Question

Execution: A portfolio manager makes a decision to buy 5,000 shares of Sumatra Natural Resources at 10:00 a.m, when the price was 22.36. The following

Execution:

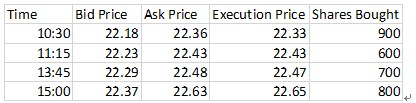

A portfolio manager makes a decision to buy 5,000 shares of Sumatra Natural Resources at 10:00 a.m, when the price was 22.36. The following are snapshots of the trades made during that time.

The closing price for the day was the portfolio managers last trade at 22.65, at which point the order for the remaining 2,000 shares was cancelled. Calculate the following:

i) What is the average effective spread (Hint: you know how to calculate all the individual spreads):

ii) Assume that the trades listed are the only ones executed that day in Sumatra. What is the VWAP?

iii) Assume that total commissions paid were $210 for the 3,000 shares purchased. Calculate the implementation shortfall:

iv) Calculate the explicit costs

Bid Price Ask Price Execution Price Shares Bought Time 1030 900 22.18 22.36 22.33 11:15 22.23 22.43 600 22.43 13:45 22.29 700 22.48 22.47 15:00 22.37 22.63 800 22.65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started