Answered step by step

Verified Expert Solution

Question

1 Approved Answer

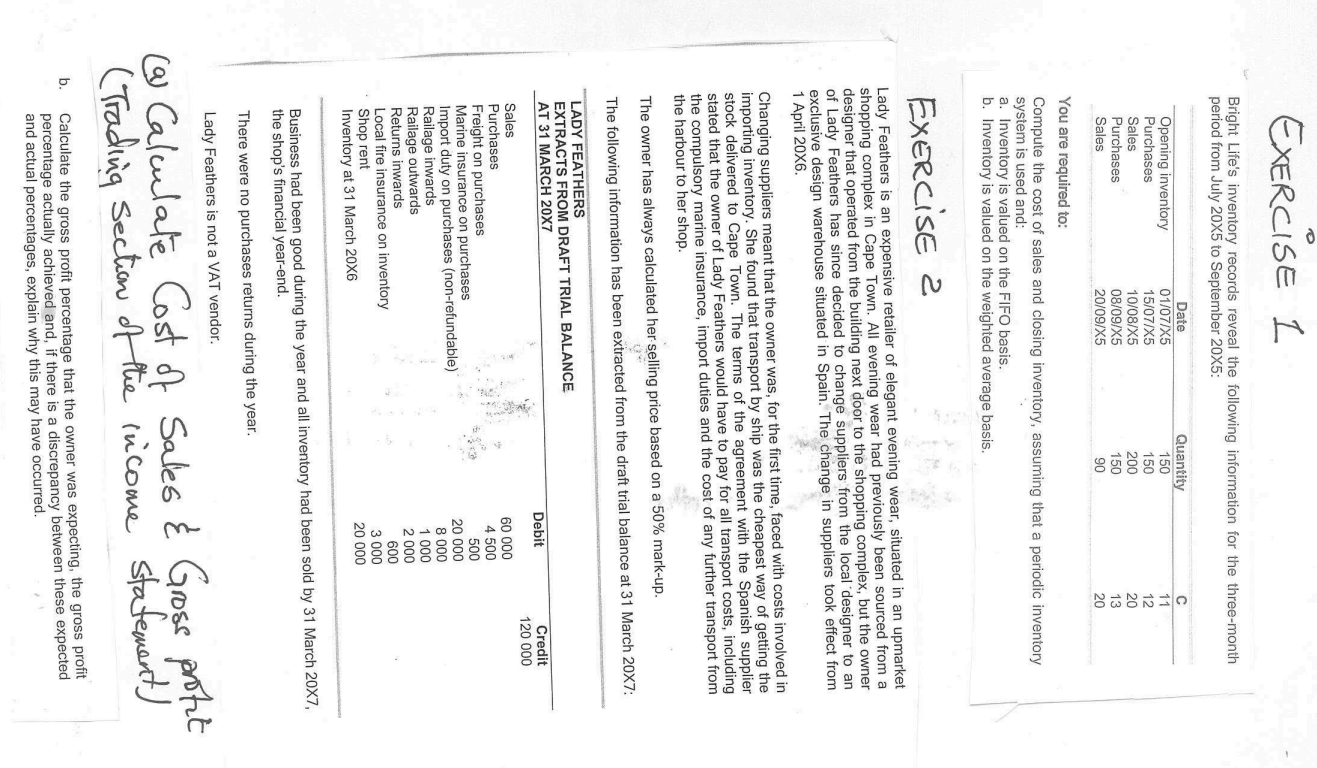

EXERCISE 1 Bright Life's inventory records reveal the following information for the three - month period from July 2 0 5 to September 2 0

EXERCISE

Bright Life's inventory records reveal the following information for the threemonth

period from July to September :

You are required to:

Compute the cost of sales and closing inventory, assuming that a periodic inventory

system is used and:

a Inventory is valued on the FIFO basis.

b Inventory is valued on the weighted average basis.

EXERCISE

Lady Feathers is an expensive retailer of elegant evening wear, situated in an upmarket

shopping complex in Cape Town. All evening wear had previously been sourced from a

designer that operated from the building next door to the shopping complex, but the owner

of Lady Feathers has since decided to change suppliers from the local designer to an

exclusive design warehouse situated in Spain. The change in suppliers took effect from

April

Changing suppliers meant that the owner was, for the first time, faced with costs involved in

importing inventory. She found that transport by ship was the cheapest way of getting the

stock delivered to Cape Town. The terms of the agreement with the Spanish supplier

stated that the owner of Lady Feathers would have to pay for all transport costs, including

the compulsory marine insurance, import duties and the cost of any further transport from

the harbour to her shop.

The owner has always calculated her selling price based on a markup

The following information has been extracted from the draft trial balance at March X:

LADY FEATHERS

EXTRACTS FROM DRAFT TRIAL BALANCE

AT MARCH

Business had been good during the year and all inventory had been sold by March X

the shop's financial yearend.

There were no purchases returns during the year.

Lady Feathers is not a VAT vendor.

a Calculate Cost of Sales & Gross protet

Trading section of the income stafement

b Calculate the gross profit percentage that the owner was expecting, the gross profit

percentage actually achieved and, if there is a discrepancy between these expected

and actual percentages, explain why this may have occurred.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started