Answered step by step

Verified Expert Solution

Question

1 Approved Answer

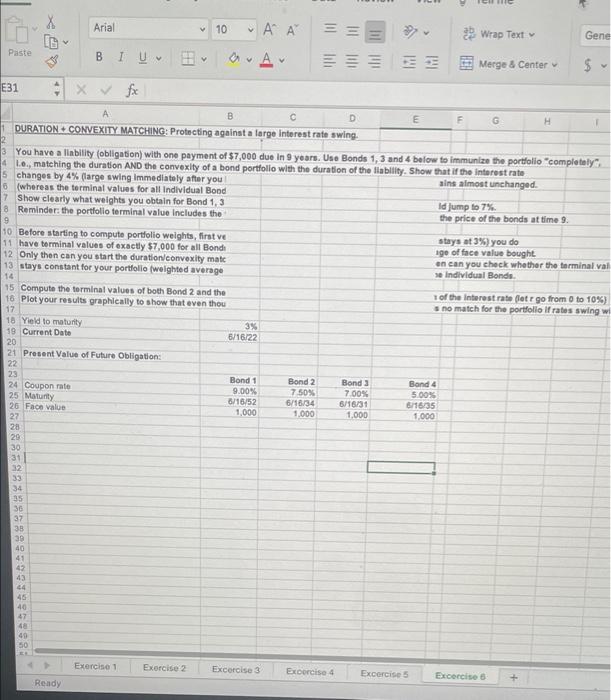

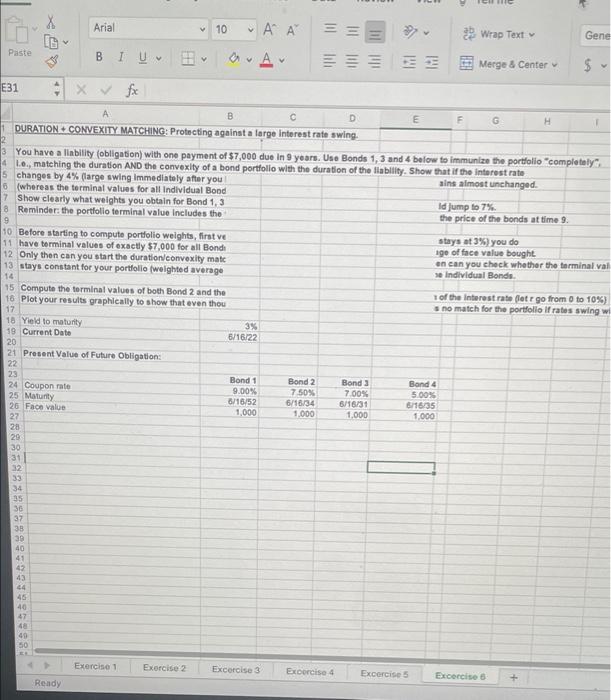

excel please Arial ' ' WEE Wrap Text Gene B IU V A Merge & Center $ Y E31 x fx A D E H

excel please

Arial ' ' WEE Wrap Text Gene B IU V A Merge & Center $ Y E31 x fx A D E H DURATION CONVEXITY MATCHING: Protecting against a large interest rate swing. 3 You have a liability (obligation) with one payment of $7,000 due in 9 years. Use Bonds 1, 3 and 4 below to immunize the portfolio "completely", Le., matching the duration AND the convexity of a bond portfolio with the duration of the liability. Show that if the interest rate 5 changes by 4% (large swing Immediately after you ains almost unchanged. 6 (whereas the terminal values for all Individual Bond 7 Show clearly what weights you obtain for Bond 1,3 ld jump to 7% 8 Reminder: the portfolio terminal value includes the 9 the price of the bonds at time 9. stays at 3%) you do 10 Before starting to compute portfolio weights, first ve 11 have terminal values of exactly $7,000 for all Bond 12 Only then can you start the duration/convexity matc 13 stays constant for your portfolio (weighted average age of face value bought en can you check whether the terminal val se Individual Bonds. 14 15 Compute the terminal values of both Bond 2 and the 16 Plot your results graphically to show that even thou 1 of the interest rate (let r go from 0 to 10%) s no match for the portfolio if rates swing wi 17 18 Yield to maturity 19 Current Date 20 21 Present Value of Future Obligation: 22 23 24 Coupon rate 25 Maturity 26 Face value 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Paste 45 40 47 X 48 49 50 RE 44 V Ready Exercise 1 V Exercise 2 3% 6/16/22 Bond 1 9.00% 6/16/52 1,000 Excercise 3 Bond 2 7.50% 6/16/34 1,000 Excercise 4 Bond 3 7.00% 6/16/31 1,000 Band 4 5.00% 6/16/35 1,000 Excercise 5 Excercise 6 Arial ' ' WEE Wrap Text Gene B IU V A Merge & Center $ Y E31 x fx A D E H DURATION CONVEXITY MATCHING: Protecting against a large interest rate swing. 3 You have a liability (obligation) with one payment of $7,000 due in 9 years. Use Bonds 1, 3 and 4 below to immunize the portfolio "completely", Le., matching the duration AND the convexity of a bond portfolio with the duration of the liability. Show that if the interest rate 5 changes by 4% (large swing Immediately after you ains almost unchanged. 6 (whereas the terminal values for all Individual Bond 7 Show clearly what weights you obtain for Bond 1,3 ld jump to 7% 8 Reminder: the portfolio terminal value includes the 9 the price of the bonds at time 9. stays at 3%) you do 10 Before starting to compute portfolio weights, first ve 11 have terminal values of exactly $7,000 for all Bond 12 Only then can you start the duration/convexity matc 13 stays constant for your portfolio (weighted average age of face value bought en can you check whether the terminal val se Individual Bonds. 14 15 Compute the terminal values of both Bond 2 and the 16 Plot your results graphically to show that even thou 1 of the interest rate (let r go from 0 to 10%) s no match for the portfolio if rates swing wi 17 18 Yield to maturity 19 Current Date 20 21 Present Value of Future Obligation: 22 23 24 Coupon rate 25 Maturity 26 Face value 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Paste 45 40 47 X 48 49 50 RE 44 V Ready Exercise 1 V Exercise 2 3% 6/16/22 Bond 1 9.00% 6/16/52 1,000 Excercise 3 Bond 2 7.50% 6/16/34 1,000 Excercise 4 Bond 3 7.00% 6/16/31 1,000 Band 4 5.00% 6/16/35 1,000 Excercise 5 Excercise 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started