Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sue was puzzled as to what course of action to take. She had recently started her job with a national CPA firm, and she

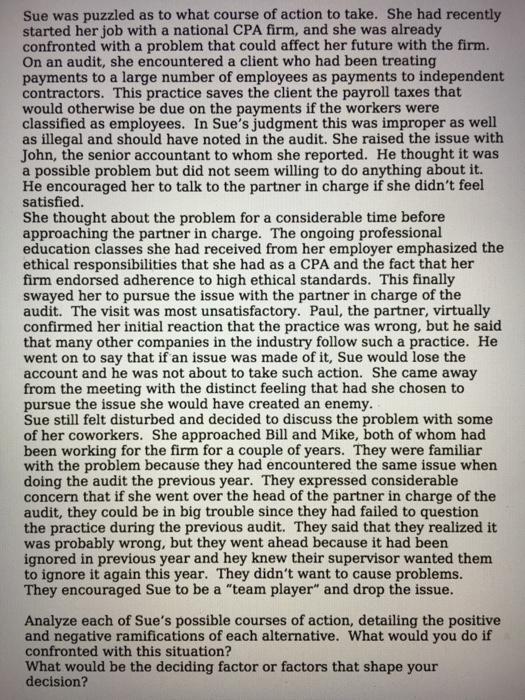

Sue was puzzled as to what course of action to take. She had recently started her job with a national CPA firm, and she was already confronted with a problem that could affect her future with the firm. On an audit, she encountered a client who had been treating payments to a large number of employees as payments to independent contractors. This practice saves the client the payroll taxes that would otherwise be due on the payments if the workers were classified as employees. In Sue's judgment this was improper as well as illegal and should have noted in the audit. She raised the issue with John, the senior accountant to whom she reported. He thought it was a possible problem but did not seem willing to do anything about it. He encouraged her to talk to the partner in charge if she didn't feel satisfied. She thought about the problem for a considerable time before approaching the partner in charge. The ongoing professional education classes she had received from her employer emphasized the ethical responsibilities that she had as a CPA and the fact that her firm endorsed adherence to high ethical standards. This finally swayed her to pursue the issue with the partner in charge of the audit. The visit was most unsatisfactory. Paul, the partner, virtually confirmed her initial reaction that the practice was wrong, but he said that many other companies in the industry follow such a practice. He went on to say that if an issue was made of it, Sue would lose the account and he was not about to take such action. She came away from the meeting with the distinct feeling that had she chosen to pursue the issue she would have created an enemy. Sue still felt disturbed and decided to discuss the problem with some of her coworkers. She approached Bill and Mike, both of whom had been working for the firm for a couple of years. They were familiar with the problem because they had encountered the same issue when doing the audit the previous year. They expressed considerable concern that if she went over the head of the partner in charge of the audit, they could be in big trouble since they had failed to question the practice during the previous audit. They said that they realized it was probably wrong, but they went ahead because it had been ignored in previous year and hey knew their supervisor wanted them to ignore it again this year. They didn't want to cause problems. They encouraged Sue to be a "team player" and drop the issue. Analyze each of Sue's possible courses of action, detailing the positive and negative ramifications of each alternative. What would you do if confronted with this situation? What would be the deciding factor or factors that shape your decision?

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Sue can either report the incident to the labor department with proof or keep quiet and continue her service in the firm without hiding the clients ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started