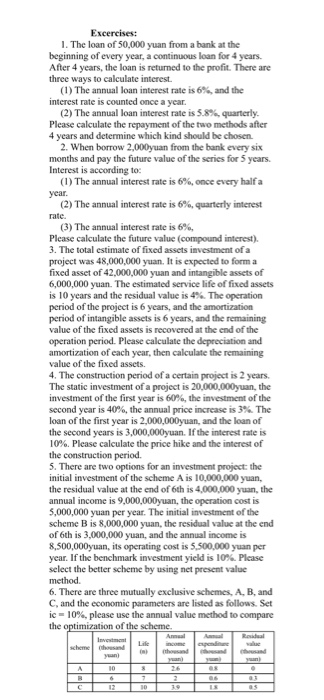

Excercises: 1. The loan of 50,000 yuan from a bank at the beginning of every year, a continuous loan for 4 years. After 4 years, the loan is returned to the profit. There are ways to calculate interest. (1 ) The annual loan interest rate is 6% and the interest rate is counted once a year (2) The annual loan interest tate is 5.8%, quarterly. Please calculate the repayment of the two methods after years and determine which kind should be chosen 2. When borrow 2,000yuan from the bank every six months and pay the future value of the series for 5 years Interest is according to: ( 1 ) The annual interest rate is 6%, once every halfa (2) The annual interest rate is 6%, quarterly interest (3) The annual interest rate is 6%, Please calculate the future value (compound interest). 3. The total estimate of fixed assets investment of a project was 48,000,000 yuan. It is expected to form a fixed asset of 42,000,000 yuan 6,000,000 yuan. The estimated service life of fixed assets is 10 years and the residual value is 4% The operation period of the project is 6 years, and the amortization period of intangible assets is 6 years, and the remaining value of the fixed assets is recovered at the end of the operation period. Please calculate the depreciation and amortization of each year, value of the fixed assets. 4. The construction period of a certain project is 2 years. The static investment of a project is 20,000,000yuan, the investment of the first year is 60%, the investment of the second year is 4050, the annual price increase is 3% The loan of the first year is 2,000,000yuan, and the loan of the second years is 3,000,000yuan. If the interest rate is 10%. Please calculate the construction period. 5. There are two options for an investment project: the initial investment of the scheme A is 10,000,000 yuan, the residual value at the end of 6th is 4,000,000 yuan, annual income is 9,000,000yuan, the operation cost is 5,000,000 yuan per year. The initial investment of the scheme B is 8,000,000 of 6th is 3,000,000 yuan, and the annual income is 8,500,000yuan, its operating cost is 5,500,000 yuan per year. If the benchmark investment yield is 10%. Pease select the better scheme by using net present value and intangible assets of then calculate the remaining the price hike and the interest of yuan, the residual value at the end 6. There are three mutually exclusive schemes, A, B, and C, and the economic parameters are listed as follows. Set ic-10%, please use the annual value method to compare of the scheme thousandLncome