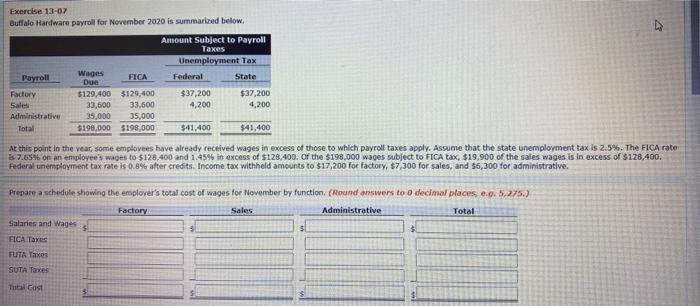

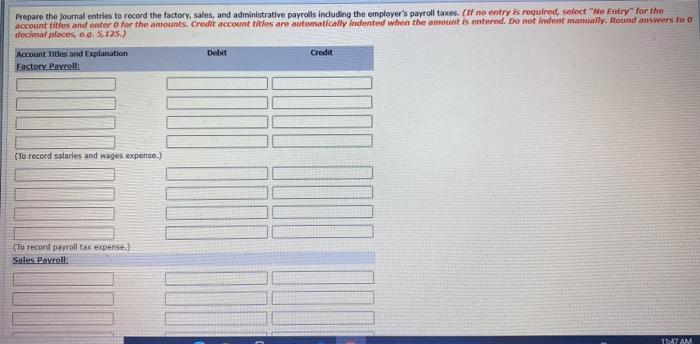

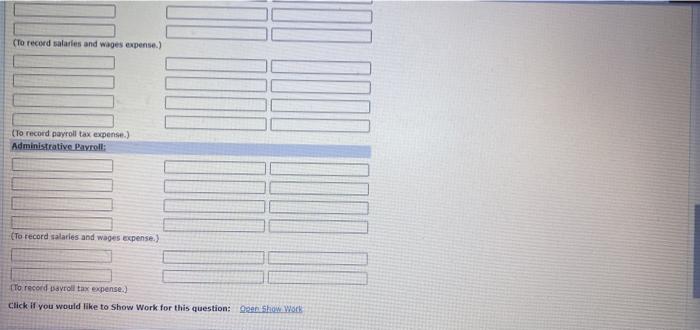

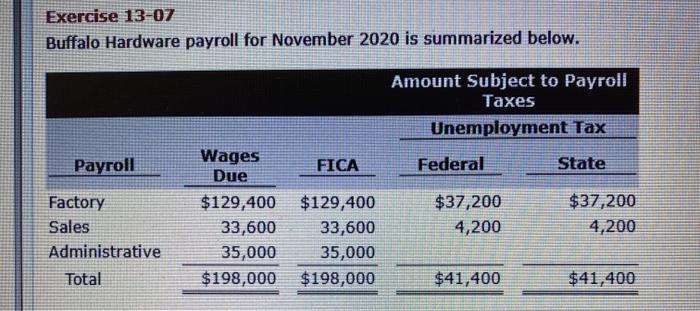

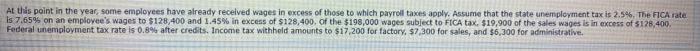

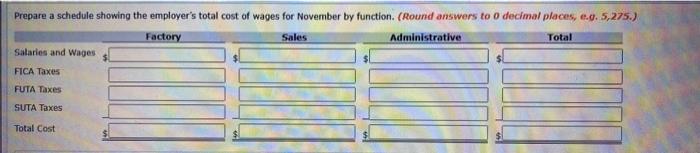

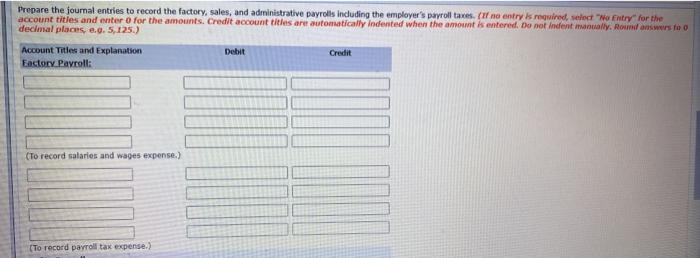

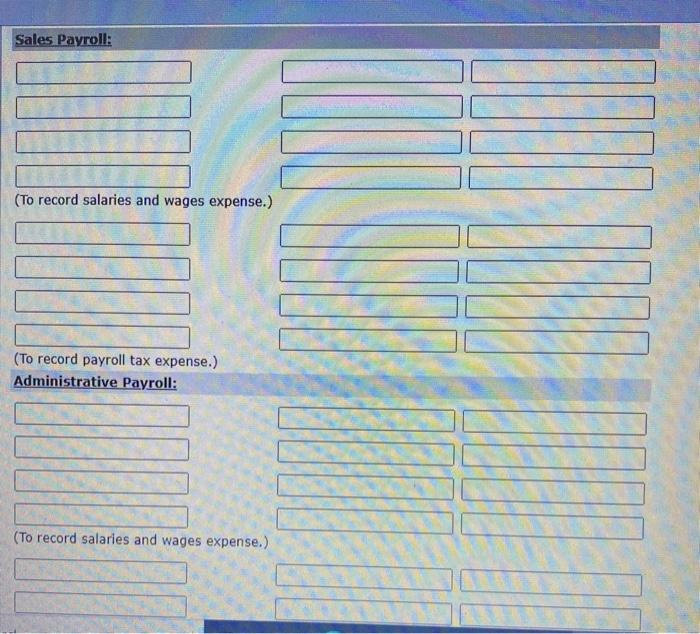

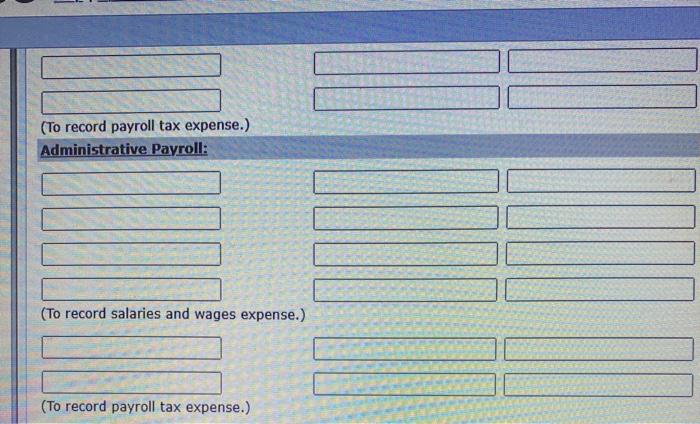

Excercise 13-07 Buffalo Hardware payroll for November 2020 is summarized below. Amount Subject to Payroll Taxes Unemployment Tax Payroll Wages FICA Due Federal State Factory $129,400 $129,400 $37,200 $37,200 Sales 33,600 33,600 4,200 4,200 Administrative 35,000 35,000 $198.000 $198.000 $41,400 $41,400 At this point in the year, some employees have already received wages in excess of those to which payroll taxes apply. Assume that the state unemployment tax is 2.5%. The FICA rate 87.65% on an employee's wages to $128,400 and 1.459 in excess of $128,400. Of the $198.000 wages subject to FICA tax, $19,900 of the sales wages is in excess of $128.400. Federal unemployment tax rate is 0.8% after credits. Income tax withheld amounts to $17,200 for factory, $7,300 for sales, and $6,300 for administrative. Prepare a schedule showing the emplover's total cost of wages for November by function (Round answers to decimal places e... 5.275.) Factory Sales Administrative Total Salaries and Wages FICA Taxes TUTA TX SUTA Torres Tus Cost Prepare the Journal entries to record the factory, sales, and administrative payrolls including the employer's payroll taxes. (If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to o decimal places, e.g. 5,125) Account Titles and Explanation Debit Credit Factory Payroll (lo record salaries and wages expense.) To record payroll tax expensed Sales Payroll 11:47 AM (To record salaries and wages expense) (To record payroll tax expense.) Administrative Payroll: To record salaries and wages expense.) To record avroll tax expense.) Click if you would like to Show Work for this question: On Show Work Exercise 13-07 Buffalo Hardware payroll for November 2020 is summarized below. Amount Subject to Payroll Taxes Unemployment Tax Payroll Federal State Wages FICA Due $129,400 $129,400 33,600 33,600 35,000 35,000 $198,000 $198,000 $37,200 4,200 Factory Sales Administrative Total $37,200 4,200 $41,400 $41,400 At this point in the year, some employees have already received wages in excess of those to which payroll taxes apply. Assume that the state unemployment tax is 2.5%. The FICA rate Is 7.65% on an employee's wages to $128,400 and 1.45% in excess of $128,400. Of the $199,000 wages subject to FICA tax. $19,900 of the sales wages is in excess of $128.400 Federal unemployment tax rate is 0.8% after credits. Income tax withheld amounts to $17.200 for factory, $7,300 for sales, and $6,300 for administrative. Prepare a schedule showing the employer's total cost of wages for November by function. (Round answers to o decimal places, c.0.5,275.) Factory Sales Administrative Total Salaries and Wages FICA Taxes FUTA Taxes SUTA Taxes Total Cost Prepare the journal entries to record the factory, sales, and administrative payrolls including the employer's payroll taxes. (If no entry is required, select "No Entry for the account tities and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not Indentally. Round answers to o decimal places, e.g. 5,125.) Account Titles and Explanation Debit Credit Factory Payroll: To record salaries and wages expense.) (To record payroll tax expense.) Sales Payroll: (To record salaries and wages expense.) (To record payroll tax expense.) Administrative Payroll: (To record salaries and wages expense.) (To record payroll tax expense.) Administrative Payroll: (To record salaries and wages expense.) (To record payroll tax expense.)