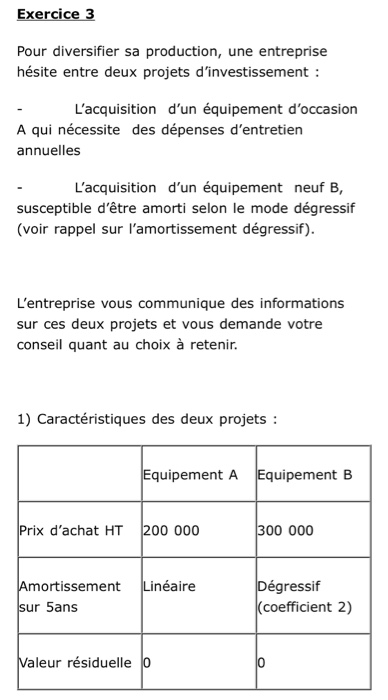

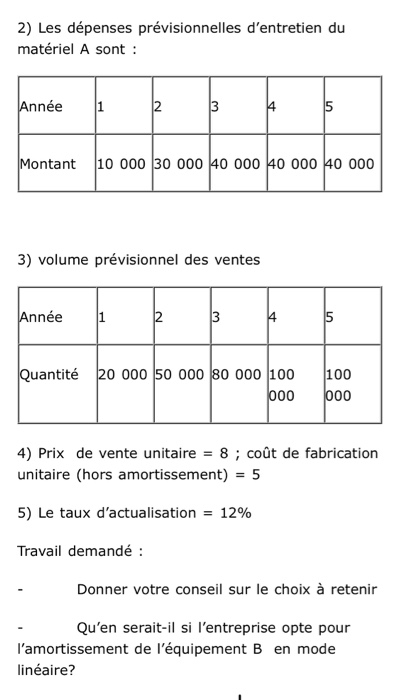

Exercice 3 Pour diversifier sa production, une entreprise hsite entre deux projets d'investissement : L'acquisition d'un quipement d'occasion A qui ncessite des dpenses d'entretien annuelles - L'acquisition d'un quipement neuf B, susceptible d'tre amorti selon le mode dgressif (voir rappel sur l'amortissement dgressif). L'entreprise vous communique des informations sur ces deux projets et vous demande votre conseil quant au choix retenir. 1) Caractristiques des deux projets : Equipement A Equipement B Prix d'achat HT 200 000 300 000 Linaire Amortissement sur 5ans Dgressif (coefficient 2) Valeur rsiduelle 2) Les dpenses prvisionnelles d'entretien du matriel A sont : Anne 1 2 3 4 Montant 10 000 30 000 40 000 40 000 40 000 3) volume prvisionnel des ventes Anne Quantit 20 000 50 000 80 000 100 000 000 4) Prix de vente unitaire = 8; cot de fabrication unitaire (hors amortissement) = 5 5) Le taux d'actualisation = 12% Travail demand : Donner votre conseil sur le choix retenir Qu'en serait-il si l'entreprise opte pour l'amortissement de l'quipement B en mode linaire? Exo 3 To diversify its production, a company hesitates between two investment projects: - The acquisition of second-hand equipment A which requires annual maintenance costs - The acquisition of new equipment B, capable of being depreciated using the declining balance method (see reminder on declining balance depreciation). The company will provide you with information on these two projects and ask you for your advice on the choice to make. 1) Characteristics of the two projects: Purchase price excl : Equipment A : 200,000 Equipment B: 300,000 Amortization over 5 years : Linear & Decreasing (coefficient 2) Residual value : 0&0 2) The forecast maintenance expenses for equipment A are: Year & Amount 1:10,000 2:30,000 3:40,000 4:40,000 5:40,000 3) Forecast sales volume Year & Quantity 1: 20,000 2:50,000 3: 80,000 4: 100,000 5: 100,000 4) Unit selling price = 8; Unit manufacturing cost (excluding depreciation) = 5 5) The discount rate = 12% Required work: - Give your advice on the choice to retain - What if the company chooses to depreciate equipment B in linear mode ? Exercice 3 Pour diversifier sa production, une entreprise hsite entre deux projets d'investissement : L'acquisition d'un quipement d'occasion A qui ncessite des dpenses d'entretien annuelles - L'acquisition d'un quipement neuf B, susceptible d'tre amorti selon le mode dgressif (voir rappel sur l'amortissement dgressif). L'entreprise vous communique des informations sur ces deux projets et vous demande votre conseil quant au choix retenir. 1) Caractristiques des deux projets : Equipement A Equipement B Prix d'achat HT 200 000 300 000 Linaire Amortissement sur 5ans Dgressif (coefficient 2) Valeur rsiduelle 2) Les dpenses prvisionnelles d'entretien du matriel A sont : Anne 1 2 3 4 Montant 10 000 30 000 40 000 40 000 40 000 3) volume prvisionnel des ventes Anne Quantit 20 000 50 000 80 000 100 000 000 4) Prix de vente unitaire = 8; cot de fabrication unitaire (hors amortissement) = 5 5) Le taux d'actualisation = 12% Travail demand : Donner votre conseil sur le choix retenir Qu'en serait-il si l'entreprise opte pour l'amortissement de l'quipement B en mode linaire? Exo 3 To diversify its production, a company hesitates between two investment projects: - The acquisition of second-hand equipment A which requires annual maintenance costs - The acquisition of new equipment B, capable of being depreciated using the declining balance method (see reminder on declining balance depreciation). The company will provide you with information on these two projects and ask you for your advice on the choice to make. 1) Characteristics of the two projects: Purchase price excl : Equipment A : 200,000 Equipment B: 300,000 Amortization over 5 years : Linear & Decreasing (coefficient 2) Residual value : 0&0 2) The forecast maintenance expenses for equipment A are: Year & Amount 1:10,000 2:30,000 3:40,000 4:40,000 5:40,000 3) Forecast sales volume Year & Quantity 1: 20,000 2:50,000 3: 80,000 4: 100,000 5: 100,000 4) Unit selling price = 8; Unit manufacturing cost (excluding depreciation) = 5 5) The discount rate = 12% Required work: - Give your advice on the choice to retain - What if the company chooses to depreciate equipment B in linear mode