Answered step by step

Verified Expert Solution

Question

1 Approved Answer

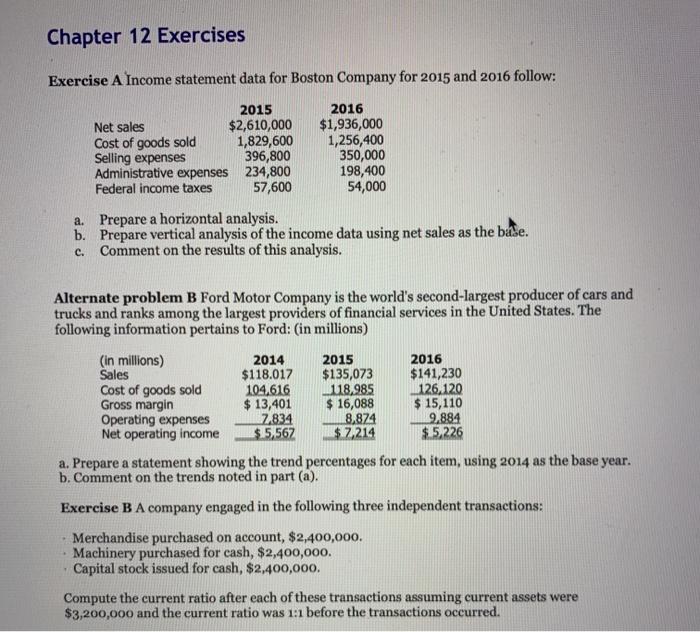

Excercises A-H Chapter 12 Exercises Exercise A Income statement data for Boston Company for 2015 and 2016 follow: 2015 2016 Net sales $2,610,000 $1,936,000 Cost

Excercises A-H

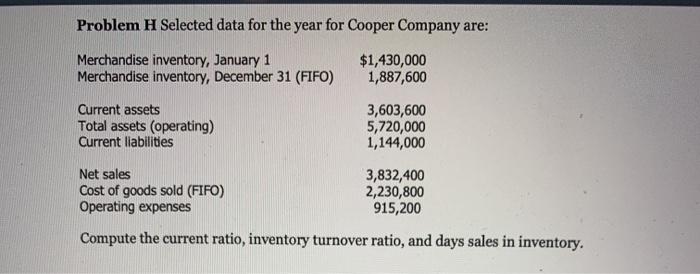

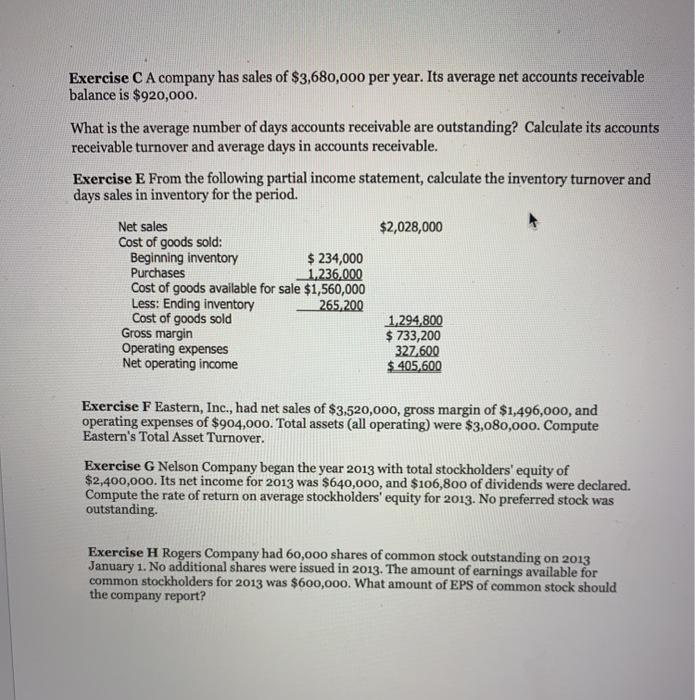

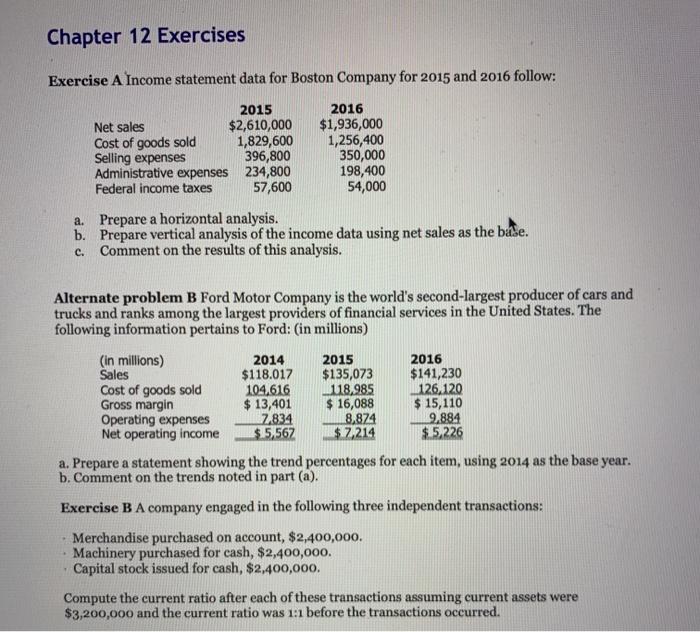

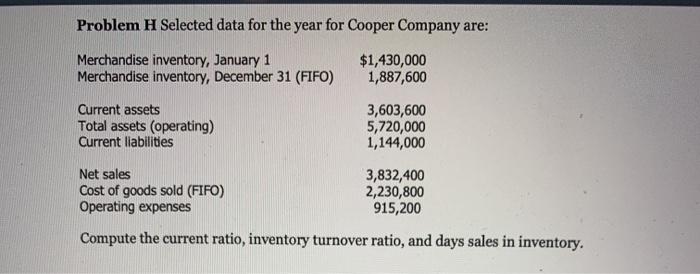

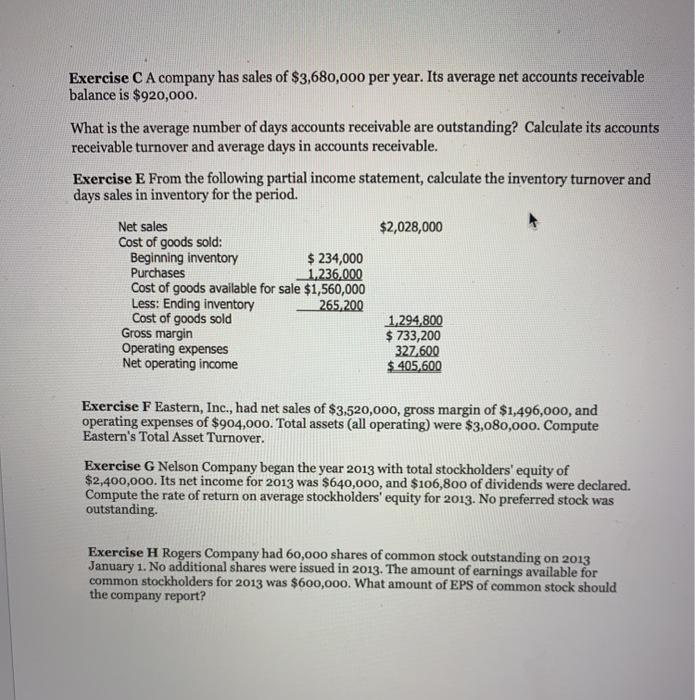

Chapter 12 Exercises Exercise A Income statement data for Boston Company for 2015 and 2016 follow: 2015 2016 Net sales $2,610,000 $1,936,000 Cost of goods sold 1,829,600 1,256,400 Selling expenses 396,800 350,000 Administrative expenses 234,800 198,400 Federal income taxes 57,600 54,000 a. Prepare a horizontal analysis. b. Prepare vertical analysis of the income data using net sales as the base. c. Comment on the results of this analysis. Alternate problem B Ford Motor Company is the world's second-largest producer of cars and trucks and ranks among the largest providers of financial services in the United States. The following information pertains to Ford: (in millions) (in millions) 2014 2015 2016 Sales $118.017 $135,073 $141,230 Cost of goods sold 104.616 118,985 126, 120 Gross margin $ 13,401 $ 16,088 $ 15,110 Operating expenses 7.834 8,874 9.884 Net operating income $5,562 $ 7,214 $5,226 a. Prepare a statement showing the trend percentages for each item, using 2014 as the base year. b. Comment on the trends noted in part (a). Exercise B A company engaged in the following three independent transactions: Merchandise purchased on account, $2,400,000. Machinery purchased for cash, $2,400,000. Capital stock issued for cash, $2,400,000. Compute the current ratio after each of these transactions assuming current assets were $3,200,000 and the current ratio was 1:1 before the transactions occurred. Problem H Selected data for the year for Cooper Company are: Merchandise inventory, January 1 Merchandise inventory, December 31 (FIFO) $1,430,000 1,887,600 Current assets Total assets (operating) Current liabilities 3,603,600 5,720,000 1,144,000 Net sales Cost of goods sold (FIFO) Operating expenses 3,832,400 2,230,800 915,200 Compute the current ratio, inventory turnover ratio, and days sales in inventory. Exercise C A company has sales of $3,680,000 per year. Its average net accounts receivable balance is $920,000. What is the average number of days accounts receivable are outstanding? Calculate its accounts receivable turnover and average days in accounts receivable. Exercise E From the following partial income statement, calculate the inventory turnover and days sales in inventory for the period. $2,028,000 Net sales Cost of goods sold: Beginning inventory $ 234,000 Purchases 1,236,000 Cost of goods available for sale $1,560,000 Less: Ending inventory 265,200 Cost of goods sold Gross margin Operating expenses Net operating income 1.294,800 $ 733,200 327,600 $ 405,600 Exercise F Eastern, Inc., had net sales of $3,520,000, gross margin of $1,496,000, and operating expenses of $904,000. Total assets (all operating) were $3,080,000. Compute Eastern's Total Asset Turnover. Exercise G Nelson Company began the year 2013 with total stockholders' equity of $2,400,000. Its net income for 2013 was $640,000, and $106,800 of dividends were declared. Compute the rate of return on average stockholders' equity for 2013. No preferred stock was outstanding. Exercise H Rogers Company had 60,000 shares of common stock outstanding on 2013 January 1. No additional shares were issued in 2013. The amount of earnings available for common stockholders for 2013 was $600,000. What amount of EPS of common stock should the company report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started