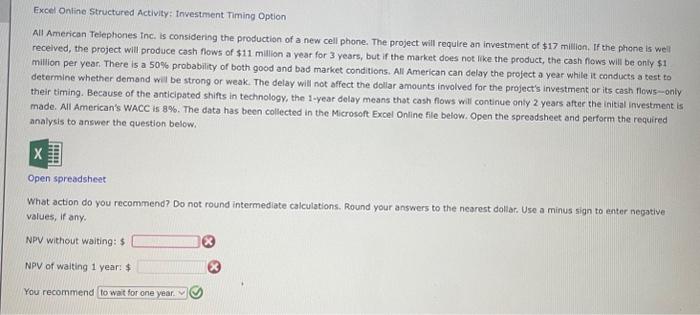

Excel Ontine Structured Activity; tnvestment Timing Option All American Teiephones inc, is considering the production of a new cell phone. The project will require an investment of $17 million, If the phone is well received, the project will produce cash nows of $11 million a vear for 3 years, but if the market does not like the product, the cash fows will be only $1 million per year. There is a 50% probability of both good and bad market conditions. All American can delay the profect a year while it conducts a test to determine whether demand wal be strong or weak. The delay will not affect the dollar amounts involved for the project's investment or its cash flews -only their timing. Because of the anticipated shifts in technology, the 1 -year delay means that cash flows will continue only 2 years after the initial investment is made. All American's WACC is 8%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What action do you recommend? Do not round intermediate calculations. Round your answers to the nearest dollar. Use a minus sign to enter negative values, if any. NPV without waiting: 5 NPV of waiting 1 year: $ You recommend Excel Ontine Structured Activity; tnvestment Timing Option All American Teiephones inc, is considering the production of a new cell phone. The project will require an investment of $17 million, If the phone is well received, the project will produce cash nows of $11 million a vear for 3 years, but if the market does not like the product, the cash fows will be only $1 million per year. There is a 50% probability of both good and bad market conditions. All American can delay the profect a year while it conducts a test to determine whether demand wal be strong or weak. The delay will not affect the dollar amounts involved for the project's investment or its cash flews -only their timing. Because of the anticipated shifts in technology, the 1 -year delay means that cash flows will continue only 2 years after the initial investment is made. All American's WACC is 8%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What action do you recommend? Do not round intermediate calculations. Round your answers to the nearest dollar. Use a minus sign to enter negative values, if any. NPV without waiting: 5 NPV of waiting 1 year: $ You recommend