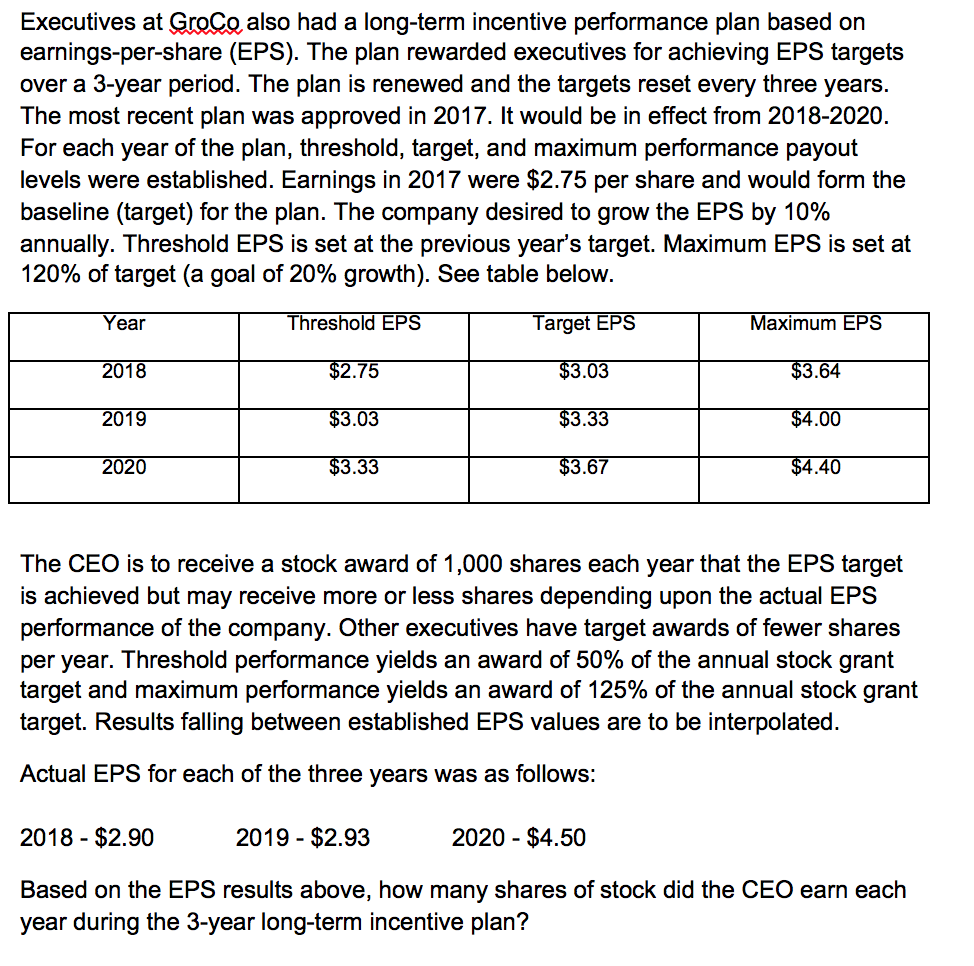

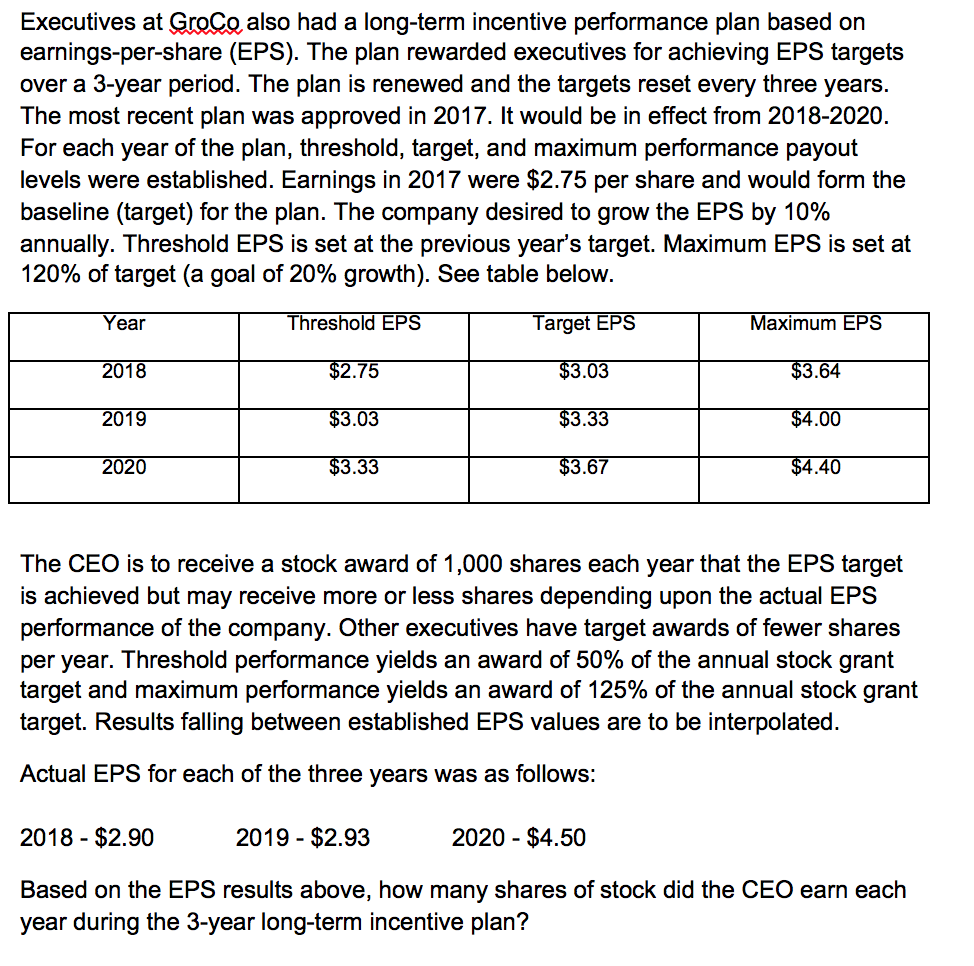

Executives at Groce also had a long-term incentive performance plan based on earnings-per-share (EPS). The plan rewarded executives for achieving EPS targets over a 3-year period. The plan is renewed and the targets reset every three years. The most recent plan was approved in 2017. It would be in effect from 2018-2020. For each year of the plan, threshold, target, and maximum performance payout levels were established. Earnings in 2017 were $2.75 per share and would form the baseline (target) for the plan. The company desired to grow the EPS by 10% annually. Threshold EPS is set at the previous year's target. Maximum EPS is set at 120% of target (a goal of 20% growth). See table below. Year Threshold EPS Target EPS Maximum EPS 2018 $2.75 $3.03 $3.64 2019 $3.03 $3.33 $4.00 2020 $3.33 $3.67 $4.40 The CEO is to receive a stock award of 1,000 shares each year that the EPS target is achieved but may receive more or less shares depending upon the actual EPS performance of the company. Other executives have target awards of fewer shares per year. Threshold performance yields an award of 50% of the annual stock grant target and maximum performance yields an award of 125% of the annual stock grant target. Results falling between established EPS values are to be interpolated. Actual EPS for each of the three years was as follows: 2018 - $2.90 2019 - $2.93 2020 - $4.50 Based on the EPS results above, how many shares of stock did the CEO earn each year during the 3-year long-term incentive plan? Executives at Groce also had a long-term incentive performance plan based on earnings-per-share (EPS). The plan rewarded executives for achieving EPS targets over a 3-year period. The plan is renewed and the targets reset every three years. The most recent plan was approved in 2017. It would be in effect from 2018-2020. For each year of the plan, threshold, target, and maximum performance payout levels were established. Earnings in 2017 were $2.75 per share and would form the baseline (target) for the plan. The company desired to grow the EPS by 10% annually. Threshold EPS is set at the previous year's target. Maximum EPS is set at 120% of target (a goal of 20% growth). See table below. Year Threshold EPS Target EPS Maximum EPS 2018 $2.75 $3.03 $3.64 2019 $3.03 $3.33 $4.00 2020 $3.33 $3.67 $4.40 The CEO is to receive a stock award of 1,000 shares each year that the EPS target is achieved but may receive more or less shares depending upon the actual EPS performance of the company. Other executives have target awards of fewer shares per year. Threshold performance yields an award of 50% of the annual stock grant target and maximum performance yields an award of 125% of the annual stock grant target. Results falling between established EPS values are to be interpolated. Actual EPS for each of the three years was as follows: 2018 - $2.90 2019 - $2.93 2020 - $4.50 Based on the EPS results above, how many shares of stock did the CEO earn each year during the 3-year long-term incentive plan