Question

Dani Corp. issued 20,000 bonds with 4.5 percent semiannual coupon and a face value of $1,000, three years ago. The yield to maturity of

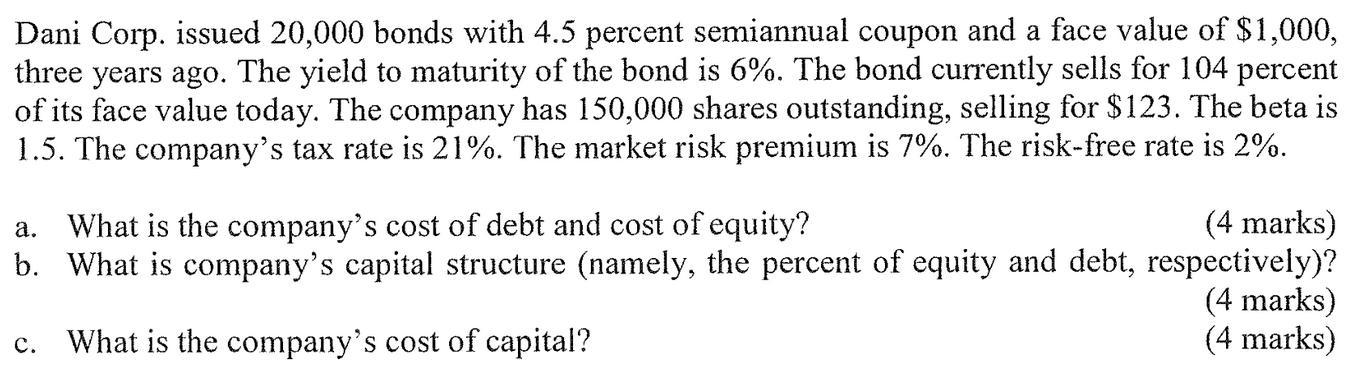

Dani Corp. issued 20,000 bonds with 4.5 percent semiannual coupon and a face value of $1,000, three years ago. The yield to maturity of the bond is 6%. The bond currently sells for 104 percent of its face value today. The company has 150,000 shares outstanding, selling for $123. The beta is 1.5. The company's tax rate is 21%. The market risk premium is 7%. The risk-free rate is 2%. (4 marks) a. What is the company's cost of debt and cost of equity? b. What is company's capital structure (namely, the percent of equity and debt, respectively)? (4 marks) C. What is the company's cost of capital? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Companys cost of debt and cost of equity The cost of debt is the interest rate that a company pays ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: Roger A. Arnold

12th edition

978-1305758674, 1305758676, 978-1285738321

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App