Question

Excel Online Structured Activity: Required annuity payments Your father is 50 years old and will retire in 10 years. He expects to live for 25

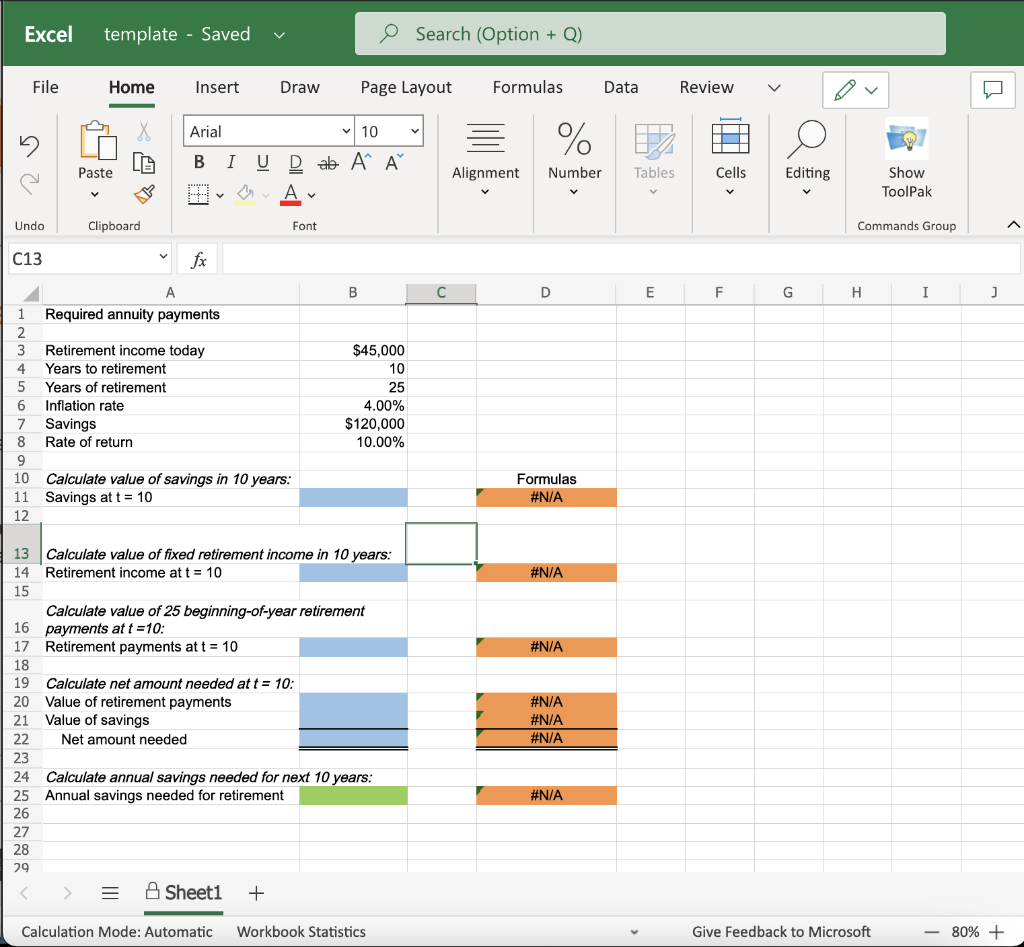

Excel Online Structured Activity: Required annuity payments Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $120,000 saved, and he expects to earn 10% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? Do not round your intermediate calculations. Round your answer to the nearest cent.

Excel template - Saved Search (Option + Q) File Home Insert Draw Page Layout Formulas Data Review 1 Arial 10 Dab AA % LO . I U Paste Alignment Number Tables Cells Editing R Show ToolPak A Undo Clipboard Font Commands Group C13 fx A B D E F G H I J 1 Required annuity payments 2 3 Retirement income today 4 Years to retirement 5 Years of retirement 6 Inflation rate 7 Savings 8 Rate of return 9 10 Calculate value of savings in 10 years: 11 Savings at t = 10 12 $45,000 10 25 4.00% $120,000 10.00% Formulas #N/A #N/A #N/A 13 Calculate value of fixed retirement income in 10 years: 14 Retirement income at t = 10 15 Calculate value of 25 beginning-of-year retirement 16 payments at t = 10: 17 Retirement payments at t = 10 18 19 Calculate net amount needed at t = 10: 20 Value of retirement payments 21 Value of savings 22 Net amount needed 23 24 Calculate annual savings needed for next 10 years: 25 Annual savings needed for retirement #N/A #N/A #N/A #N/A 27 28 29 III Sheet1 + Calculation Mode: Automatic Workbook Statistics Give Feedback to Microsoft 80% +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started