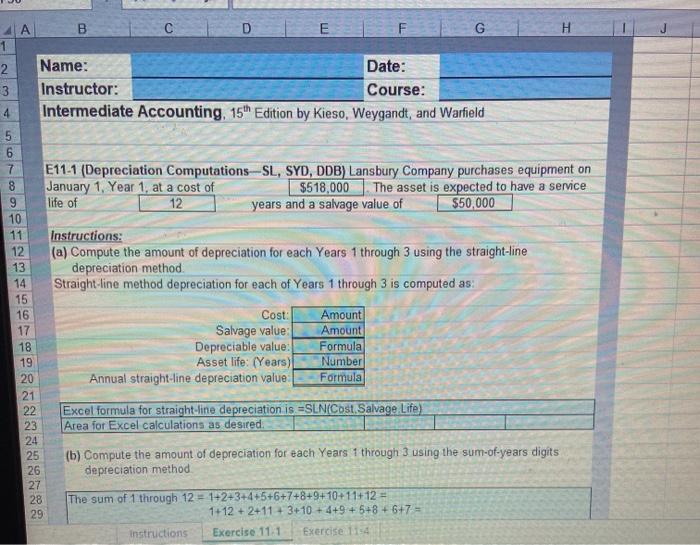

excercise 11-1

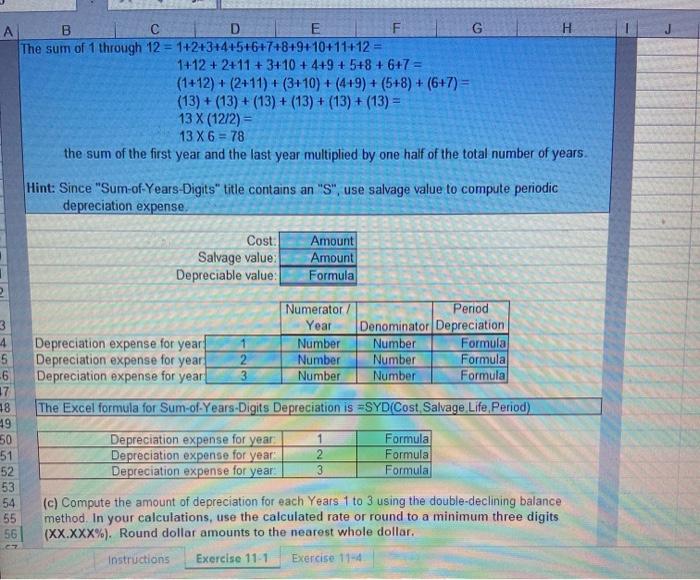

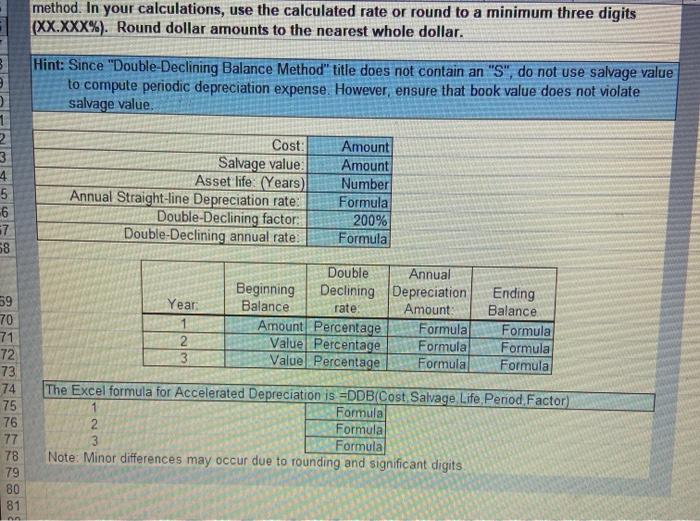

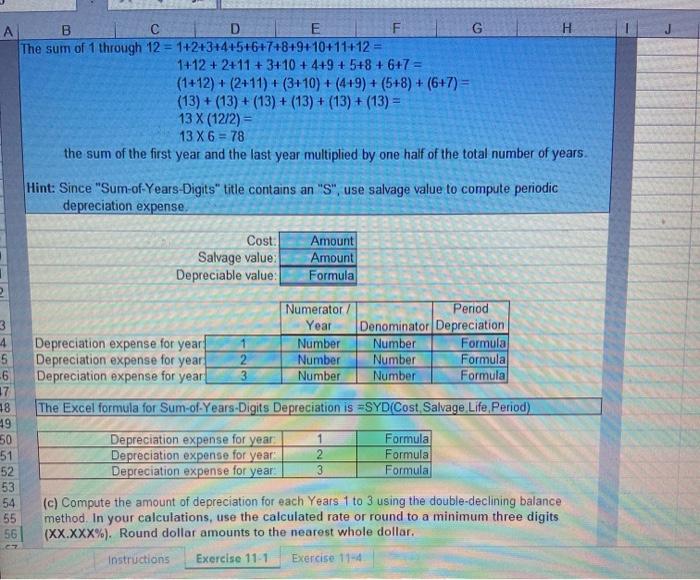

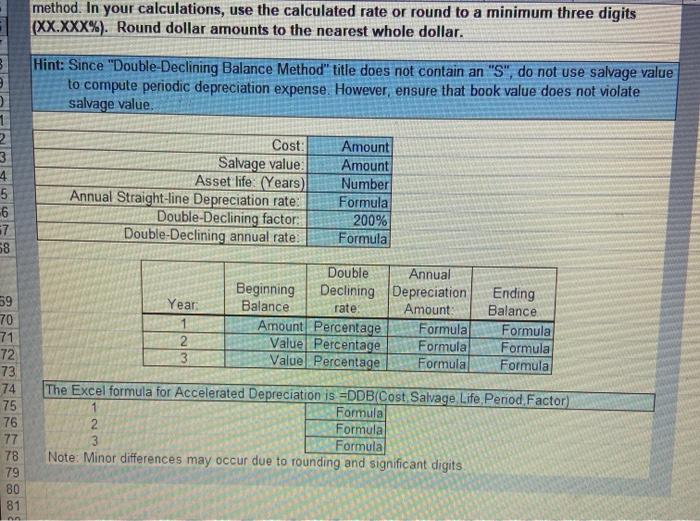

H 4) B D E G 1 2 Name: Date: 3 Instructor: Course: Intermediate Accounting, 15th Edition by Kieso, Weygandt, and Warfield 4 E11-1 (Depreciation Computations-SL, SYD, DDB) Lansbury Company purchases equipment on January 1, Year 1, at a cost of $518,000 The asset is expected to have a service life of 12 years and a salvage value of $50,000 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Instructions: (a) Compute the amount of depreciation for each Years 1 through 3 using the straight-line depreciation method Straight-line method depreciation for each of Years 1 through 3 is computed as: Cost: Amount Salvage value: Amount Depreciable value Formula Asset life: (Years) Number Annual straight-line depreciation value Formula Excel formula for straight-line depreciation is =SLN(Cost, Salvage Life) Area for Excel calculations as desired. (b) Compute the amount of depreciation for each Years 1 through 3 using the sum-of-years digits depreciation method The sum of 1 through 12 = 1+23+4+5+6+7+8+9+10+11+12 = 1+12 +2+11+ 3+10 + 4+9 + 5+8 + 6+7= Instructions Exercise 11.1 Exercise H A D F G The sum of 1 through 12 = 1+2+3+4+5+6+7+8+9+10+11+12 = 1+12 + 2+11+310 +4+9 + 5+8 + 6+7 = (1+12) + (2+11)+(3+10) + (4+9) + (5+8) + (6+7)= (13) + (13) + (13) + (13) + (13) + (13) = 13 X (12/2) = 13 X 6 = 78 the sum of the first year and the last year multiplied by one half of the total number of years. Hint: Since "Sum-of-Years-Digits" title contains an "S", use salvage value to compute periodic depreciation expense. Cost: Salvage value Depreciable value: Amount Amount Formula 1 2 Depreciation expense for year Depreciation expense for year Depreciation expense for year 1 2. 3 Numerator / Year Number Number Number Period Denominator Depreciation Number Formula Number Formula Number Formula The Excel formula for Sum-of-Years-Digits Depreciation is =SYD(Cost Salvage Life Period) 4 5 -6 37 18 49 50 51 52 53 54 55 56 Depreciation expense for year Depreciation expense for year Depreciation expense for year 1 2 3 Formula Formula Formula (c) Compute the amount of depreciation for each Years 1 to 3 using the double-declining balance method in your calculations, use the calculated rate or round to a minimum three digits (XX.XXX%). Round dollar amounts to the nearest whole dollar Instructions Exercise 11-1 Exercise 11-4 method. In your calculations, use the calculated rate or round to a minimum three digits (XX.XXX%). Round dollar amounts to the nearest whole dollar. 3 Hint: Since "Double Declining Balance Method" title does not contain an "S", do not use salvage value to compute periodic depreciation expense. However, ensure that book value does not violate salvage value 1 2 3 4 5 -6 -7 58 Cost: Salvage value. Asset life: (Years) Annual Straight-line Depreciation rate: Double-Declining factor: Double-Declining annual rate: Amount Amount Number Formula 200% Formula Year Double Annual Beginning Declining Depreciation Balance rate: Amount Amount Percentage Formula Value Percentage Formula Value Percentage Formula Ending Balance Formula Formula Formula 2 59 70 71 72 73 74 75 76 77 78 79 80 81 The Excel formula for Accelerated Depreciation is =DDB(Cost Salvage Life Period Factor) 1 Formula 2 Formula 3 Formula Note: Minor differences may occur due to rounding and significant digits