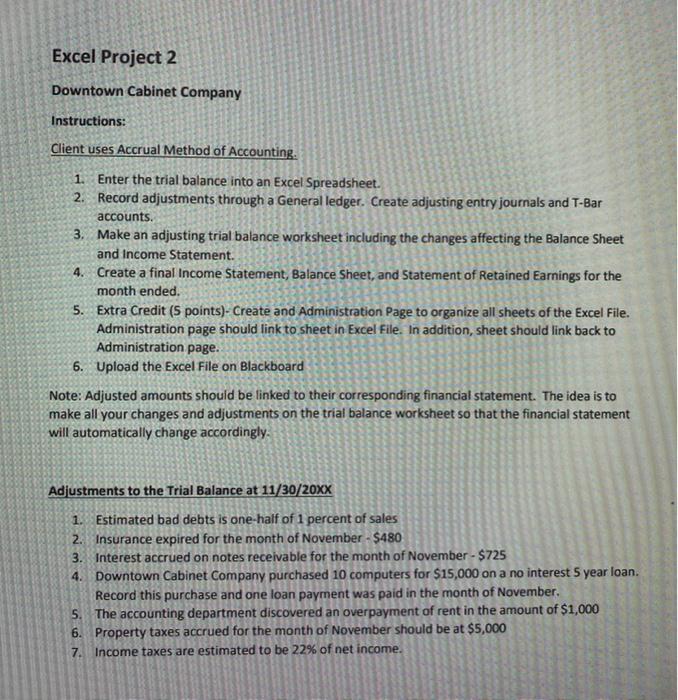

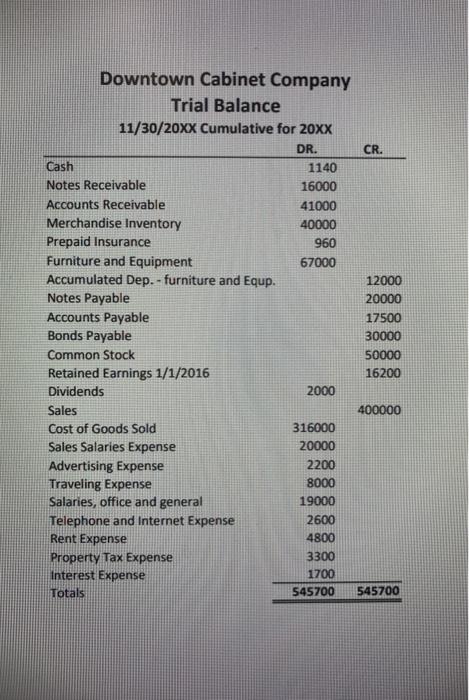

Excel Project 2 Downtown Cabinet Company Instructions: Client uses Accrual Method of Accounting. 1. Enter the trial balance into an Excel Spreadsheet. 2. Record adjustments through a General ledger. Create adjusting entry journals and T-Bar accounts. 3. Make an adjusting trial balance worksheet including the changes affecting the Balance Sheet and Income Statement. 4. Create a final Income Statement, Balance Sheet, and Statement of Retained Earnings for the month ended. 5. Extra Credit (s points)- Create and Administration Page to organize all sheets of the Excel File. Administration page should link to sheet in Excel file. In addition, sheet should link back to Administration page. 6. Upload the Excel File on Blackboard 5. Note: Adjusted amounts should be linked to their corresponding financial statement. The idea is to make all your changes and adjustments on the trial balance worksheet so that the financial statement will automatically change accordingly. Adjustments to the Trial Balance at 11/30/20XX 1. Estimated bad debts is one-half of 1 percent of sales 2. Insurance expired for the month of November - $480 3. Interest accrued on notes receivable for the month of November - $725 4. Downtown Cabinet Company purchased 10 computers for $15,000 on a no interest 5 year loan. Record this purchase and one loan payment was paid in the month of November 5. The accounting department discovered an overpayment of rent in the amount of $1,000 6. Property taxes accrued for the month of November should be at $5,000 7. Income taxes are estimated to be 22% of net income. Downtown Cabinet Company Trial Balance 11/30/20XX Cumulative for 20XX DR. CR. Cash 1140 Notes Receivable 16000 Accounts Receivable 41000 Merchandise Inventory 40000 Prepaid Insurance 960 Furniture and Equipment 67000 Accumulated Dep. - furniture and Equp. 12000 Notes Payable 20000 Accounts Payable 17500 Bonds Payable 30000 Common Stock 50000 Retained Earnings 1/1/2016 16200 Dividends 2000 Sales 400000 Cost of Goods Sold 316000 Sales Salaries Expense 20000 Advertising Expense 2200 Traveling Expense 8000 Salaries, office and general 19000 Telephone and Internet Expense 2600 Rent Expense 4800 Property Tax Expense 3300 Interest Expense 1700 Totals 545700 545700 Excel Project 2 Downtown Cabinet Company Instructions: Client uses Accrual Method of Accounting. 1. Enter the trial balance into an Excel Spreadsheet. 2. Record adjustments through a General ledger. Create adjusting entry journals and T-Bar accounts. 3. Make an adjusting trial balance worksheet including the changes affecting the Balance Sheet and Income Statement. 4. Create a final Income Statement, Balance Sheet, and Statement of Retained Earnings for the month ended. 5. Extra Credit (s points)- Create and Administration Page to organize all sheets of the Excel File. Administration page should link to sheet in Excel file. In addition, sheet should link back to Administration page. 6. Upload the Excel File on Blackboard 5. Note: Adjusted amounts should be linked to their corresponding financial statement. The idea is to make all your changes and adjustments on the trial balance worksheet so that the financial statement will automatically change accordingly. Adjustments to the Trial Balance at 11/30/20XX 1. Estimated bad debts is one-half of 1 percent of sales 2. Insurance expired for the month of November - $480 3. Interest accrued on notes receivable for the month of November - $725 4. Downtown Cabinet Company purchased 10 computers for $15,000 on a no interest 5 year loan. Record this purchase and one loan payment was paid in the month of November 5. The accounting department discovered an overpayment of rent in the amount of $1,000 6. Property taxes accrued for the month of November should be at $5,000 7. Income taxes are estimated to be 22% of net income. Downtown Cabinet Company Trial Balance 11/30/20XX Cumulative for 20XX DR. CR. Cash 1140 Notes Receivable 16000 Accounts Receivable 41000 Merchandise Inventory 40000 Prepaid Insurance 960 Furniture and Equipment 67000 Accumulated Dep. - furniture and Equp. 12000 Notes Payable 20000 Accounts Payable 17500 Bonds Payable 30000 Common Stock 50000 Retained Earnings 1/1/2016 16200 Dividends 2000 Sales 400000 Cost of Goods Sold 316000 Sales Salaries Expense 20000 Advertising Expense 2200 Traveling Expense 8000 Salaries, office and general 19000 Telephone and Internet Expense 2600 Rent Expense 4800 Property Tax Expense 3300 Interest Expense 1700 Totals 545700 545700