Excercise 4-19,4-21

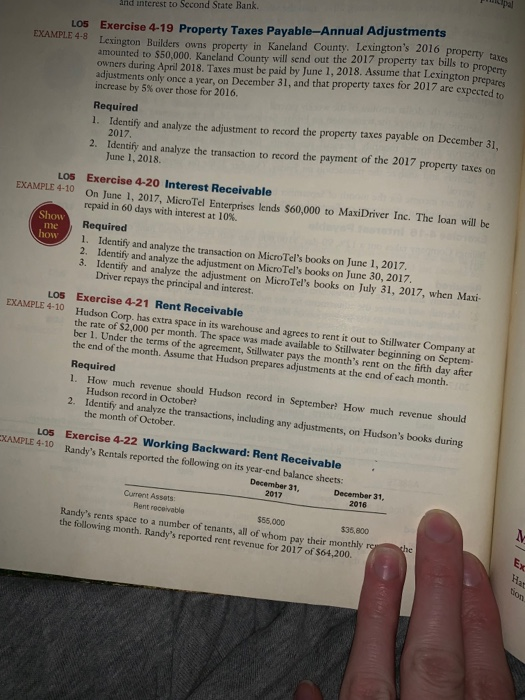

Required 1. Identify and analyze the transaction to take out the loan on March 1, 2017 2. Identify and analyze the adjustment on March 31, 2017 3. Identify and analyze the transaction on May 30, 2017, when Glendive repays the principal and interest to Second State Bank. LOS Exercise 4-19 Property Taxes Payable-Annual Adjustments PLE 4-8 Lexington Builders owns property in Kaneland County. Lexington's 2016 property taxes amounted to $50,000. Kaneland County will send out the 2017 property tax bills to property owners during April 2018. Taxes must be paid by June 1, 2018. Assume that Lexington prepares adjustments only once a year, on December 31, and that property taxes for 2017 are expected to increase by 5% over those for 2016. Required 1. Identify and analyze the adjustment to record the property taxes payable on December 31, 2017 Identify and analyze the transaction to record the payment of the 2017 property taxes on June 1, 2018. 2. LO5 Exercise 4-20 Interest Receivable LE 4-10 On June 1, 2017, MicroTel Enterprises lends s60,000 to MaxiDriver Inc. The loan will be repaid in 60 days with interest at 10%. Required 1. Identify and analyze the transaction on MicroTel's books on June 1, 2017. 2. Identify and analyze the adjustment on MicroTel's books on June 30, 2017. 3. Identify and analyze the adjustment on MicroTel's books on July 31, 2017 me ow Driver repays the principal and interest. LO5 Exercise 4-21 Rent Receivable E4-10 Hudson Corp. has extra space in its warehouse and agrees to rent it out the rate of $2,000 per month. The space was made available to Stillwa ber 1. Under the terms of the agreement, Stillwater pays the month's the end of the month. Assume that Hudson prepares adjustments at the ng Required 1. How much revenue should Hudson record in Sept Hudson record in October? 2. Identify and analyze the transactions, including any a the month of October. Los Exercise 4-22 Working Backward: Rent Re E 4-10 Randy's Rentals reported the following on its year-end bal December 3 2017 Current Assets Rent recolvable $55,000 Randy's rents space to a number of tenants, all of whom p the following month. Randy's reported rent revenue for 20 LOS Exercise 4-19 Property Taxes Payable-Annual Adjustments 4-8 Lexington and interest to Second State Bank. property taxes amounted to $50,000. Kaneland County will send out the 2017 property tax bills to propemu owners during April 2018. Taxes must be paid by June 1, 2018. Assume that Lexington prepares adjustments only once a year, on December 31, and that property taxes t1 are expected to increase by 5% over those for 2016. Builders owns property in Kaneland County. Lexington's 2016 1. dentiy and analyze the adjustment to record the property taxes payable on December 31 2. Ldentify and analyze the transaction to record the payment of the 2017 property taxes on Required 2017 June 1, 2018. LOs Exercise 4-20 Interest Receivable EXAMPLE 4-10 On June 1, 2017, MicroTel Enterprises lends $60,000 to MaxiDriver Inc. The loan will be repaid in 60 days with interest at 10%. Show me how Required . Identify and analyze the transaction on MicroTel's books on June 1, 2017 2. Identify and analyze the adjustment on MicroTel's books on June 30, 2017. 3. Identify and analyze the adjustment on MicroTel's books on July 31, 2017, when Maxi Driver repays the principal and interest Los Exercise 4-21 Rent Receivable 4-10 EXAMPLE Hudson Corp. has extra space in its warehouse and agrees to rent it out to Stillwater Company at the rate of $2,000 per month. The space was made available to Stillwater beginning on Septem- ber 1. Under the terms of the agreement, Stillwater pays the month's rent on the fifth day after the end of the month. Assume that Hudson prepares adjustments at the end of each month Required 1. How much revenue should Hudson record in September? How much revenue should Hudson record in October? 2. Identify and analyze the transactions, including any adjustments, on Hudson's books during the month of October. Exercise 4-22 Working Backward: Rent Receivable Randy's Rentals reported the following on its year-end balance sheets Los XAMPLE 4-10 December 31, 2017 December 31, 2016 Current Assets: Rent receivable $55,000 $35,800 Randy's rents space to a number of tenants, all of whom pay their monthly the following month. Randy's reported rent revenue for 2017 of $64,200