Answered step by step

Verified Expert Solution

Question

1 Approved Answer

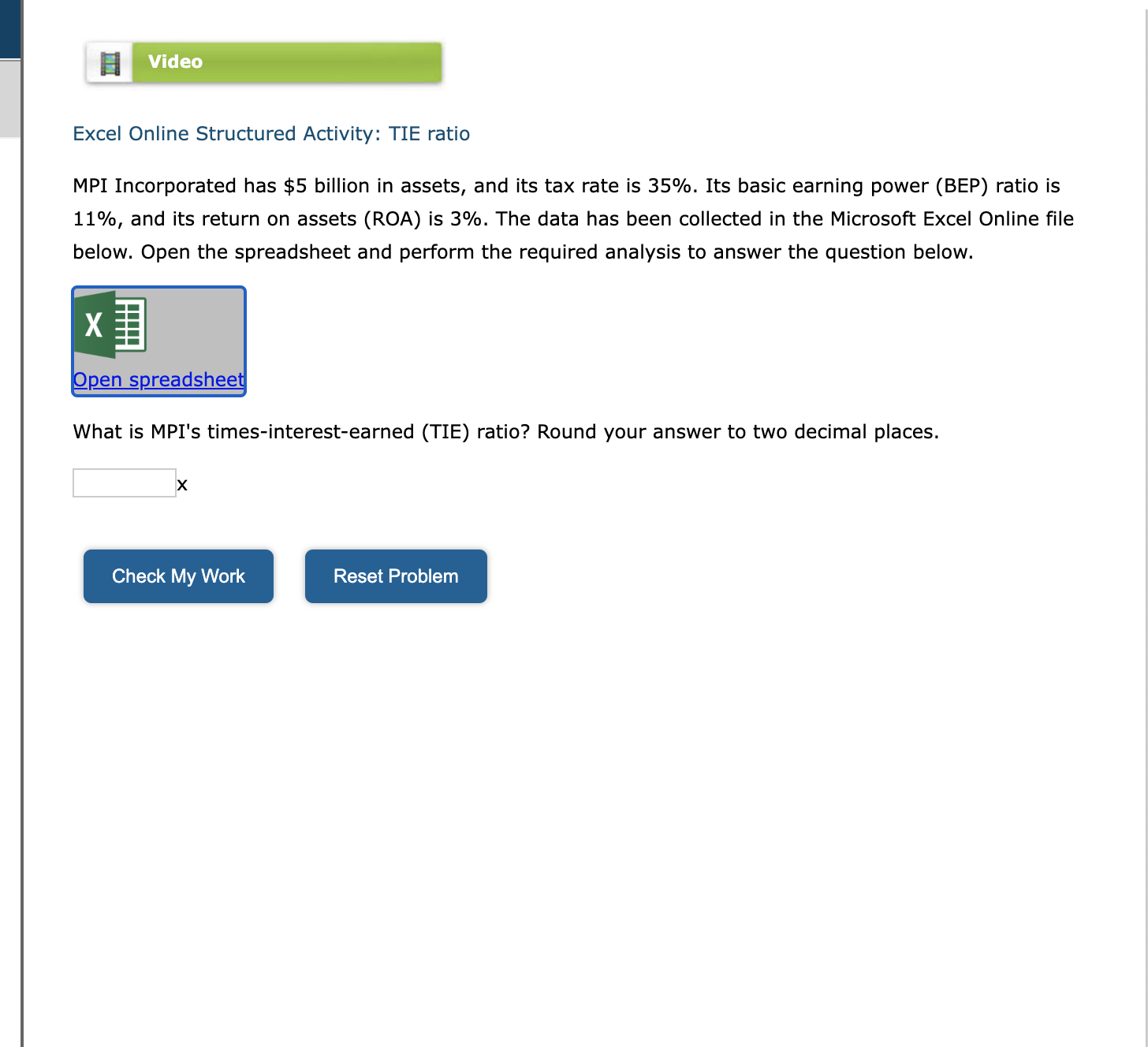

Excel Online Structured Activity: TIE ratio MPI Incorporated has $5 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio

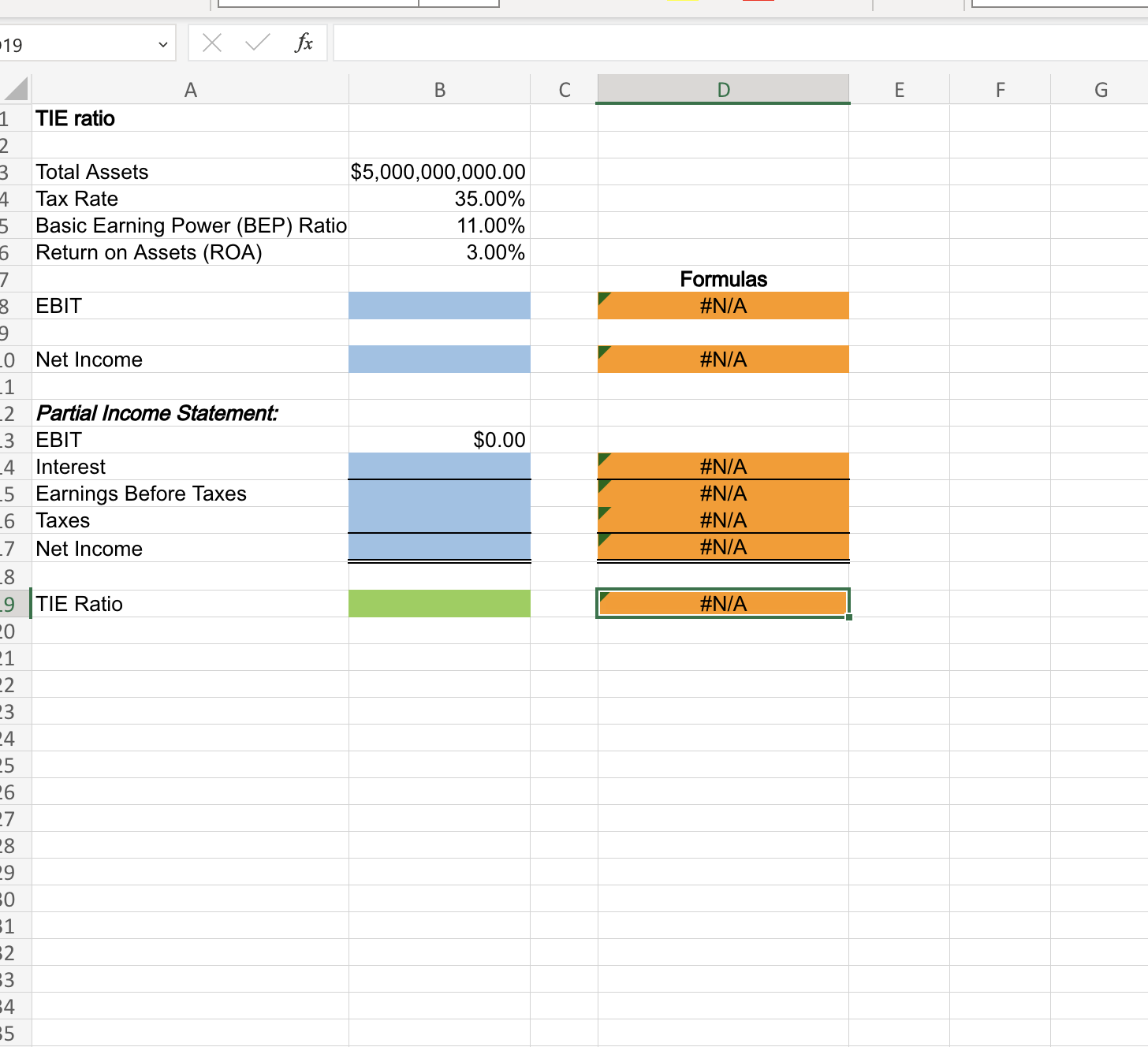

Excel Online Structured Activity: TIE ratio MPI Incorporated has $5 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 3%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places. TIE ratio \begin{tabular}{|lr|} \hline Total Assets & $5,000,000,000.00 \\ \hline Tax Rate & 35.00% \\ \hline Basic Earning Power (BEP) Ratio & 11.00% \\ \hline Return on Assets (ROA) & 3.00% \end{tabular} EBIT Net Income Partial Income Statement: EBIT Interest Earnings Before Taxes Taxes Net Income TIE Ratio fx C D E F G B F G 19 A \begin{tabular}{|r|} \hline \multicolumn{1}{|c|}{ B } \\ $5,000,000,000.00 \\ 35.00% \\ 11.00% \\ 3.00% \\ \hline \\ \hline$0.00 \\ \hline \hline \end{tabular} L fx Total Assets Tax Rate Basic Earning Power (BEP) Ratio \begin{tabular}{l} Net Income \\ Partial Income Statement: \\ EBIT \\ Interest \\ Earnings Before Taxes \\ Taxes \\ Net Income \\ \hline TIE Ratio \end{tabular} 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

Excel Online Structured Activity: TIE ratio MPI Incorporated has $5 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 3%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places. TIE ratio \begin{tabular}{|lr|} \hline Total Assets & $5,000,000,000.00 \\ \hline Tax Rate & 35.00% \\ \hline Basic Earning Power (BEP) Ratio & 11.00% \\ \hline Return on Assets (ROA) & 3.00% \end{tabular} EBIT Net Income Partial Income Statement: EBIT Interest Earnings Before Taxes Taxes Net Income TIE Ratio fx C D E F G B F G 19 A \begin{tabular}{|r|} \hline \multicolumn{1}{|c|}{ B } \\ $5,000,000,000.00 \\ 35.00% \\ 11.00% \\ 3.00% \\ \hline \\ \hline$0.00 \\ \hline \hline \end{tabular} L fx Total Assets Tax Rate Basic Earning Power (BEP) Ratio \begin{tabular}{l} Net Income \\ Partial Income Statement: \\ EBIT \\ Interest \\ Earnings Before Taxes \\ Taxes \\ Net Income \\ \hline TIE Ratio \end{tabular} 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started