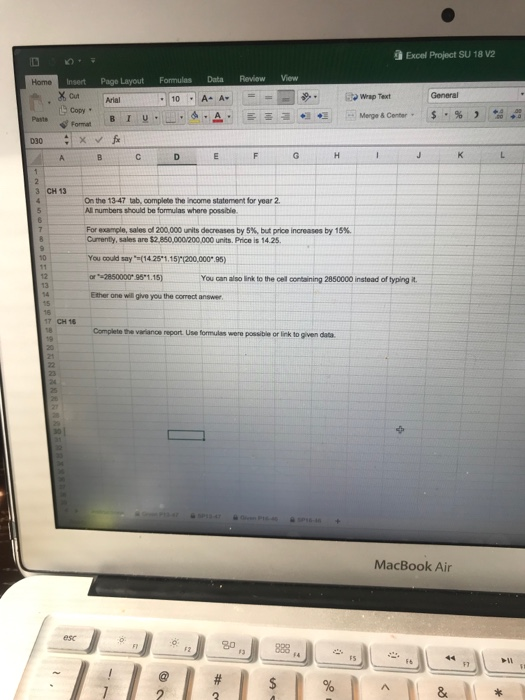

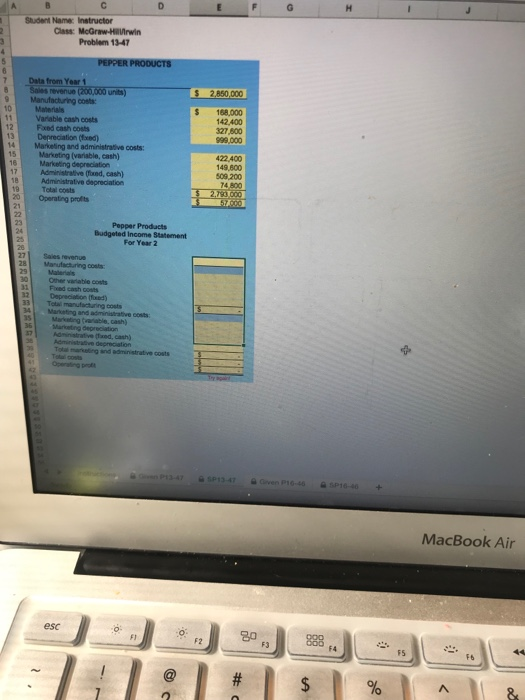

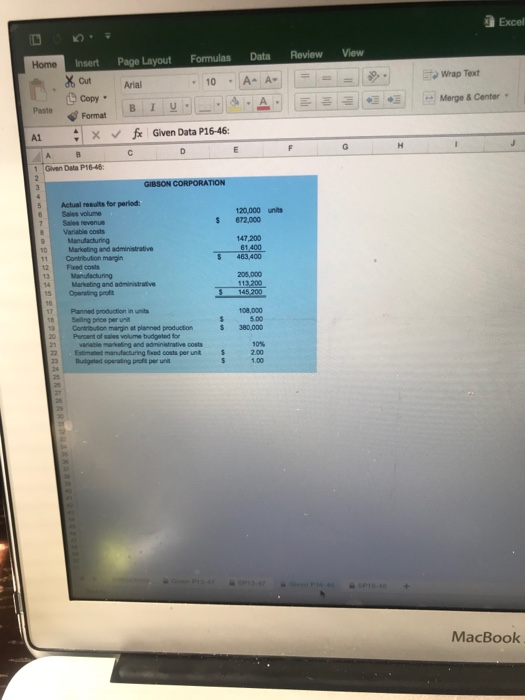

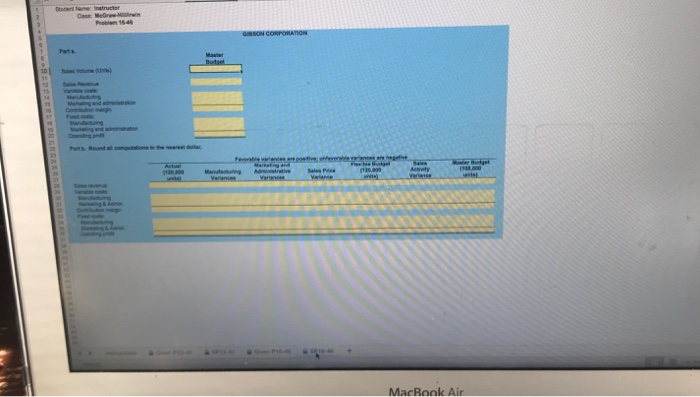

Excel Project SU 18 V2 Review View Formulas Data. Page Layout Home Insert X Cut General A A- Wrap Text Arial 10 5Copy $ % Merge & Center Paster B Format D30 G H J K L D E F C A 3 CH 13 On the 13-47 tab, complete the income statement for year 2 All numbers should be formulas where possible. For example, sales of 200,000 units decreases by 5 % , but price increas Currenty, sales are $2,850,000/200,000 units. Price is 14.25. s by 15 % . You could say (14.251.15)(200,000.95) 11 or "2850000 951.15) 12 You can also link to the cell containing 2850000 instead of typing it. 13 Ether one will give you the correct answer 14 16 17 CH 16 Complete the variance report. Use formulas were possible or link to given data. 21 22 23 MacBook Air esc 80 44 # % A le 2. A Student Name: Instructor Class: MeGraw-Hilrwin Problem 13-47 3 4 PEPPER PRODUCTS 5 Data from Year 1 Sales revenue (200,000 units) Manufacturing o0sts Materials Variable cash costs Fxed cash costs Depreciation (fxed) Marketing and administrative costs Marketing (variable, cash) Markeling depreciations Administrative (fxed, cash) Administrative depreciations Total costs Operating profits 2,850,000 S S 168,000 142.400 327,800 999,000 10 422,400 149.600 509,200 74,800 2,793,000 57.000 Pepper Products Budgeted Income Statement For Year 2 Sales revenu Manufacturing costs Malerials Other vadable costs Fxed cash costs Depreciation (fed) Total manufacturing costs Markating and administrative costs Marketing (ariable, cash) Mariceting depreciations A (ed, cash) Totl marketing and administrative costs Tell cost Openating prot ve depreciation yaaint SP13-47 a Given P16-46 A SP16-40 MacBook Air esc F2 F3 6 % 88 G esaasss # #01p20eeRE8axnnhARREERERRR xExcel View Review Data Formulas Page Layout Insert Home Wrap Text A A Cut 10 Arial Merge & Center L Copy A B I U- Paste Format fx Given Data P16-46: A1 H G E C A 1 Given Data P16-46: 2 GIBSON CORPORATION 3 4 Actual results for period:) Sales volume 120,000 units 672,000 6 Sales revenue Variabl Manufacturing Marketing and administrative Contribution mangin 7 sts 147,200 61,400 463,400 11 Fxed costs. Manufacturing Marketing and administrative Operating proft 12 205,000 113.200 145,200 13 14 15 16 Planned production in units Selling price per unit Contribution margin at planned productions Percent of sales volume budgeted for variable marketing and administrative costs Estimated manufacturing fxed costs per unit Budgeted operating profit per unit 108.000 17 5.00 18 380.000 20 10% 21 22 200 1.00 13 47 a SPI3-47 MG P SP16-40 MacBook Studert me Instruter Oa MeOrew in Problem 16-4 GmSON CORPORATION Parta Master Budget 101 Sales Volue (Units) Ss Revenu 13 14 Coreonmarn Fd Mandactuing nd adm Pyh Round a mputtins to he neaet dailar 20 Feerabie varlances apowtive nfererhie aanes are negetive Flaxbe tgrt (128,800 Moser Budget Saes Marketg ard Adinistrative Variance Sales Pce Adrery Manufactuing Variances (130 00 unite wital Vwiance P64 MacBook Air