Answered step by step

Verified Expert Solution

Question

1 Approved Answer

excel works as long as you can show the formulas You have a $1000 to irwest with a 10-year horror and are comparing investing in

excel works as long as you can show the formulas

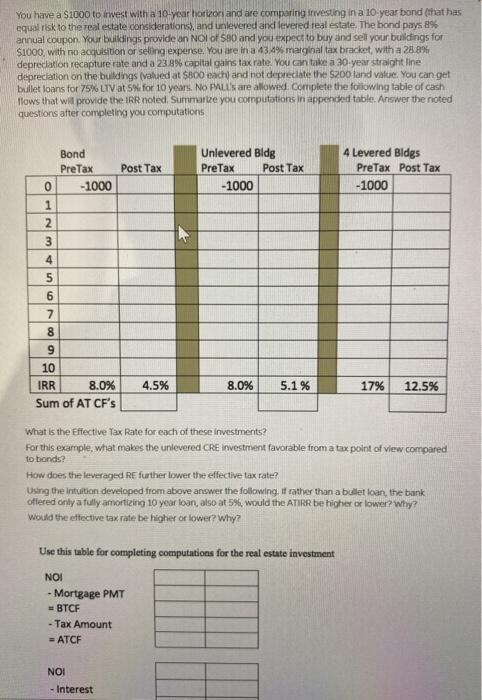

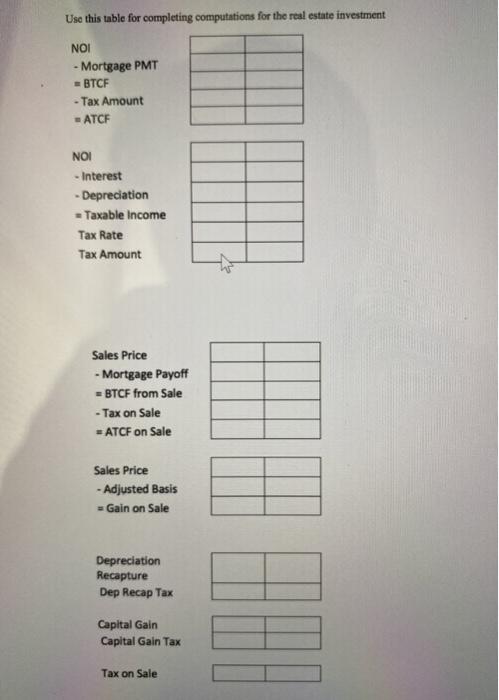

You have a $1000 to irwest with a 10-year horror and are comparing investing in a 10-year bond (that has equal risk to the real estate considerations, and unlevered and levered real estate. The bond pays 8% annual coupon your buildings provide an NOI of SBD and you expect to buy and sell your buildings for $1000, with no acquisition or selling expense. You are in a 43.4% marginal tax bracket with a 28.8% depreciation recapture rate and a 23.8% capital gains tax rate. You can take a 30-year straight line depreciation on the buildings (valued at $300 each and not depreciate the $200 land value. You can get bullet loans for 75% LTV at 5% for 10 years. No PALL's are allowed. Complete the following table of cash llows that will provide the IRR noted Sumarbe you computations in appended table. Answer the noted questions after completing you computations Bond Pre Tax -1000 Post Tax Unlevered Bldg Pre Tax Post Tax -1000 4 Levered Bldgs PreTax Post Tax -1000 0 NH ml 4 5 6 7 8 9 10 IRR 8.0% Sum of AT CF's 4.5% 8.0% 5.1 % 17% 12.5% What is the effective Tax Rate for each of these investments? For this example, what makes the unlevered CRE investment favorable from a tax point of view compared to bonds? How does the leveraged RE further lower the effective tax rate? Using the Intuition developed from above answer the following. I rather than a ballet fanthe bank offered only a fully amortizing 10 year loan, also at 5%, would the ATIRR be higher or lower? Why? Would the effective tax rate be higher or lower? Why? Use this table for completing computations for the real estate investment NOI - Mortgage PMT =BTCF - Tax Amount = ATCF NOI - Interest Use this table for completing computations for the real estate investment NOI - Mortgage PMT - BTCF - Tax Amount - ATCF NOI - Interest - Depreciation = Taxable income Tax Rate Tax Amount Sales Price - Mortgage Payoff = BTCF from Sale - Tax on Sale = ATCF on Sale Sales Price - Adjusted Basis = Gain on Sale Depreciation Recapture Dep Recap Tax HE Capital Gain Capital Gain Tax Tax on Sale You have a $1000 to irwest with a 10-year horror and are comparing investing in a 10-year bond (that has equal risk to the real estate considerations, and unlevered and levered real estate. The bond pays 8% annual coupon your buildings provide an NOI of SBD and you expect to buy and sell your buildings for $1000, with no acquisition or selling expense. You are in a 43.4% marginal tax bracket with a 28.8% depreciation recapture rate and a 23.8% capital gains tax rate. You can take a 30-year straight line depreciation on the buildings (valued at $300 each and not depreciate the $200 land value. You can get bullet loans for 75% LTV at 5% for 10 years. No PALL's are allowed. Complete the following table of cash llows that will provide the IRR noted Sumarbe you computations in appended table. Answer the noted questions after completing you computations Bond Pre Tax -1000 Post Tax Unlevered Bldg Pre Tax Post Tax -1000 4 Levered Bldgs PreTax Post Tax -1000 0 NH ml 4 5 6 7 8 9 10 IRR 8.0% Sum of AT CF's 4.5% 8.0% 5.1 % 17% 12.5% What is the effective Tax Rate for each of these investments? For this example, what makes the unlevered CRE investment favorable from a tax point of view compared to bonds? How does the leveraged RE further lower the effective tax rate? Using the Intuition developed from above answer the following. I rather than a ballet fanthe bank offered only a fully amortizing 10 year loan, also at 5%, would the ATIRR be higher or lower? Why? Would the effective tax rate be higher or lower? Why? Use this table for completing computations for the real estate investment NOI - Mortgage PMT =BTCF - Tax Amount = ATCF NOI - Interest Use this table for completing computations for the real estate investment NOI - Mortgage PMT - BTCF - Tax Amount - ATCF NOI - Interest - Depreciation = Taxable income Tax Rate Tax Amount Sales Price - Mortgage Payoff = BTCF from Sale - Tax on Sale = ATCF on Sale Sales Price - Adjusted Basis = Gain on Sale Depreciation Recapture Dep Recap Tax HE Capital Gain Capital Gain Tax Tax on Sale Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started