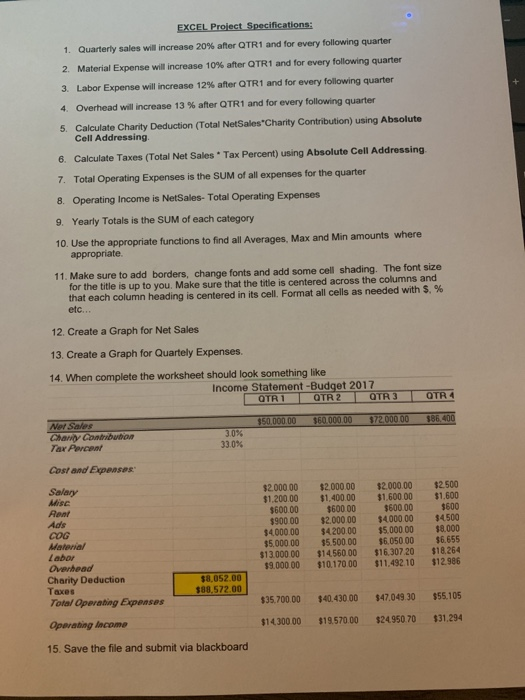

EXCEL Project Specifications: 1. Quarterly sales will increase 20% after QTR1 and for every following quarter 2. Material Expense will increase 10% after QTR1 and for every following quarter 3. Labor Expense will increase 12% after QTR1 and for every following quarter 4. Overhead will increase 13 % after QTR1 and for every following quarter 5. Calculate Charity Deduction (Total NetSales "Charity Contribution) using Absolute Cell Addressing 6. Calculate Taxes (Total Net Sales Tax Percent) using Absolute Cell Addressing 7. Total Operating Expenses is the SUM of all expenses for the quarter 8. Operating Income is NetSales - Total Operating Expenses 9. Yearly Totals is the SUM of each category 10. Use the appropriate functions to find all Averages, Max and Min amounts where appropriate 11. Make sure to add borders, change fonts and add some cell shading. The font size for the title is up to you. Make sure that the title is centered across the columns and that each column heading is centered in its cell. Format all cells as needed with 5% etc... 12. Create a Graph for Net Sales 13. Create a Graph for Quartely Expenses 14. When complete the worksheet should look something like Income Statement-Budget 2017 OTRI OTR 2 QTR 3 OTRA $50,000.00 160.000.00 72.000.00 386.400 Mer Sales Cham Contbution Tax Alvar 30% 33.0% Cost and Expenses Salary Ree Ads ce Material Labor Overhead Charity Deduction Taxes Total Operating Expenses $2.000,00 $1.200.00 $600.00 $900 00 34000.00 35.000 00 $13.000.00 $9.000.00 2.000.00 $1,400.00 $600.00 $2,000.00 $4,200.00 15.500.00 3 14560.00 $10,170.00 2.000.00 $1.600.00 360000 1400000 $5.00000 $6,050 00 $16.307.20 $11.492.10 $2.500 $1,600 3600 $4500 $8.000 $6.655 $18.264 $12.986 S8052.00 S88 57200 $35.700.00 $40.430.00 $47.049 30 $55.105 Operating Income $14300.00 $19.570.00 $24.950 70 $31.294 15. Save the file and submit via blackboard EXCEL Project Specifications: 1. Quarterly sales will increase 20% after QTR1 and for every following quarter 2. Material Expense will increase 10% after QTR1 and for every following quarter 3. Labor Expense will increase 12% after QTR1 and for every following quarter 4. Overhead will increase 13 % after QTR1 and for every following quarter 5. Calculate Charity Deduction (Total NetSales "Charity Contribution) using Absolute Cell Addressing 6. Calculate Taxes (Total Net Sales Tax Percent) using Absolute Cell Addressing 7. Total Operating Expenses is the SUM of all expenses for the quarter 8. Operating Income is NetSales - Total Operating Expenses 9. Yearly Totals is the SUM of each category 10. Use the appropriate functions to find all Averages, Max and Min amounts where appropriate 11. Make sure to add borders, change fonts and add some cell shading. The font size for the title is up to you. Make sure that the title is centered across the columns and that each column heading is centered in its cell. Format all cells as needed with 5% etc... 12. Create a Graph for Net Sales 13. Create a Graph for Quartely Expenses 14. When complete the worksheet should look something like Income Statement-Budget 2017 OTRI OTR 2 QTR 3 OTRA $50,000.00 160.000.00 72.000.00 386.400 Mer Sales Cham Contbution Tax Alvar 30% 33.0% Cost and Expenses Salary Ree Ads ce Material Labor Overhead Charity Deduction Taxes Total Operating Expenses $2.000,00 $1.200.00 $600.00 $900 00 34000.00 35.000 00 $13.000.00 $9.000.00 2.000.00 $1,400.00 $600.00 $2,000.00 $4,200.00 15.500.00 3 14560.00 $10,170.00 2.000.00 $1.600.00 360000 1400000 $5.00000 $6,050 00 $16.307.20 $11.492.10 $2.500 $1,600 3600 $4500 $8.000 $6.655 $18.264 $12.986 S8052.00 S88 57200 $35.700.00 $40.430.00 $47.049 30 $55.105 Operating Income $14300.00 $19.570.00 $24.950 70 $31.294 15. Save the file and submit via blackboard