Answered step by step

Verified Expert Solution

Question

1 Approved Answer

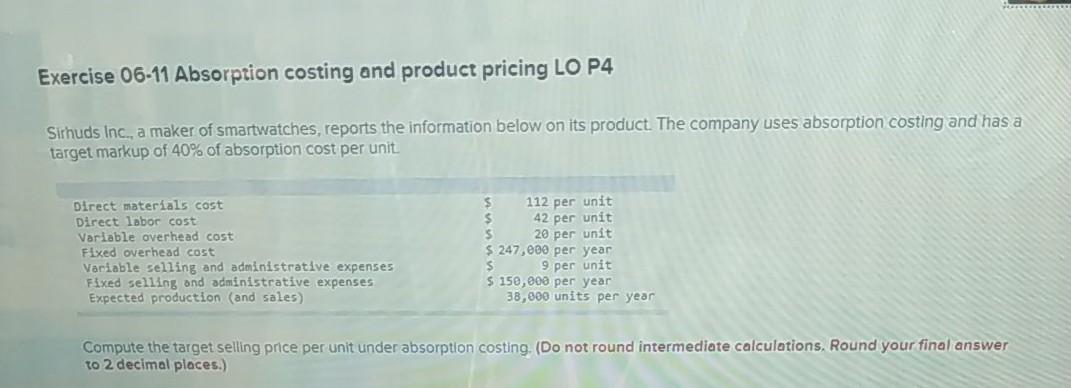

Exercise 06-11 Absorption costing and product pricing LO P4 Sirhuds Inc., a maker of smartwatches reports the information below on its product. The company uses

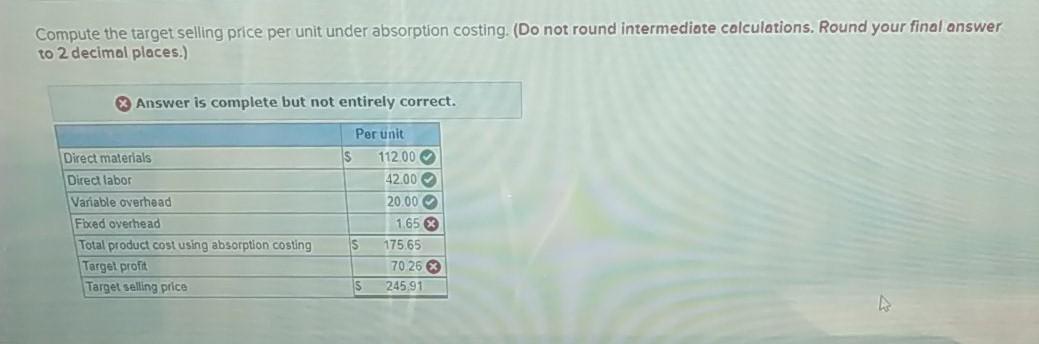

Exercise 06-11 Absorption costing and product pricing LO P4 Sirhuds Inc., a maker of smartwatches reports the information below on its product. The company uses absorption costing and has a target markup of 40% of absorption cost per unit Direct materials cost Direct labor cost Variable overhead cost Fixed overhead cost Variable selling and administrative expenses Fixed selling and administrative expenses Expected production (and sales) $ 112 per unit $ 42 per unit $ 20 per unit $ 247,000 per year $ 9 per unit $ 150,000 per year 38,000 units per year Compute the target selling price per unit under absorption costing. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Compute the target selling price per unit under absorption costing (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Answer is complete but not entirely correct. Direct materials Direct labor Variable overhead Forced overhead Total product cost using absorption costing Target profit Target selling price Per unit S 112.00 42.00 20.00 1.65$ IS 175.65 70 25 S 245,91

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started