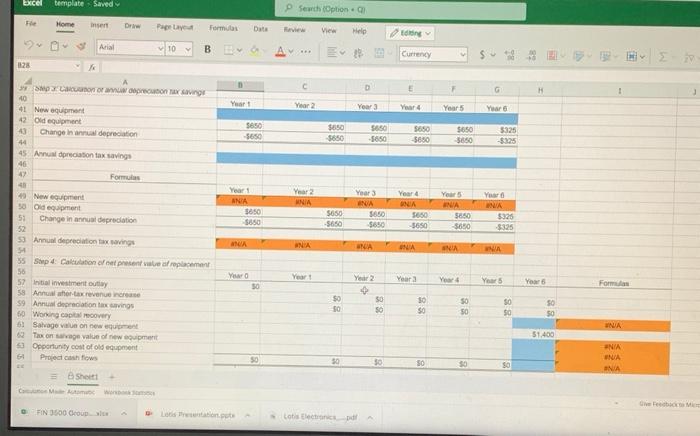

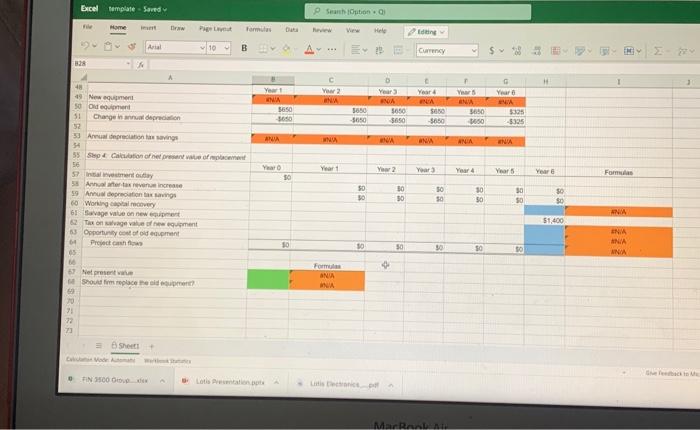

Excel Online Structured Activity: Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape quitar sides. The steamer has 6 years of remaining life. I kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the sixth year. Its current book value is $3,575, and it can be sold on an Internet auction site for $4,150 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $14,000, and has an estimated useful life of 6 years with an estimated salvage value of 51,400. This steamer falls into the MACRS 5-years dass, so the applicable depreciation rates are 20.00%, 32,00%, 19.20%. 11.52%, 11.529, and 5.76%. The new steamer is faster and would allow for an output expansion, so sales would rise by $2,000 per year; even so, the new machine's much greater efficiency would reduce operating expenses by $1,500 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is com and its WACC IS 12% The data has been collected in the Microsoft Exent Online flle below, Open the spreadsheet and perform the required analysis to answer the questions below Open spreadsheet Should it replace the old steamer? The old steamer be replaced What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar $ Back Next 190 Arial 10 BYO A... Currency 60 B28 C D E F G $650 $325 $3,575 $4, 150 $800 1 Replacement Analysis 2 3 Old Equipment 4 Depreciation expense, Years 1 to 5 5 Depreciation expense, Year 6 6 Current book value 7 Current market value 8 Market value Year 9 10 New Equipment 11 Estimated useful life in years) 12 Purchase price 13 Salvage value Year 8 14 Annual sales increase 15 Annual reduction in operating expenses 16 initial increase in inventories 17 Initial increase in accounts payable 18 19 20 MACRS depreciation rates (5-year class) 21 22 Tax rate 23 WACC 24 25 Step 1: Calculation of investment att 26 Purchase price of new equipment 77 Sain of old woman Sheet + 6 $14.000 $1,400 $2,000 $1,500 $2.900 $700 Your 1 20.00% Year 2 32.00% Your 10 20% Year 4 1152 Year 5 11.52% Year 5.76% 40.00% 12.00% Formulas $14.000 $4150 Calcon Mode Auto Wortbook o FIN 3500 Group Lotis Presentation pptx Lotis Electronics pdf B28 B D E G Year 2 Year 1 20.00% Year 3 19.20% Year 4 11.52% Year 5 11.52% Year 6 5.76% 32.00% 40.00% 12.00% Formulas $14,000 $4,150 WNIA #N/A 10 19 20 MACRS depreciation rates (5-year class) 21 22 Tax rate 23 WACC 24 25 Step 1: Calculation of investment at 0 26 Purchase price of new equipment 27 Sale of old equipment 28 Tax on sale of old equipment 29 Change in net operating working capital 30 Total investment outlay 31 32 Step 2: Calculation of annual for tax cash inflowe 33 Annual sales increase 34 Annual reduction in operating expenses 35 Annual increase in pre-tax revenues 36 37 After-tax annual revenue increase 38 39. Step 3: Calculation of annual depreciation tax savings 40 41 New equipment 42 Old equipment 43 Change in annual depreciation WNIA $2,000 $1,500 NNA WNIA Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $650 $650 $650 $650 5650 S650 $650 $650 $650 -5650 $325 $325 Sheet1 + Calculation Mode: Automatic Worboot CAR Excel template Saved Sewch Option Home insen Draw Page Layou Formu Date View Arial 10 B Currency $ c G Yeart Year 2 Year 3 Year 4 Years Year 5650 -S650 $650 $850 $850 3325 $8.50 -5650 3650 $650 3650 Year Yeart ANTA 3650 S850 Year2 WNIA 128 X A SOX CONTO 40 41 New equipment 42 Old equipment 43 Change in annual depreciation 44 45 Annual preciation tax savings 46 47 Fomus 48 4 New querent 50 Old quipment 53 Change in annual depreciation 52 51 Annual depreciation taxings 51 55 Smp d. Callation of net pratent valse af replacement 56 57 Initial investment 58 Annual wher-tax revenue crosse 59 Annual depreciation tax savings 60 Working capital Povery 61 Salvage valu on new equipment 62 Thxonage value of new guipment Opportunity cost of old edument 6 Project cash flows Short S650 5650 $850 Year 4 NUR 5660 -5650 Yours ANA $850 3650 Year NA $325 $325 A NA NA UNA NA Yeart YO 50 Year 2 Year Year Years Year Form $0 SO 50 50 30 $0 50 50 SO 50 WNA 51.400 NIA UNA ANA 30 50 50 9 SO M FIN 3500 Coub Lotis lectes Excel template Soved Shton. Home Dr Formules Wew Hele Editing Arial 10 B Currency $* Year 2 Yeart G Yare NA Year NA EN 3650 NA 3650 5650 SONO Years ANA 3850 3650 SEO 3650 -5325 ANA WN ANIA NA 48 49 New 50 O 51 Change in depreciation SR 53 Anuario savings 34 5 Sh & Calcution of new of me 56 57 any 58 Amatan increase 59 Auction ang 60 Working recovery 61 Savage value on new upent 62 Taxonage valuement 63 Opport content 64 Proyectoshow 05 Year 1 Your Year Year 4 Yar 5 Yoare Fomus 50 88 30 50 50 so 30 50 30 50 50 30 ANA 51,400 INI ANIA ANA 50 30 50 30 50 4 59. Nel presenta Should replace the side Form ANA A 0 71 72 23 She FINHO Mar