Answered step by step

Verified Expert Solution

Question

1 Approved Answer

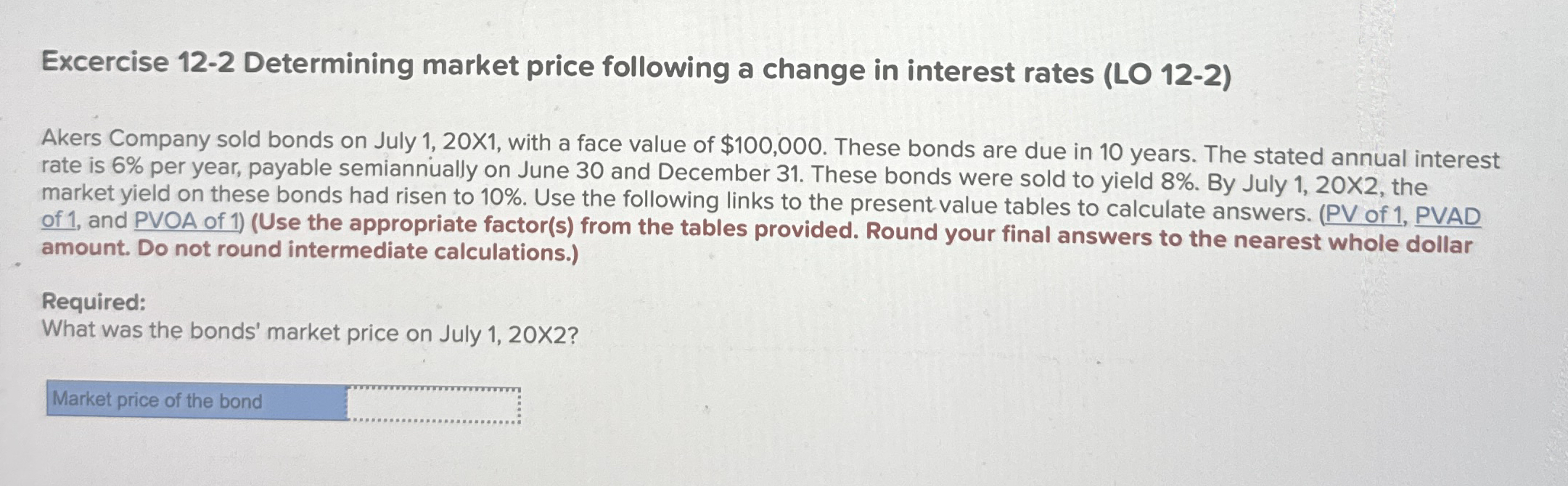

Excercise 1 2 - 2 Determining market price following a change in interest rates ( LO 1 2 - 2 ) Akers Company sold bonds

Excercise Determining market price following a change in interest rates LO

Akers Company sold bonds on July X with a face value of $ These bonds are due in years. The stated annual interest

rate is per year, payable semiannually on June and December These bonds were sold to yield By July X the

market yield on these bonds had risen to Use the following links to the present value tables to calculate answers. PV of PVAD

of and PVOA of Use the appropriate factors from the tables provided. Round your final answers to the nearest whole dollar

amount. Do not round intermediate calculations.

Required:

What was the bonds' market price on July times

Market price of the bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started