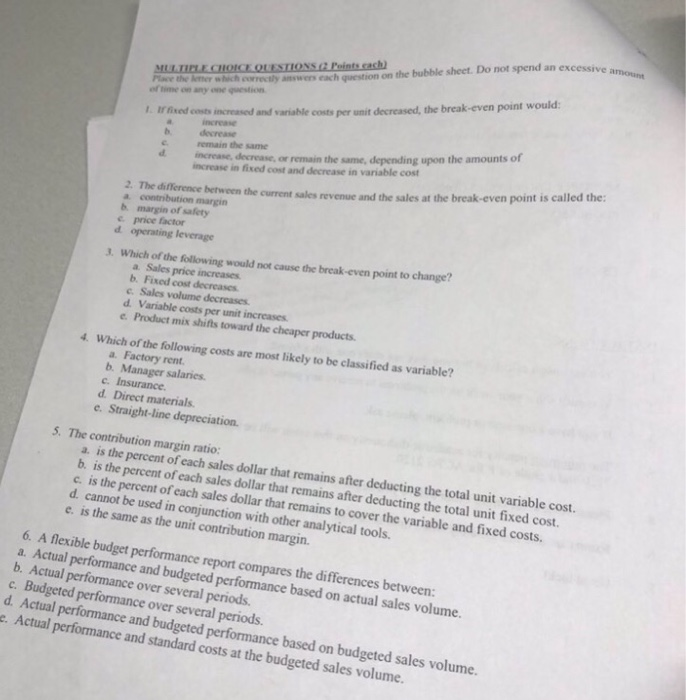

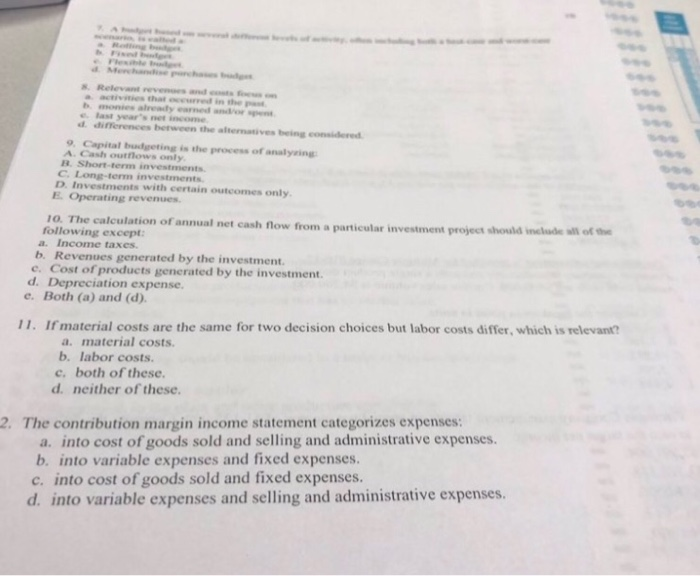

excessive amoant Points cach) MLTICLE CHOICE QUESTIONS Place t cstion on the bubble sheet. Do not the Atier which orely anwers each question on the bubble sheet. Do not spend an e of thime on sny onetion . irfed cot asod and variahle cots per unit decreased,the break-even point would increase, decrease, or remain the same, depending upon the amounts of increase in fixed cost and decrease in variable cost remain the same 2. The difference between the current sales revenue and the sales at the break-even point is a contribution margin b. margin of safety c. price factor operating leverage Which of the following would not cause the break-even point to change? 3. a. Sales price increases b. Fixed cost decreases c. Sales volume decreases d. Variable costs per unit increases e- Product mix shifts toward the cheaper products. Which of the following costs are most likely to be classified as variable? 4. a. Factory rent b. Manager salaries. c. d. Direct materials e. Straight-line depreciation. 5. The contribution margin ratio: a is the percent of each sales dollar that b. is the percent of each sales dollar tha remains after deducting the total unit variable cost. t remains after deducting the total unit fixed cost. c. is the percent of each sales doll lar that remains to cover the variable and fixed costs. d cannot be used in conjunction e. is the same as the unit contribution margin. in conjunction with other analytical tools. ible budget performance report compares the differences a. Actual performance and b. Actual performance over several periods. c. Budgeted performance over several periods. d. Actual performance and budge . Actual performance and standard costs at the budgeted sales volume. ed performance based on actual sales volume. ted performance based on budgeted sales volume. ctivities that owurred in the b monies alreaity earned andor sent last year's net income d. ifferences between the altematives being considered 069 9. Capital budgeting is the process of analysing A. Cash outflows only 096 B. Short-term investments C. Long-term investments D. Investments with certain outcomes only E. Operating revenues 10. The calculation of annual net cash flow from a particular investment project should include all of following except a. Income taxes b. Revenues generated by the investment e. Cost of products generated by the investment. d. Depreciation expense. e. Both (a) and (d). Ifmaterial costs are the same for two decision choices but labor costs differ, which is relevant? 11. a. material costs b. labor costs. e, both of these d. neither of these. 2. The contribution margin income statement categorizes expenses: a. into cost of goods sold and selling and administrative expenses. b. into variable expenses and fixed expenses. c. into cost of goods sold and fixed expenses. d. into variable expenses and selling and administrative expenses