Answered step by step

Verified Expert Solution

Question

1 Approved Answer

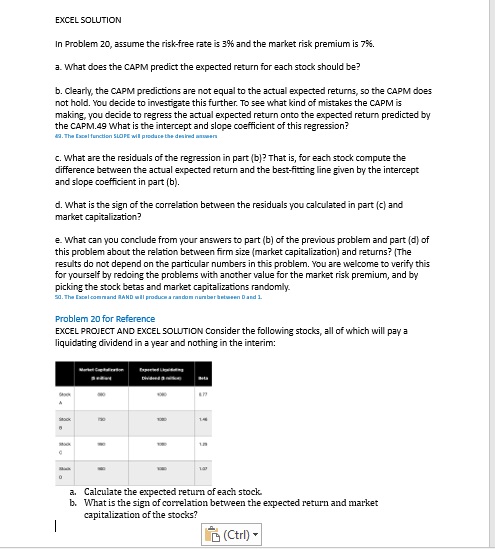

EXCEL SOLUTION In Problem 2 0 , assume the risk - free rate is 3 % and the market risk premium is 7 % .

EXCEL SOLUTION

In Problem assume the riskfree rate is and the market risk premium is

a What does the CAPM predict the expected return for each stock should be

b Clearly, the CAPM predictions are not equal to the actual expected returns, so the CAPM does

not hold. You decide to inwestigate this further. To see what kind of mistakes the CAPM is

making, you decide to regress the actual expected return onto the expected return predicted by

the CAPM. What is the intercept and slope coefficient of this regression?

c What are the residuals of the regression in part b That is for each stock compute the

difference between the actual expected return and the bestfitting line given by the intercept

and slope coefficient in part b

d What is the sign of the correlation between the residuals you calculated in part c and

market capitalization?

e What can you conclude from your answers to part b of the previous problem and part d of

this problem about the relation between firm size market capitalization and returns? The

results do not depend on the particular numbers in this problem. You are welcome to verify this

for yourself by redoing the problems with another value for the market risk premium, and by

picking the stock betas and market capitalizations randomly.

Problem for Reference

EXCEL PROJECT AND EXCEL SOLUTION

Consider the following stocks, all of which will pay a

liquidating dividend in a year and nothing in the interim:

a Calculate the expected return of each stock.

b What is the sign of correlation between the expected return and market

capitalization of the stocks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started