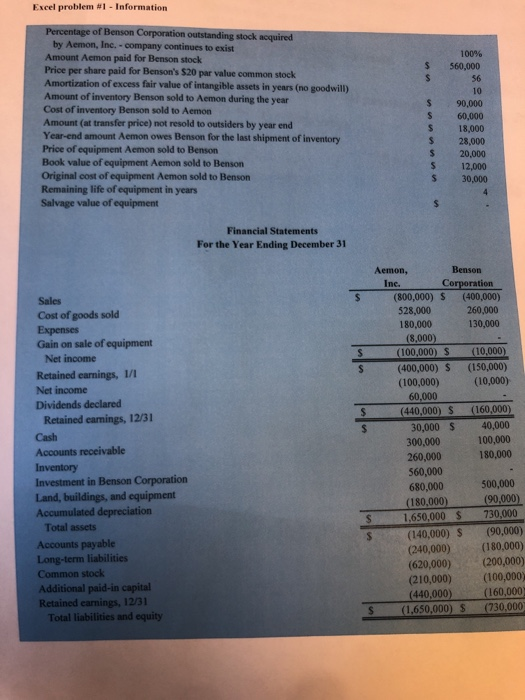

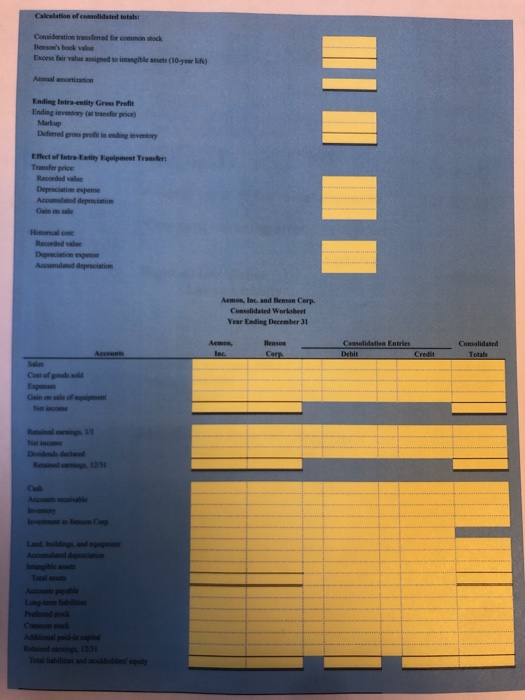

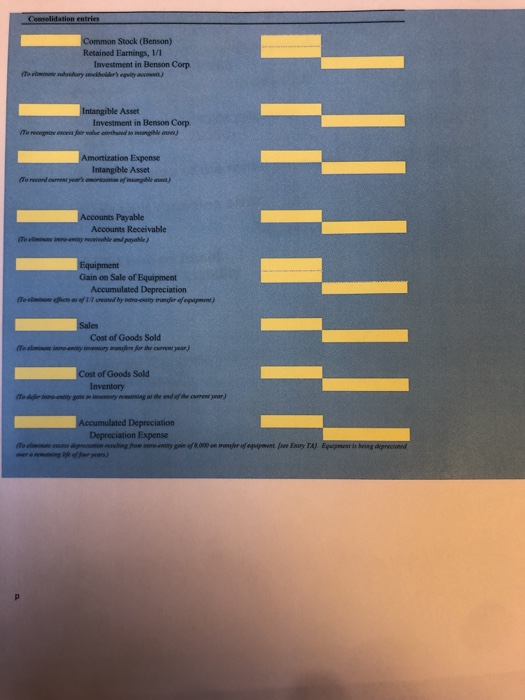

Excel problem #1-Information Percentage of Benson Corporation outstanding stock acquired by Aemon, Inc.- company continues to exist Amount Aemon paid for Benson stock Price per share paid for Benson's $20 par value common stock Amortization of excess fair value of intangible assets in years (no goodwill) Amount of inventory Benson sold to Aemon during the year Cost of inventory Benson sold to Aemon Amount (at transfer price) not resold to outsiders by year end Year-end amount Aemon owes Benson for the last shipment of inventory Price of equipment Aemon sold to Benson Book value of equipment Aemon sold to Benson Original cost of equipment Aemon sold to Benson Remaining life of equipment in years Salvage value of equipment 100% $ 560,000 56 10 S 90,000 S 60,000 S 18,000 $ 28,000 S 20,000 s 12,000 S 30,000 Financial Statements For the Year Ending December 31 Benson Co Aemon, (800,000) S (400,000) 260,000 130,000 Sales 528,000 180,000 Cost of goods sold (8,000) Gain on sale of equipment (100,000)(10,000) Net income Retained earnings, 1/1 Net income Dividends declared S (400,000) $ (150,000) (10,000) (440,000) (160,000) 100,000 (100,000) Retained eamings, 12/31 Cash Accounts receivable 30,000 40,000 300,000 260,000 560,000 680,000 (180,000) 1,650,000 730,000 180,000 Investment in Benson Corporation Land, buildings, and equipment Accumulated depreciation 500,000 Total assets Accounts payable Long-term liabilities Common stock Additional paid-in capital Retained earnings, 12/31 (240,000)(180,000) (620,000) (200,000) (210,000) (100,000) (440,000)(160,000 (1,650,000) (730,000 Total liabilities and equity Consideration transSered for common stock Benson's bock valse Excess fair value assigned so inangibless(10-year life) Anmual amortization Ending Intra-entity Gress Preft Ending inventory (at rensfor price) Markup Defenred gross profit in ending inventoty Effect of letrs Estity Equipment Transfer Transfer price Recorded valoe Depreciaticn espense Gain on sale Historical cou Depreciation expense Aemos, Inc and Benson Corp. Year Ending December 31 Consolidated Cost of goods sold Net income Dividends declared Prelred sc Common k Common Stock (Benson) Retained Earnings, 1/1 Investment in Benson Corp ble Asset Investment in Benson Corp ization Expense Intangible Asset Payable Accounts Receivable Equipment Gain on Sale of Equipment Accumulated Depreciation Cost of Goods Sold of Goods Sold Inventory Depreciation Expense Excel problem #1-Information Percentage of Benson Corporation outstanding stock acquired by Aemon, Inc.- company continues to exist Amount Aemon paid for Benson stock Price per share paid for Benson's $20 par value common stock Amortization of excess fair value of intangible assets in years (no goodwill) Amount of inventory Benson sold to Aemon during the year Cost of inventory Benson sold to Aemon Amount (at transfer price) not resold to outsiders by year end Year-end amount Aemon owes Benson for the last shipment of inventory Price of equipment Aemon sold to Benson Book value of equipment Aemon sold to Benson Original cost of equipment Aemon sold to Benson Remaining life of equipment in years Salvage value of equipment 100% $ 560,000 56 10 S 90,000 S 60,000 S 18,000 $ 28,000 S 20,000 s 12,000 S 30,000 Financial Statements For the Year Ending December 31 Benson Co Aemon, (800,000) S (400,000) 260,000 130,000 Sales 528,000 180,000 Cost of goods sold (8,000) Gain on sale of equipment (100,000)(10,000) Net income Retained earnings, 1/1 Net income Dividends declared S (400,000) $ (150,000) (10,000) (440,000) (160,000) 100,000 (100,000) Retained eamings, 12/31 Cash Accounts receivable 30,000 40,000 300,000 260,000 560,000 680,000 (180,000) 1,650,000 730,000 180,000 Investment in Benson Corporation Land, buildings, and equipment Accumulated depreciation 500,000 Total assets Accounts payable Long-term liabilities Common stock Additional paid-in capital Retained earnings, 12/31 (240,000)(180,000) (620,000) (200,000) (210,000) (100,000) (440,000)(160,000 (1,650,000) (730,000 Total liabilities and equity Consideration transSered for common stock Benson's bock valse Excess fair value assigned so inangibless(10-year life) Anmual amortization Ending Intra-entity Gress Preft Ending inventory (at rensfor price) Markup Defenred gross profit in ending inventoty Effect of letrs Estity Equipment Transfer Transfer price Recorded valoe Depreciaticn espense Gain on sale Historical cou Depreciation expense Aemos, Inc and Benson Corp. Year Ending December 31 Consolidated Cost of goods sold Net income Dividends declared Prelred sc Common k Common Stock (Benson) Retained Earnings, 1/1 Investment in Benson Corp ble Asset Investment in Benson Corp ization Expense Intangible Asset Payable Accounts Receivable Equipment Gain on Sale of Equipment Accumulated Depreciation Cost of Goods Sold of Goods Sold Inventory Depreciation Expense