Answered step by step

Verified Expert Solution

Question

1 Approved Answer

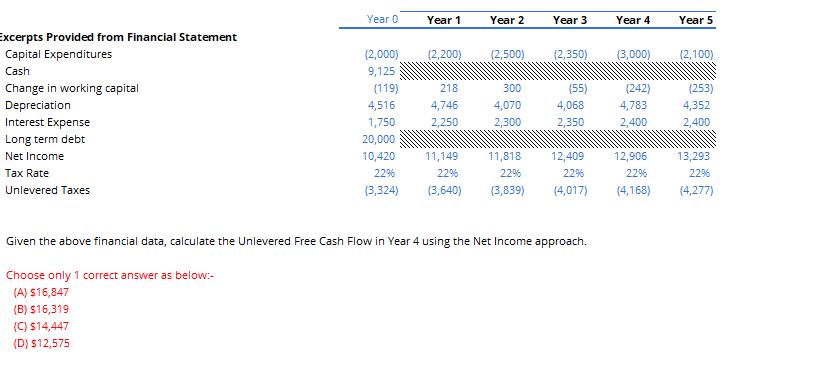

Excerpts Provided from Financial Statement Capital Expenditures Cash Change in working capital Depreciation Interest Expense Long term debt Net Income Tax Rate Unlevered Taxes

Excerpts Provided from Financial Statement Capital Expenditures Cash Change in working capital Depreciation Interest Expense Long term debt Net Income Tax Rate Unlevered Taxes Year 0 (2,000) 9,125 (119) 4,516 1,750 20,000 10,420 2296 (3,324) Year 1 (2,200) 218 4,746 2,250 11,149 22% (3,640) Year 2 (2,500) 300 4,070 2,300 11,818 22% (3,839) Year 3 (2,350) (55) 4,068 2,350 12,409 22% (4,017) Given the above financial data, calculate the Unlevered Free Cash Flow in Year 4 using the Net Income approach. Choose only 1 correct answer as below:- (A) $16,847 (B) $16,319 (C) $14,447 (D) $12,575 Year 4 (3,000) (242) 4,783 2,400 12,906 2296 (4,168) Year 5 (2,100) (253) 4,352 2,400 13,293 22% (4,277)

Step by Step Solution

★★★★★

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Unlevered Free Cash Flow UFCF using the Net Income approach we use the formula UFC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started