Answered step by step

Verified Expert Solution

Question

1 Approved Answer

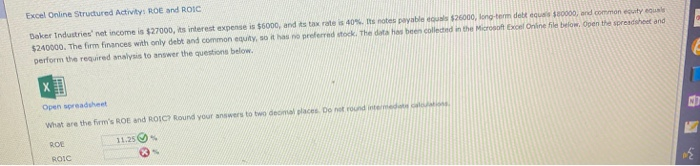

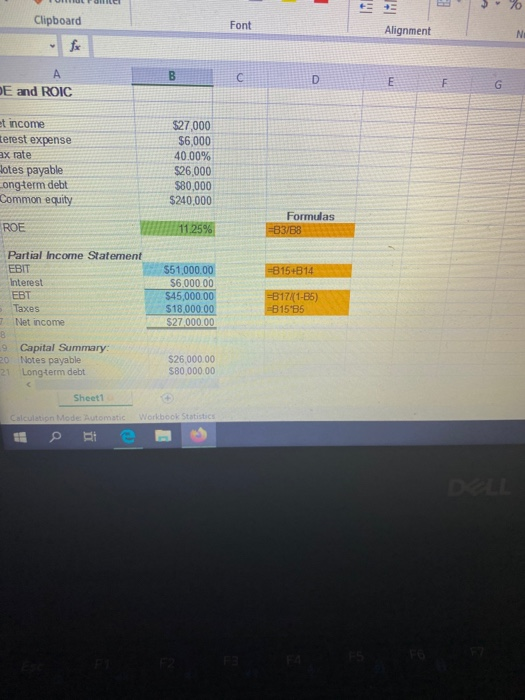

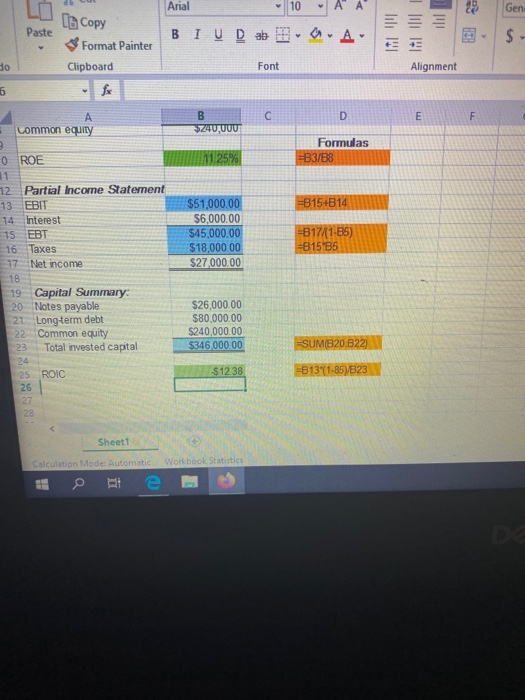

Excel Online Structured Activity: ROE and ROIC Baker Industries' net income is $27000, its interest expense is $6000, and its tax rate is 40%. Its

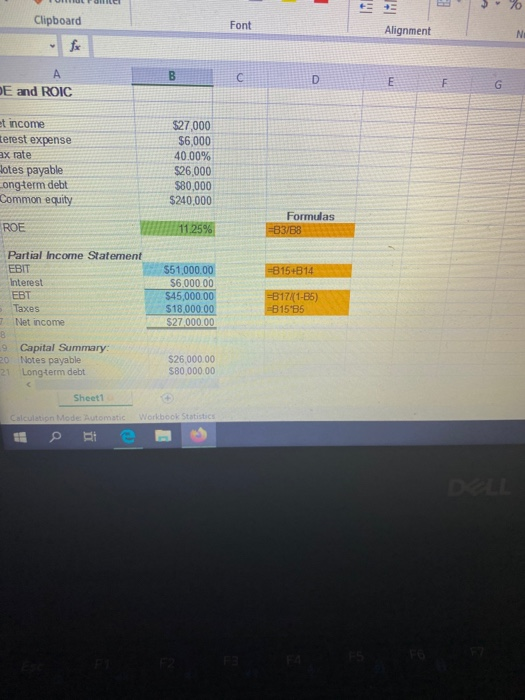

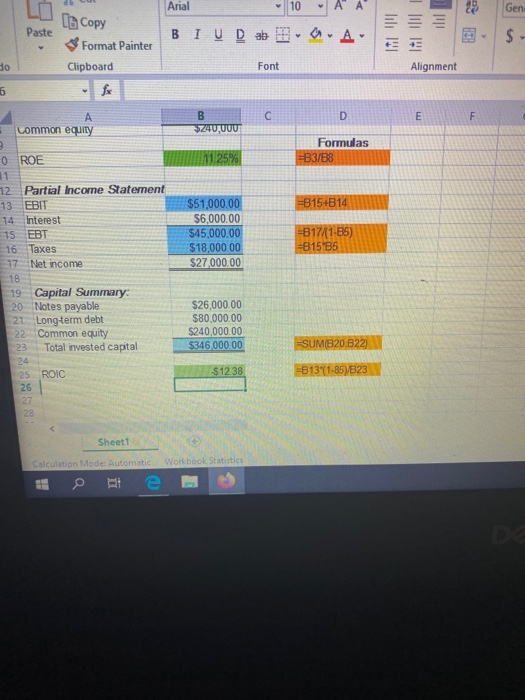

Excel Online Structured Activity: ROE and ROIC Baker Industries' net income is $27000, its interest expense is $6000, and its tax rate is 40%. Its notes payable quals $26000, long-term dette 80000, and common cuity $240000. The firm finances with only debt and common equly, so it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What are the firm's ROE and ROIC Round your answers to two del places. Do not round in 11.25 0 ROIC $ 70 Font Clipboard fx Alignment NE B DE and ROIC D E F G et income terest expense ax rate Flotes payable $27,000 $6,000 40.00% $26.000 $80,000 $240,000 Longterm debt Common equity ROE Formulas =B3/B8 11.25% =815+B14 Partial Income Statement EBIT Interest EBT Taxes Net income 8 9 Capital Summary 20 Notes payable 21 Long-term debt 551,000.00 $6,000.00 $45,000.00 $18,000.00 $27.000.00 =B17/(1-B5) B15 B5 - $26.000.00 $80,000.00 Sheet1 Workbook Statistics Calculation Mode Automatic BA Arial 10 A Gen LO Paste la Copy BI U Da BA $ Format Painter Ho Clipboard Font Alignment 6 fx D mm F A common equity B $240,000 Formulas B3/B8 1125% =815+B14 $51,000.00 $6,000.00 $45,000.00 $18,000.00 $27,000.00 =B17/(1-15) =815 B5 0 ROE 11 12 Partial Income Statement 13 EBIT 14 Interest 15 EBT 16 Taxes 17 Net income 18 19 Capital Summary: 20 Notes payable 21. Long-term debt 22 Common equity 23 Total invested capital 24 25 ROIC 26 27 28 $26,000.00 $80,000.00 $240,000.00 $346,000.00 =SUMB20 B22) $12.38 =B131-85)823 Sheet1 Calculation Mode: Automatic Workbook Statistics

Excel Online Structured Activity: ROE and ROIC Baker Industries' net income is $27000, its interest expense is $6000, and its tax rate is 40%. Its notes payable quals $26000, long-term dette 80000, and common cuity $240000. The firm finances with only debt and common equly, so it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What are the firm's ROE and ROIC Round your answers to two del places. Do not round in 11.25 0 ROIC $ 70 Font Clipboard fx Alignment NE B DE and ROIC D E F G et income terest expense ax rate Flotes payable $27,000 $6,000 40.00% $26.000 $80,000 $240,000 Longterm debt Common equity ROE Formulas =B3/B8 11.25% =815+B14 Partial Income Statement EBIT Interest EBT Taxes Net income 8 9 Capital Summary 20 Notes payable 21 Long-term debt 551,000.00 $6,000.00 $45,000.00 $18,000.00 $27.000.00 =B17/(1-B5) B15 B5 - $26.000.00 $80,000.00 Sheet1 Workbook Statistics Calculation Mode Automatic BA Arial 10 A Gen LO Paste la Copy BI U Da BA $ Format Painter Ho Clipboard Font Alignment 6 fx D mm F A common equity B $240,000 Formulas B3/B8 1125% =815+B14 $51,000.00 $6,000.00 $45,000.00 $18,000.00 $27,000.00 =B17/(1-15) =815 B5 0 ROE 11 12 Partial Income Statement 13 EBIT 14 Interest 15 EBT 16 Taxes 17 Net income 18 19 Capital Summary: 20 Notes payable 21. Long-term debt 22 Common equity 23 Total invested capital 24 25 ROIC 26 27 28 $26,000.00 $80,000.00 $240,000.00 $346,000.00 =SUMB20 B22) $12.38 =B131-85)823 Sheet1 Calculation Mode: Automatic Workbook Statistics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started