Answered step by step

Verified Expert Solution

Question

1 Approved Answer

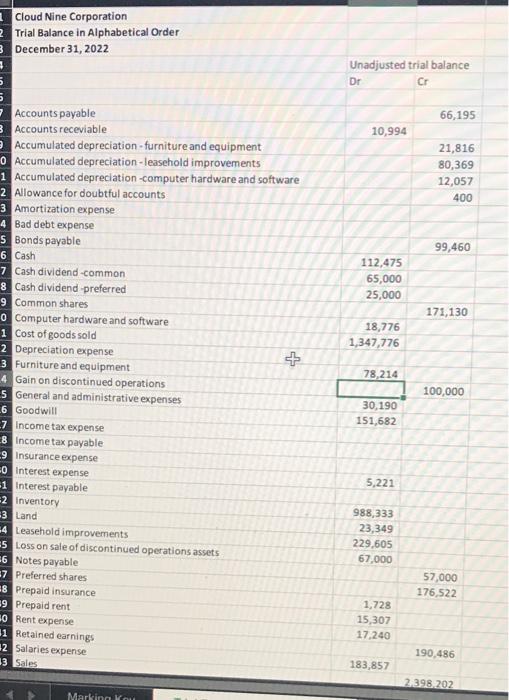

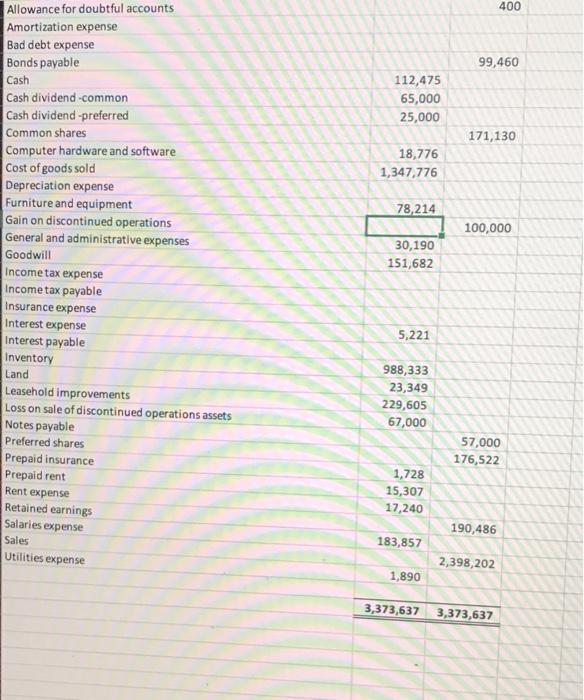

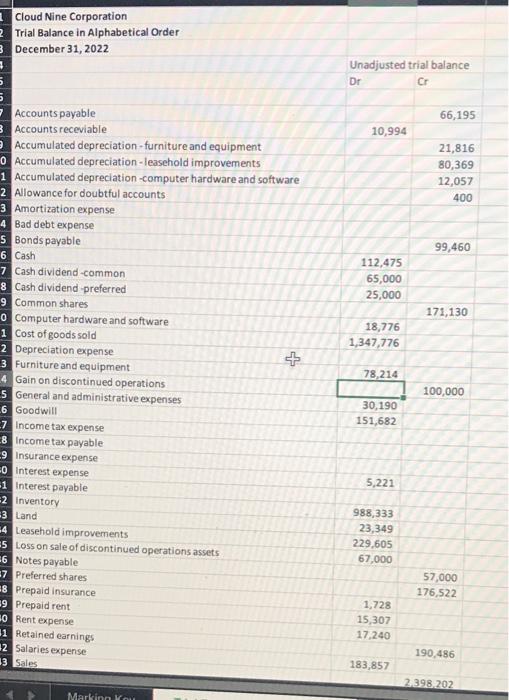

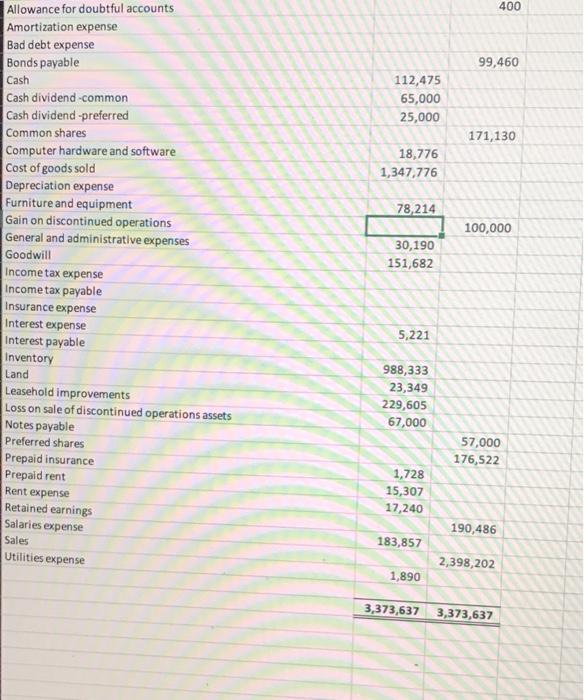

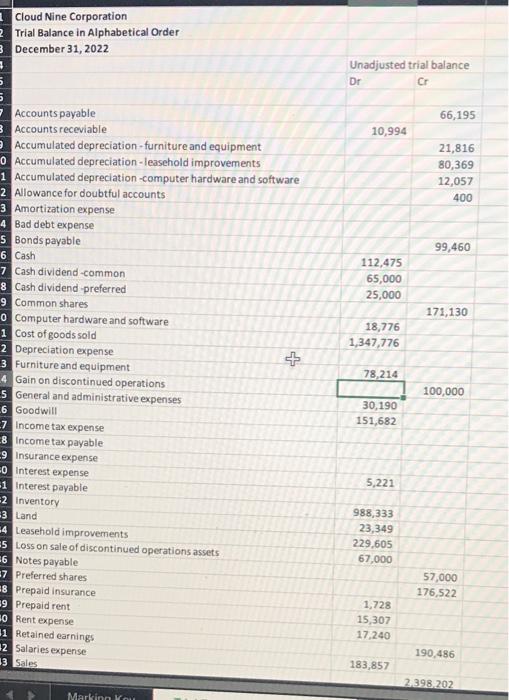

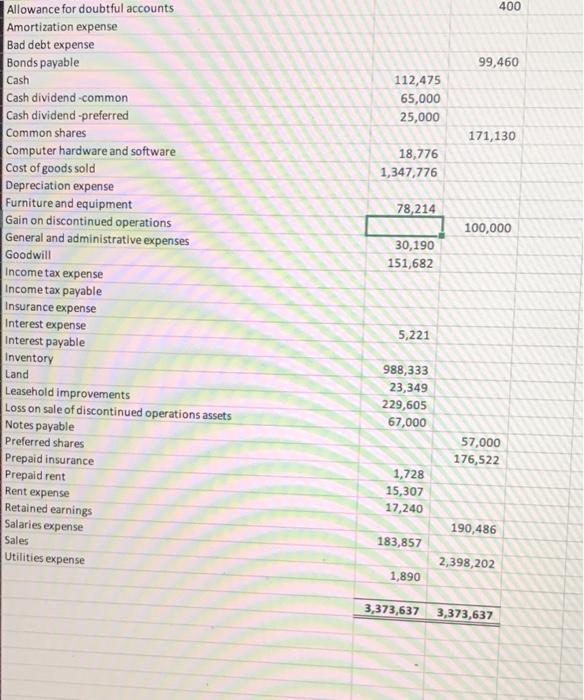

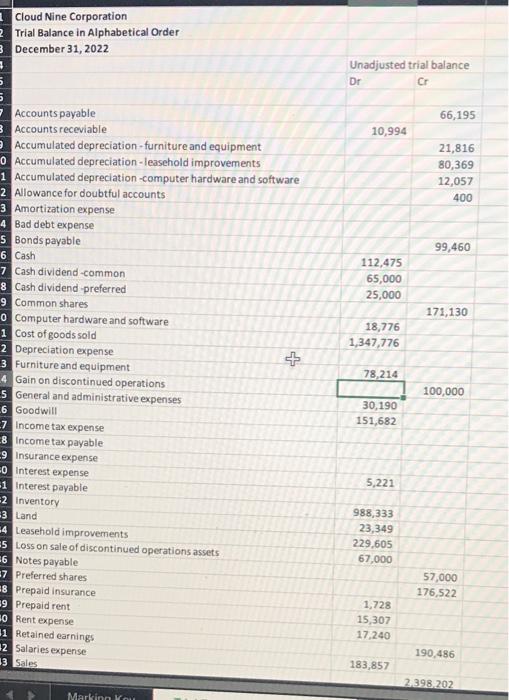

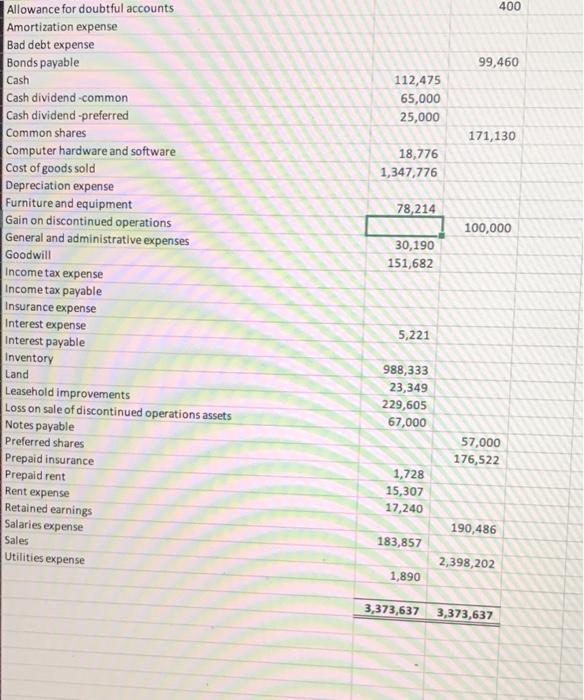

Excel Project trial balance in Alphabetical trial balance adjusting entries financial statements and EPS Closing entries The pictures shown below are Cloud Nine Corporation's Trial

Excel Project trial balance in Alphabetical

trial balance

adjusting entries

financial statements and EPS

Closing entries

The pictures shown below are Cloud Nine Corporation's Trial Balance in alphabetical order.

Cloud Nine Corporation 2 Trial Balance in Alphabetical Order 3 December 31, 2022 Unadjusted trial balance Dr Cr 66,195 10,994 21,816 80,369 12,057 400 99,460 112,475 65,000 25,000 171,130 18,776 1,347,776 + 78,214 Accounts payable 3 Accounts receviable e Accumulated depreciation - furniture and equipment 0 Accumulated depreciation - leasehold improvements 1 Accumulated depreciation-computer hardware and software 2 Allowance for doubtful accounts 3 Amortization expense 4 Bad debt expense 5 Bonds payable 6 Cash 7 Cash dividend -common 8 Cash dividend preferred 9 Common shares O Computer hardware and software 1 Cost of goods sold 2 Depreciation expense 3 Furniture and equipment -4 Gain on discontinued operations 5 General and administrative expenses -6 Goodwill 7 income tax expense 8 income tax payable -9 Insurance expense 0 Interest expense -1 Interest payable 2 Inventory -3 Land 4 Leasehold improvements 5 Loss on sale of discontinued operations assets 26 Notes payable 37 Preferred shares 8 Prepaid insurance 9 Prepaid rent 30 Rent expense 31 Retained earnings 12 Salaries expense 13 Sales 100,000 30,190 151,682 5,221 988,333 23,349 229,505 67.000 57.000 176,522 1,728 15,307 17.240 190,486 183,857 2.398.202 Markina om 400 99,460 112,475 65,000 25,000 171,130 18,776 1,347,776 78,214 100,000 Allowance for doubtful accounts Amortization expense Bad debt expense Bonds payable Cash Cash dividend -common Cash dividend -preferred Common shares Computer hardware and software Cost of goods sold Depreciation expense Furniture and equipment Gain on discontinued operations General and administrative expenses Goodwill Income tax expense Income tax payable Insurance expense Interest expense Interest payable Inventory Land Leasehold improvements Loss on sale of discontinued operations assets Notes payable Preferred shares Prepaid insurance Prepaid rent Rent expense Retained earnings Salaries expense Sales 30,190 151,682 5,221 988,333 23,349 229,605 67,000 57,000 176,522 1,728 15,307 17,240 190,486 183,857 Utilities expense 2,398,202 1,890 3,373,637 3,373,637 Unadjusted trial balance Dr Cr Adjustments Dr Cr Adjusted Trial Dr Cr Closing Entries Dr Cr Post Closing Trial Dr Cr + farking Key Trial Balance in Alphabetical Trial Balance Adjusting Entries Financial Statements and EPS Closing Fries B C D E F G H J L M N O P Marking Key Trial Balance in Alphabetical Trial Balance Ready Adjusting Entries Financial Statements and EPS Closing Entries + 10 11 12 13 14 15 LG 17 10 19 20 21 22 23 24 25 26 27 21 29 30 31 32 33 34 35 36 37 10 39 40 41 42 Marking key Tral Balance in Alphabetical Trial Balance Ready Adjusting Entries Financial Statements and EPS Closing Entries C D E F G H I K L M N O Q 10 12 + 15 16 18 Marlong Key Trial Balance in Alphabetical Trial Balance Ready Adjusting Entries Financial Statements and EPS Closing Entries Cloud Nine Corporation 2 Trial Balance in Alphabetical Order 3 December 31, 2022 Unadjusted trial balance Dr Cr 66,195 10,994 21,816 80,369 12,057 400 99,460 112,475 65,000 25,000 171,130 18,776 1,347,776 + 78,214 Accounts payable 3 Accounts receviable e Accumulated depreciation-furniture and equipment 0 Accumulated depreciation - leasehold improvements 1 Accumulated depreciation -computer hardware and software 2 Allowance for doubtful accounts 3 Amortization expense 4 Bad debt expense 5 Bonds payable 6 Cash 7 Cash dividend -common 8 Cash dividend preferred 9 Common shares Computer hardware and software 1 Cost of goods sold 2 Depreciation expense 3 Furniture and equipment 4 Gain on discontinued operations 5 General and administrative expenses -6 Goodwill 7 income tax expense -8 Income tax payable -9 Insurance expense -0 Interest expense -1 Interest payable 2 Inventory 3 Land - Leasehold improvements 5 Loss on sale of discontinued operations assets 36 Notes payable 37 Preferred shares 8 Prepaid insurance 39 Prepaid rent 0 Rent expense 31 Retained earnings 12 Salaries expense 13 Sales 100,000 30,190 151,682 5,221 988,333 23,349 229,605 67,000 57,000 176,522 1,728 15,307 17.240 190.486 183,857 2.398.202 Marvinn Vo 400 99,460 112,475 65,000 25,000 171,130 18,776 1,347,776 78,214 100,000 30,190 151,682 Allowance for doubtful accounts Amortization expense Bad debt expense Bonds payable Cash Cash dividend -common Cash dividend -preferred Common shares Computer hardware and software Cost of goods sold Depreciation expense Furniture and equipment Gain on discontinued operations General and administrative expenses Goodwill Income tax expense Income tax payable Insurance expense Interest expense Interest payable Inventory Land Leasehold improvements Loss on sale of discontinued operations assets Notes payable Preferred shares Prepaid insurance Prepaid rent Rent expense Retained earnings Salaries expense Sales 5,221 988,333 23,349 229,605 67,000 57,000 176,522 1,728 15,307 17,240 190,486 183,857 Utilities expense 2,398,202 1,890 3,373,637 3,373,637 Cloud Nine Corporation 2 Trial Balance in Alphabetical Order 3 December 31, 2022 Unadjusted trial balance Dr Cr 66,195 10,994 21,816 80,369 12,057 400 99,460 112,475 65,000 25,000 171,130 18,776 1,347,776 + 78,214 Accounts payable 3 Accounts receviable e Accumulated depreciation-furniture and equipment 0 Accumulated depreciation - leasehold improvements 1 Accumulated depreciation -computer hardware and software 2 Allowance for doubtful accounts 3 Amortization expense 4 Bad debt expense 5 Bonds payable 6 Cash 7 Cash dividend -common 8 Cash dividend preferred 9 Common shares Computer hardware and software 1 Cost of goods sold 2 Depreciation expense 3 Furniture and equipment 4 Gain on discontinued operations 5 General and administrative expenses -6 Goodwill 7 income tax expense -8 Income tax payable -9 Insurance expense -0 Interest expense -1 Interest payable 2 Inventory 3 Land - Leasehold improvements 5 Loss on sale of discontinued operations assets 36 Notes payable 37 Preferred shares 8 Prepaid insurance 39 Prepaid rent 0 Rent expense 31 Retained earnings 12 Salaries expense 13 Sales 100,000 30,190 151,682 5,221 988,333 23,349 229,605 67,000 57,000 176,522 1,728 15,307 17.240 190.486 183,857 2.398.202 Marvinn Vo 400 99,460 112,475 65,000 25,000 171,130 18,776 1,347,776 78,214 100,000 30,190 151,682 Allowance for doubtful accounts Amortization expense Bad debt expense Bonds payable Cash Cash dividend -common Cash dividend -preferred Common shares Computer hardware and software Cost of goods sold Depreciation expense Furniture and equipment Gain on discontinued operations General and administrative expenses Goodwill Income tax expense Income tax payable Insurance expense Interest expense Interest payable Inventory Land Leasehold improvements Loss on sale of discontinued operations assets Notes payable Preferred shares Prepaid insurance Prepaid rent Rent expense Retained earnings Salaries expense Sales 5,221 988,333 23,349 229,605 67,000 57,000 176,522 1,728 15,307 17,240 190,486 183,857 Utilities expense 2,398,202 1,890 3,373,637 3,373,637 With the information provided answer the following:

1. Trial Balance

2. Adjusting Entries

3. Financial Statements with EPS

4. Closing Entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started