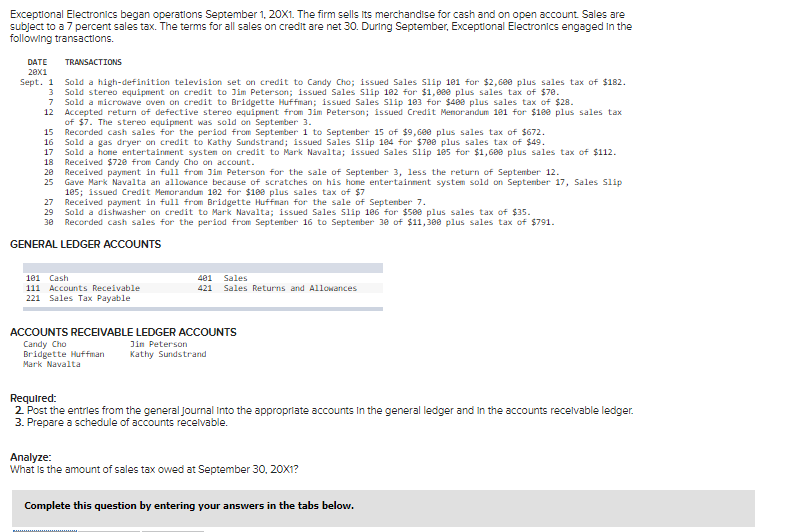

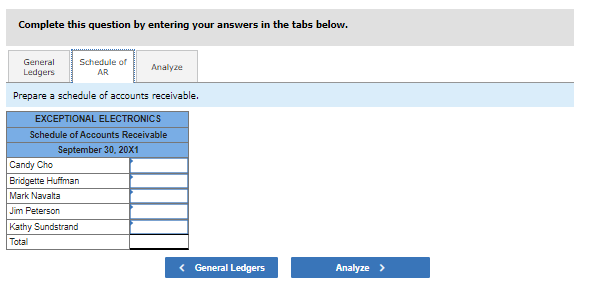

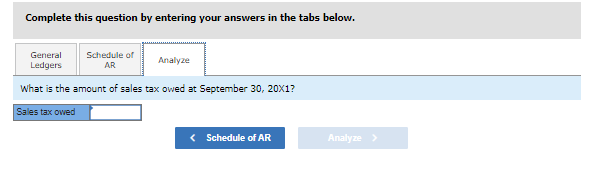

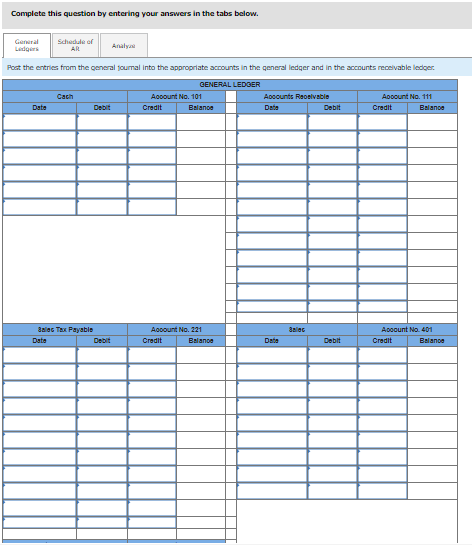

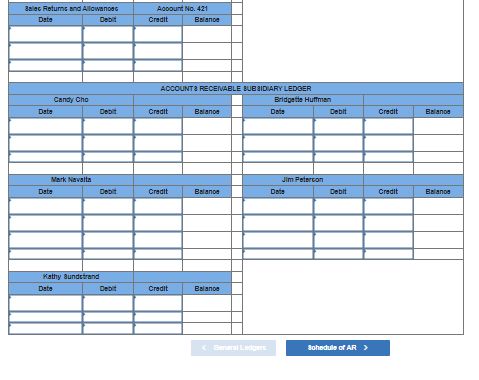

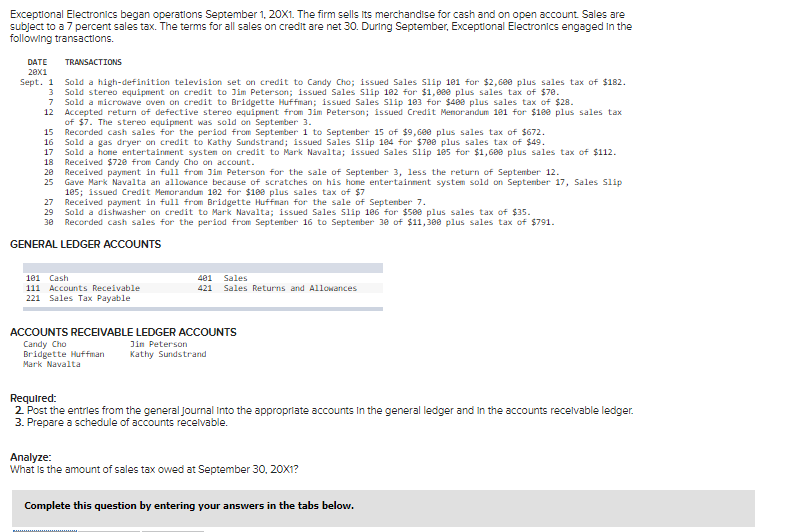

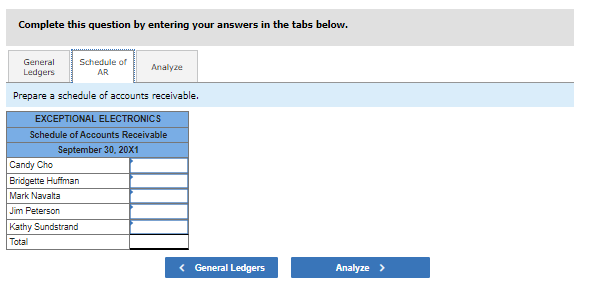

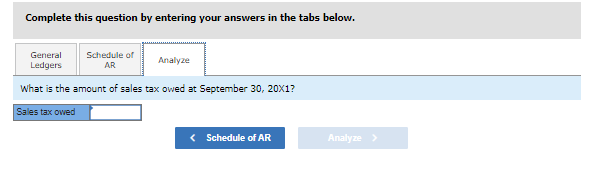

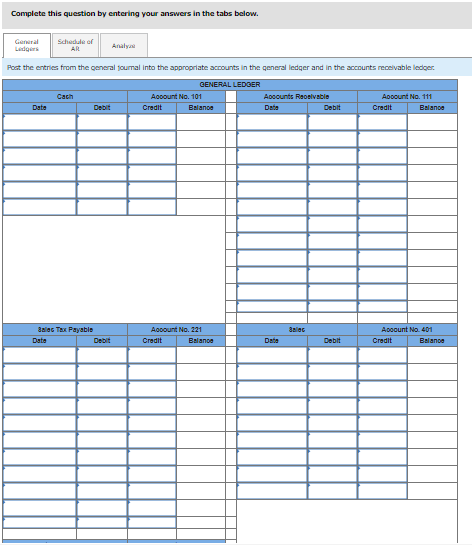

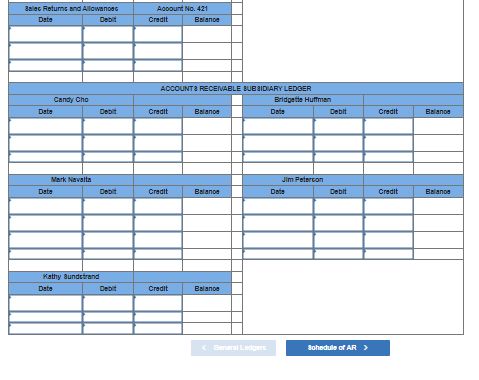

Exceptional Electronics began operations September 1, 20X1. The firm sells its merchandise for cash and on open account Sales are subject to a 7 percent sales tax. The terms for all sales on credit are net 30. During September, Exceptional Electronics engaged in the following transactions. DATE TRANSACTIONS 2exi Sept. 1 sold a high-definition television set on credit to Candy Cho; issued Sales Slip 181 for $2,600 plus sales tax of $182. 3 Sold stereo equipment on credit to Jim Peterson; issued Sales Slip 182 for $1,620 plus sales tax of $70. 7 Sold a microwave oven on credit to Bridgette Huffman; issued Sales Slip 183 for $480 plus sales tax of $28. 12 Accepted return of defective stereo equipment from Jim Peterson; issued Credit Memorandum 101 for $180 plus sales tax of $7. The stereo equipment was sold on September 3. 15 Recorded cash sales for the period from September 1 to September 15 of $9,600 plus sales tax of $672. 16 Sold a gas dryer on credit to Kathy Sundstrand; issued Sales Slip 1e4 for $788 plus sales tax of $49. 17 Sold a home entertainment system on credit to Mark Navalta; issued Sales Slip 105 for $1,680 plus sales tax of $112. 18 Received $720 from Candy Cho on account. 20 Received payment in ful from Jim Peterson for the sale of September 3, less the return of September 12. 25 Gave Mark Navalta an allowance because of scratches on his home entertainment system sold on September 17, Sales Slip 185; issued Credit Memorandum 182 for $180 plus sales tax of $7 27 Received payment in full from Bridgette Huffman for the sale of September 7. 29 Sold a dishwasher on credit to Mark Navalta; issued Sales Slip 106 for $500 plus sales tax of $35. 30 Recorded cash sales for the period from September 16 to September 30 of $11,388 plus sales tax of $791. GENERAL LEDGER ACCOUNTS 181 Cash 111 Accounts Receivable 221 Sales Tax Payable 481 Sales 421 Sales Returns and Allowances ACCOUNTS RECEIVABLE LEDGER ACCOUNTS Cardy Ch Jin Peterson Bridgette Huffman Kathy Sundstrand Mark Navalta Required: 2 Post the entries from the general Journal into the appropriate accounts in the general ledger and in the accounts recelvable ledger. 3. Prepare a schedule of accounts receivable. Analyze What is the amount of sales tax owed at September 30, 20X1? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. General Schedule of Ledgers AR Analyze Prepare a schedule of accounts receivable. EXCEPTIONAL ELECTRONICS Schedule of Accounts Receivable September 30, 20X1 Candy Cho Bridgette Huffman Mark Navalta Jim Peterson Kathy Sundstrand Total Complete this question by entering your answers in the tabs below. General Schedule of Ledgers AR Analyze What is the amount of sales tax owed at September 30, 20X1? Sales tax owed