Excel Questions; Don't write improperly formatted answers or rounded answers. Since you will be using Formulas in Excel, the BEST way to enter an answer into the Answer Cell is to Copy the cell containing the answer, then click inside the answer cell and choose 'Paste-Special Values.' I need exact answer and not a rounded answer.

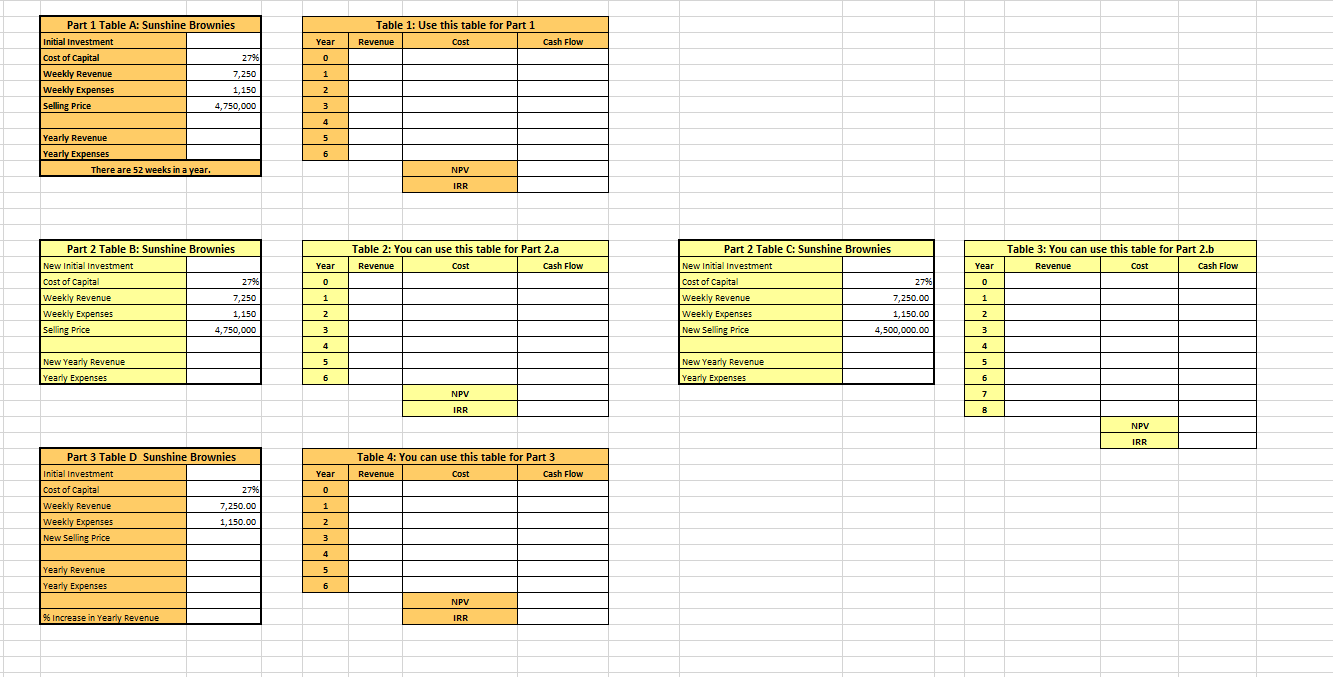

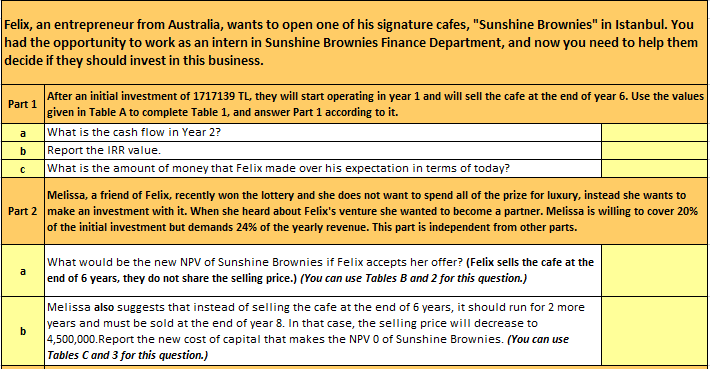

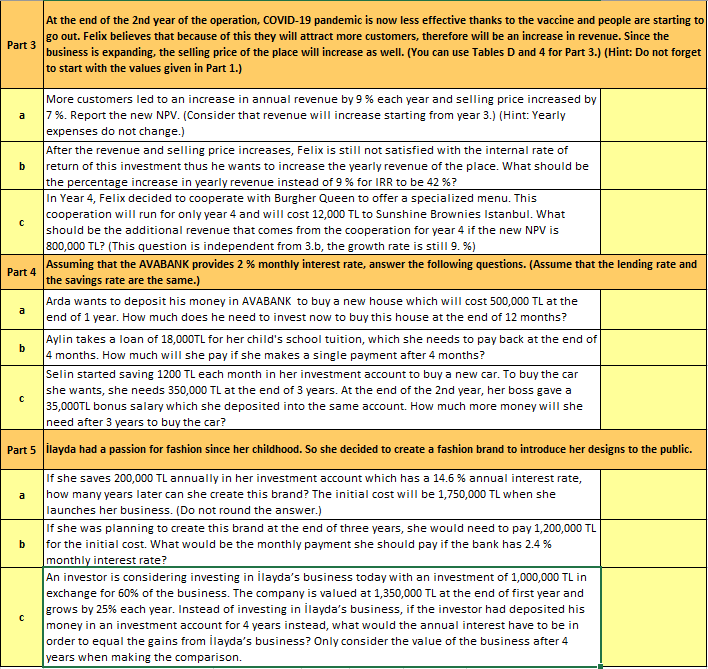

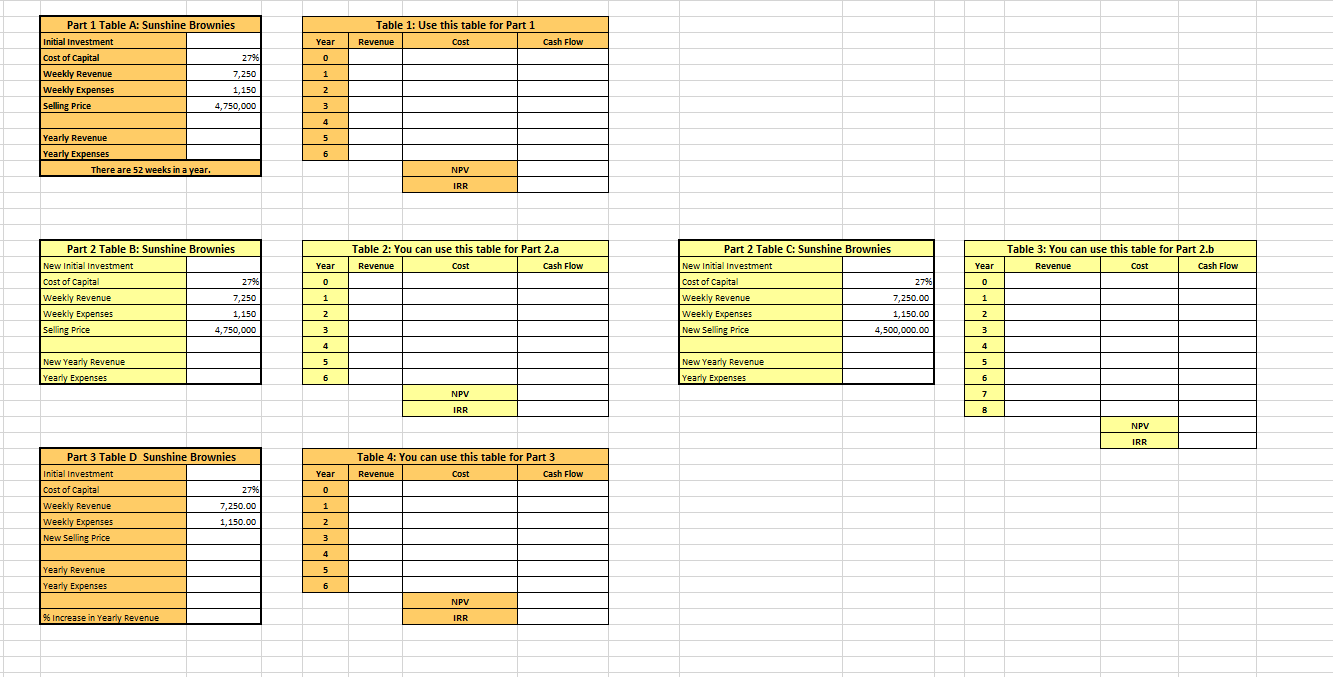

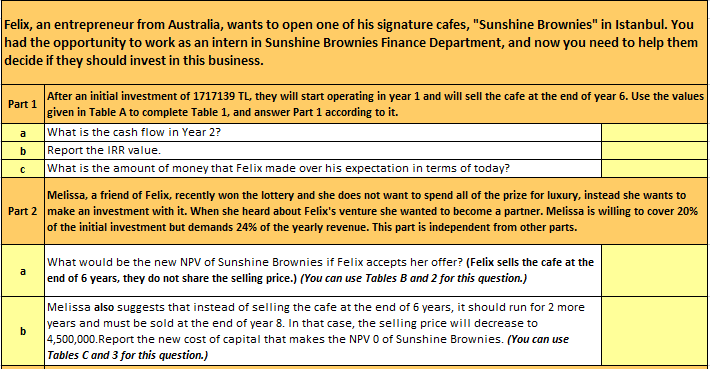

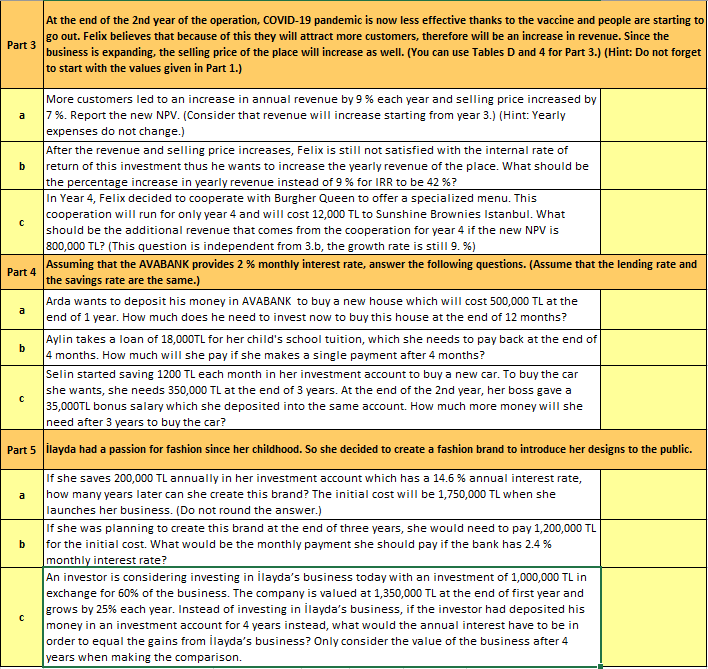

Table 1: Use this table for Part 1 Revenue Cost Cash Flow Year 0 0 Part 1 Table A: Sunshine Brownies Initial Investment Cost of Capital 2796 Weekly Revenue 7,250 Weekly Expenses 1,150 Selling Price 4,750,000 1 1 2 3 3 4 5 Yearly Revenue Yearly Expenses There are 52 weeks in a year. 6 NPV IRR Table 2: You can use this table for Part 2.a Revenue Cost Cash Flow Table 3: You can use this table for Part 2.b Revenue Cost Cash Flow Year Year 0 0 Part 2 Table B: Sunshine Brownies New Initial Investment Cost of Capital 2796 Weekly Revenue 7,250 Weekly Expenses 1,150 Selling Price 4,750,000 Part 2 Table C: Sunshine Brownies New Initial Investment Cost of Capital 2796 Weekly Revenue 7,250.00 Weekly Expenses 1,150.00 New Selling Price 4,500,000.00 1 1 1 2 2 3 3 3 . 4 4 5 5 New Yearly Revenue Yearly Expenses New Yearly Revenue Yearly Expenses 6 6 NPV 7 IRR B NPV IRR Part 3 Table D Sunshine Brownies Table 4: You can use this table for Part 3 Revenue Cost Cash Flow Initial Investment Year 0 2796 7,250.00 1 Cost of capital Weekly Revenue Weekly Expenses New Selling Price 1,150.00 2 3 4 5 Yearly Revenue Yearly Expenses 6 NPV % Increase in Yearly Revenue IRR Felix, an entrepreneur from Australia, wants to open one of his signature cafes, "Sunshine Brownies" in Istanbul. You had the opportunity to work as an intern in Sunshine Brownies Finance Department, and now you need to help them decide if they should invest in this business. b After an initial investment of 1717139 TL, they will start operating in year 1 and will sell the cafe at the end of year 6. Use the values Part 1 given in Table A to complete Table 1, and answer Part 1 according to it. What is the cash flow in Year 2? Report the IRR value. What is the amount of money that Felix made over his expectation in terms of today? Melissa, a friend of Felix, recently won the lottery and she does not want to spend all of the prize for luxury, instead she wants to Part 2 make an investment with it. When she heard about Felix's venture she wanted to become a partner. Melissa is willing to cover 20% of the initial investment but demands 24% of the yearly revenue. This part is independent from other parts. What would be the new NPV of Sunshine Brownies if Felix accepts her offer? (Felix sells the cafe at the end of 6 years, they do not share the selling price.) (You can use Tables Band 2 for this question.) Melissa also suggests that instead of selling the cafe at the end of 6 years, it should run for 2 more years and must be sold at the end of year 8. In that case, the selling price will decrease to 4,500,000. Report the new cost of capital that makes the NPV 0 of Sunshine Brownies. (You can use Tables C and 3 for this question.) b Part 3 At the end of the 2nd year of the operation, COVID-19 pandemic is now less effective thanks to the vaccine and people are starting to go out. Felix believes that because of this they will attract more customers, therefore will be an increase in revenue. Since the business is expanding, the selling price of the place will increase as well. (You can use Tables D and 4 for Part 3.) (Hint: Do not forget to start with the values given in Part 1.) a b b More customers led to an increase in annual revenue by 9 % each year and selling price increased by 7 %. Report the new NPV. (Consider that revenue will increase starting from year 3.) (Hint: Yearly expenses do not change.) After the revenue and selling price increases, Felix is still not satisfied with the internal rate of return of this investment thus he wants to increase the yearly revenue of the place. What should be the percentage increase in yearly revenue instead of 9 % for IRR to be 42 %? In Year 4, Felix decided to cooperate with Burgher Queen to offer a specialized menu. This cooperation will run for only year 4 and will cost 12,000 TL to Sunshine Brownies Istanbul. What should be the additional revenue that comes from the cooperation for year 4 if the new NPV is 800,000 TL? (This question is independent from 3.b, the growth rate is still 9.%) Assuming that the AVABANK provides 2 % monthly interest rate, answer the following questions. (Assume that the lending rate and Part 4 the savings rate are the same.) Arda wants to deposit his money in AVABANK to buy a new house which will cost 500,000 TL at the end of 1 year. How much does he need to invest now to buy this house at the end of 12 months? Aylin takes a loan of 18,000TL for her child's school tuition, which she needs to pay back at the end of 4 months. How much will she pay if she makes a single payment after 4 months? Selin started saving 1200 TL each month in her investment account to buy a new car. To buy the car she wants, she needs 350,000 TL at the end of 3 years. At the end of the 2nd year, her boss gave 35,000TL bonus salary which she deposited into the same account. How much more money will she need after 3 years to buy the car? Part 5 layda had a passion for fashion since her childhood. So she decided to create a fashion brand to introduce her designs to the public. If she saves 200,000 TL annually in her investment account which has a 14.6% annual interest rate, how many years later can she create this brand? The initial cost will be 1,750,000 TL when she launches her business. (Do not round the answer.) If she was planning to create this brand at the end of three years, she would need to pay 1,200,000 TL for the initial cost. What would be the monthly payment she should pay if the bank has 2.4 % monthly interest rate? An investor is considering investing in layda's business today with an investment of 1,000,000 TL in exchange for 60% of the business. The company is valued at 1,350,000 TL at the end of first year and grows by 25% each year. Instead of investing in layda's business, if the investor had deposited his money in an investment account for 4 years instead, what would the annual interest have to be in order to equal the gains from layda's business? Only consider the value of the business after 4 years when making the comparison. a b Table 1: Use this table for Part 1 Revenue Cost Cash Flow Year 0 0 Part 1 Table A: Sunshine Brownies Initial Investment Cost of Capital 2796 Weekly Revenue 7,250 Weekly Expenses 1,150 Selling Price 4,750,000 1 1 2 3 3 4 5 Yearly Revenue Yearly Expenses There are 52 weeks in a year. 6 NPV IRR Table 2: You can use this table for Part 2.a Revenue Cost Cash Flow Table 3: You can use this table for Part 2.b Revenue Cost Cash Flow Year Year 0 0 Part 2 Table B: Sunshine Brownies New Initial Investment Cost of Capital 2796 Weekly Revenue 7,250 Weekly Expenses 1,150 Selling Price 4,750,000 Part 2 Table C: Sunshine Brownies New Initial Investment Cost of Capital 2796 Weekly Revenue 7,250.00 Weekly Expenses 1,150.00 New Selling Price 4,500,000.00 1 1 1 2 2 3 3 3 . 4 4 5 5 New Yearly Revenue Yearly Expenses New Yearly Revenue Yearly Expenses 6 6 NPV 7 IRR B NPV IRR Part 3 Table D Sunshine Brownies Table 4: You can use this table for Part 3 Revenue Cost Cash Flow Initial Investment Year 0 2796 7,250.00 1 Cost of capital Weekly Revenue Weekly Expenses New Selling Price 1,150.00 2 3 4 5 Yearly Revenue Yearly Expenses 6 NPV % Increase in Yearly Revenue IRR Felix, an entrepreneur from Australia, wants to open one of his signature cafes, "Sunshine Brownies" in Istanbul. You had the opportunity to work as an intern in Sunshine Brownies Finance Department, and now you need to help them decide if they should invest in this business. b After an initial investment of 1717139 TL, they will start operating in year 1 and will sell the cafe at the end of year 6. Use the values Part 1 given in Table A to complete Table 1, and answer Part 1 according to it. What is the cash flow in Year 2? Report the IRR value. What is the amount of money that Felix made over his expectation in terms of today? Melissa, a friend of Felix, recently won the lottery and she does not want to spend all of the prize for luxury, instead she wants to Part 2 make an investment with it. When she heard about Felix's venture she wanted to become a partner. Melissa is willing to cover 20% of the initial investment but demands 24% of the yearly revenue. This part is independent from other parts. What would be the new NPV of Sunshine Brownies if Felix accepts her offer? (Felix sells the cafe at the end of 6 years, they do not share the selling price.) (You can use Tables Band 2 for this question.) Melissa also suggests that instead of selling the cafe at the end of 6 years, it should run for 2 more years and must be sold at the end of year 8. In that case, the selling price will decrease to 4,500,000. Report the new cost of capital that makes the NPV 0 of Sunshine Brownies. (You can use Tables C and 3 for this question.) b Part 3 At the end of the 2nd year of the operation, COVID-19 pandemic is now less effective thanks to the vaccine and people are starting to go out. Felix believes that because of this they will attract more customers, therefore will be an increase in revenue. Since the business is expanding, the selling price of the place will increase as well. (You can use Tables D and 4 for Part 3.) (Hint: Do not forget to start with the values given in Part 1.) a b b More customers led to an increase in annual revenue by 9 % each year and selling price increased by 7 %. Report the new NPV. (Consider that revenue will increase starting from year 3.) (Hint: Yearly expenses do not change.) After the revenue and selling price increases, Felix is still not satisfied with the internal rate of return of this investment thus he wants to increase the yearly revenue of the place. What should be the percentage increase in yearly revenue instead of 9 % for IRR to be 42 %? In Year 4, Felix decided to cooperate with Burgher Queen to offer a specialized menu. This cooperation will run for only year 4 and will cost 12,000 TL to Sunshine Brownies Istanbul. What should be the additional revenue that comes from the cooperation for year 4 if the new NPV is 800,000 TL? (This question is independent from 3.b, the growth rate is still 9.%) Assuming that the AVABANK provides 2 % monthly interest rate, answer the following questions. (Assume that the lending rate and Part 4 the savings rate are the same.) Arda wants to deposit his money in AVABANK to buy a new house which will cost 500,000 TL at the end of 1 year. How much does he need to invest now to buy this house at the end of 12 months? Aylin takes a loan of 18,000TL for her child's school tuition, which she needs to pay back at the end of 4 months. How much will she pay if she makes a single payment after 4 months? Selin started saving 1200 TL each month in her investment account to buy a new car. To buy the car she wants, she needs 350,000 TL at the end of 3 years. At the end of the 2nd year, her boss gave 35,000TL bonus salary which she deposited into the same account. How much more money will she need after 3 years to buy the car? Part 5 layda had a passion for fashion since her childhood. So she decided to create a fashion brand to introduce her designs to the public. If she saves 200,000 TL annually in her investment account which has a 14.6% annual interest rate, how many years later can she create this brand? The initial cost will be 1,750,000 TL when she launches her business. (Do not round the answer.) If she was planning to create this brand at the end of three years, she would need to pay 1,200,000 TL for the initial cost. What would be the monthly payment she should pay if the bank has 2.4 % monthly interest rate? An investor is considering investing in layda's business today with an investment of 1,000,000 TL in exchange for 60% of the business. The company is valued at 1,350,000 TL at the end of first year and grows by 25% each year. Instead of investing in layda's business, if the investor had deposited his money in an investment account for 4 years instead, what would the annual interest have to be in order to equal the gains from layda's business? Only consider the value of the business after 4 years when making the comparison. a b