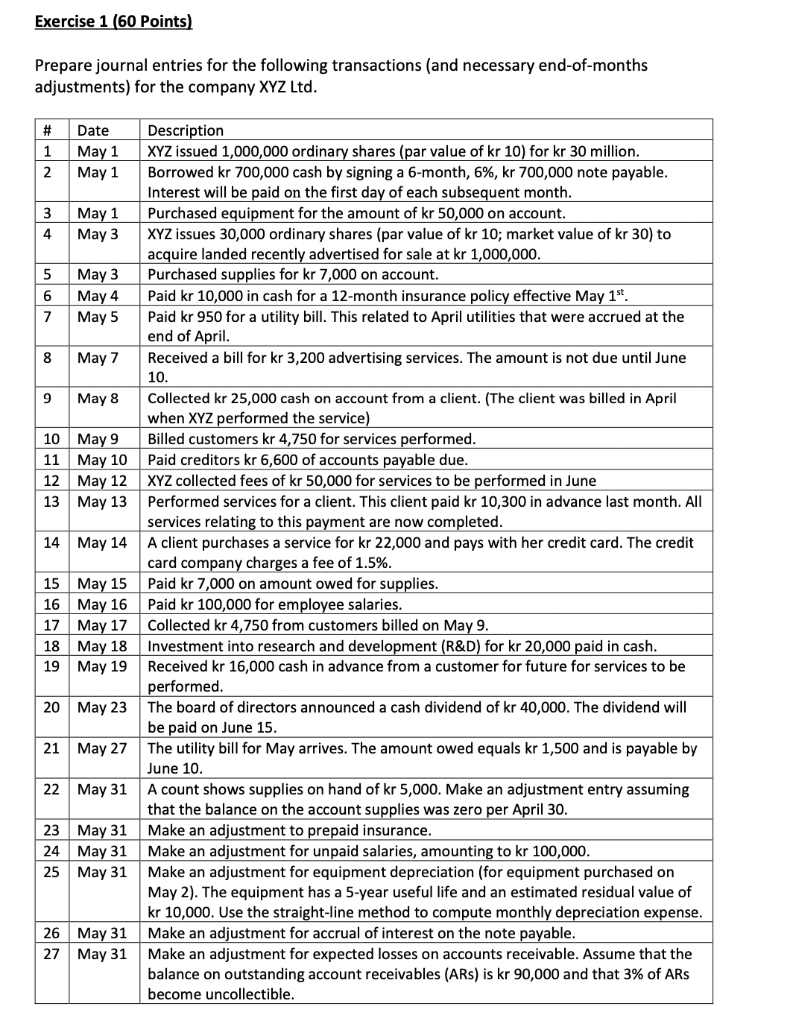

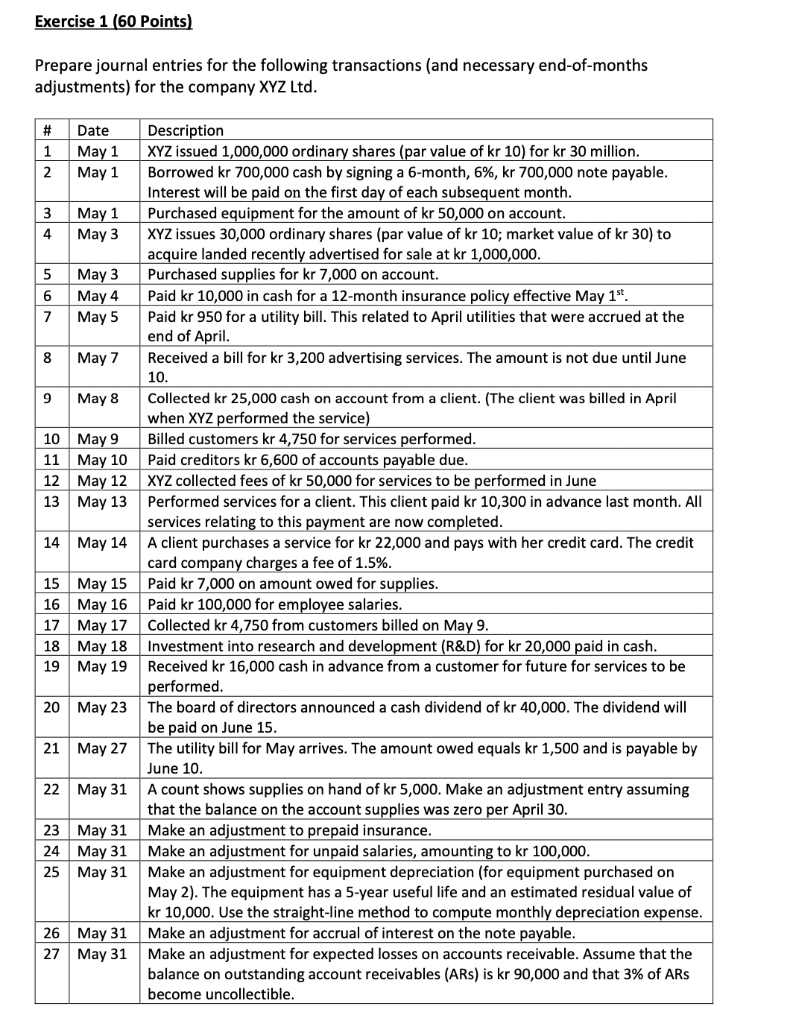

Exercise 1 (60 Points) Prepare journal entries for the following transactions (and necessary end-of-months adjustments) for the company XYZ Ltd. # Date Description 1 May 1 2 May 1 XYZ issued 1,000,000 ordinary shares (par value of kr 10) for kr 30 million. Borrowed kr 700,000 cash by signing a 6-month, 6%, kr 700,000 note payable. Interest will be paid on the first day of each subsequent month. Purchased equipment for the amount of kr 50,000 on account. 3 May 1 4 May 3 XYZ issues 30,000 ordinary shares (par value of kr 10; market value of kr 30) to acquire landed recently advertised for sale at kr 1,000,000. Purchased supplies for kr 7,000 on account. May 3 May 4 Paid kr 10,000 in cash for a 12-month insurance policy effective May 1st. May 5 Paid kr 950 for a utility bill. This related to April utilities that were accrued at the end of April. May 7 Received a bill for kr 3,200 advertising services. The amount is not due until June 10. May 8 Collected kr 25,000 cash on account from a client. (The client was billed in April when XYZ performed the service) 10 May 9 Billed customers kr 4,750 for services performed. 11 May 10 Paid creditors kr 6,600 of accounts payable due. 12 May 12 XYZ collected fees of kr 50,000 for services to be performed in June 13 May 13 Performed services for a client. This client paid kr 10,300 in advance last month. All services relating to this payment are now completed. 14 May 14 A client purchases a service for kr 22,000 and pays with her credit card. The credit card company charges a fee of 1.5%. 15 May 15 Paid kr 7,000 on amount owed for supplies. 16 May 16 Paid kr 100,000 for employee salaries. 17 May 17 Collected kr 4,750 from customers billed on May 9. 18 May 18 19 May 19 Investment into research and development (R&D) for kr 20,000 paid in cash. Received kr 16,000 cash in advance from a customer for future for services to be performed. 20 May 23 The board of directors announced a cash dividend of kr 40,000. The dividend will be paid on June 15. 21 May 27 The utility bill for May arrives. The amount owed equals kr 1,500 and is payable by June 10. 22 May 31 A count shows supplies on hand of kr 5,000. Make an adjustment entry assuming that the balance on the account supplies was zero per April 30. 23 May 31 Make an adjustment to prepaid insurance. 24 May 31 Make an adjustment for unpaid salaries, amounting to kr 100,000. 25 May 31 Make an adjustment for equipment depreciation (for equipment purchased on May 2). The equipment has a 5-year useful life and an estimated residual value of kr 10,000. Use the straight-line method to compute monthly depreciation expense. Make an adjustment for accrual of interest on the note payable. 26 May 31 27 May 31 Make an adjustment for expected losses on accounts receivable. Assume that the balance on outstanding account receivables (ARS) is kr 90,000 and that 3% of ARs become uncollectible. 5 6 7 8 9