Question

EXCEL PROBLEMS. DDM. 1. You are considering buying a stock today. you plan to swell it in 1 year. You expect it to be worth

EXCEL PROBLEMS. DDM.

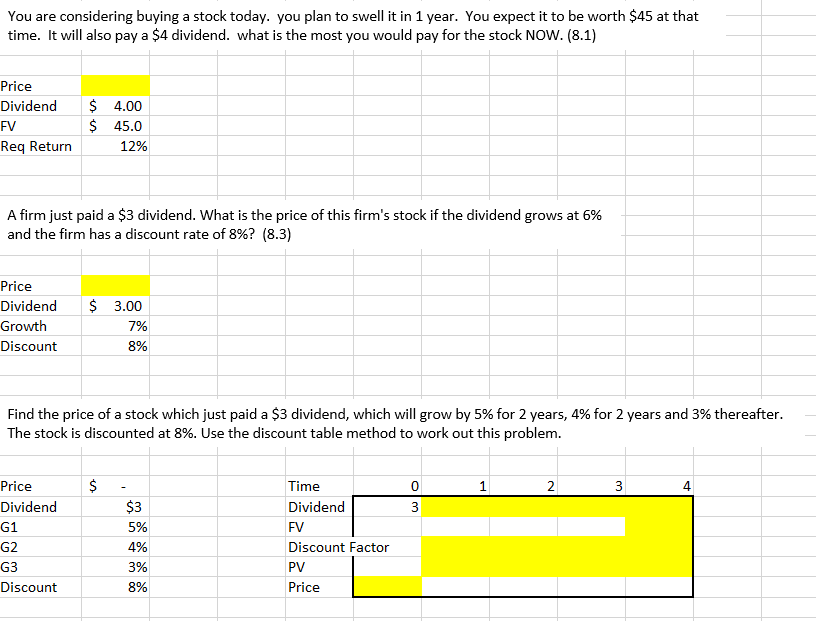

1. You are considering buying a stock today. you plan to swell it in 1 year. You expect it to be worth $45 at that

time. It will also pay a $4 dividend. what is the most you would pay for the stock NOW.

2. A firm just paid a $3 dividend. What is the price of this firm's stock if the dividend grows at 6%

and the firm has a discount rate of 8%?

3. Find the price of a stock which just paid a $3 dividend, which will grow by 5% for 2 years, 4% for 2 years and 3% thereafter.

The stock is discounted at 8%. Use the discount table method to work out this problem.

For 1 I'm pretty sure it's $43.80. I'm still not quite sure where to go with 2 and 3 because of the discount factor. Respond ASAP, if possible.

You are considering buying a stock today. you plan to swell it in 1 year. You expect it to be worth $45 at that time. It will also pay a $4 dividend. what is the most you would pay for the stock NOW. (8.1) Price Dividend$4.00 FV Req Return $ 45.0 12% A firm just paid a $3 dividend, what is the price of this firm's stock if the dividend grows at 6% and the firm has a discount rate of 8%? (83) Price Dividend$3.00 Growth Discount 8% Find the price of a stock which just paid a $3 dividend, which will grow by 5% for 2 years, 4% for 2 years and 3% thereafter The stock is discounted at 8%. Use the discount table method to work out this problem Price Dividend G1 G2 G3 Discount Time Dividend FV Discount Factor PV Price 0 4 $3 5% 0% 3% 8%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started