Answered step by step

Verified Expert Solution

Question

1 Approved Answer

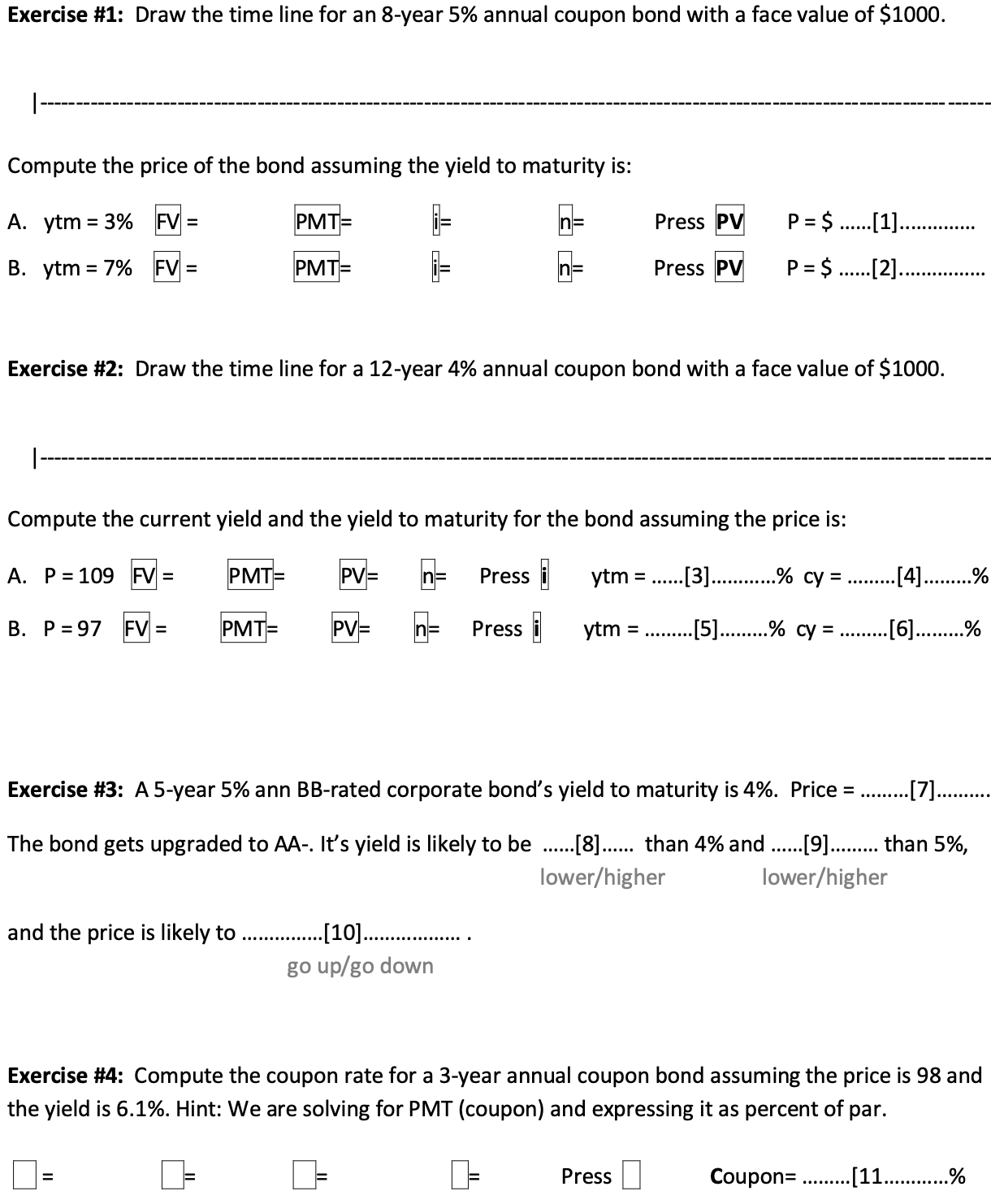

Exercise #1: Draw the time line for an 8-year 5% annual coupon bond with a face value of $1000. Compute the price of the bond

Exercise \#1: Draw the time line for an 8-year 5% annual coupon bond with a face value of $1000. Compute the price of the bond assuming the yield to maturity is: A. ytm=3% FV= PMT= n= Press PV P=$ B. ytm=7%FV= PMT= n= Press PV P=$ Exercise \#2: Draw the time line for a 12 -year 4% annual coupon bond with a face value of $1000. Compute the current yield and the yield to maturity for the bond assuming the price is: A. P=109FV=PMT=PV=n= Press iytm= [3] %cy= [4] .\% B. P=97FV=PMT=PV=n= Press iytm= [5] % = [6] \% Exercise \#3: A 5-year 5\% ann BB-rated corporate bond's yield to maturity is 4%. Price = [7] The bond gets upgraded to AA-. It's yield is likely to be [8] than 4% and [9] than 5%, lower/higher lower/higher and the price is likely to [10] go up/go down Exercise \#4: Compute the coupon rate for a 3-year annual coupon bond assuming the price is 98 and the yield is 6.1%. Hint: We are solving for PMT (coupon) and expressing it as percent of par. =:=PressCoupon= %

Exercise \#1: Draw the time line for an 8-year 5% annual coupon bond with a face value of $1000. Compute the price of the bond assuming the yield to maturity is: A. ytm=3% FV= PMT= n= Press PV P=$ B. ytm=7%FV= PMT= n= Press PV P=$ Exercise \#2: Draw the time line for a 12 -year 4% annual coupon bond with a face value of $1000. Compute the current yield and the yield to maturity for the bond assuming the price is: A. P=109FV=PMT=PV=n= Press iytm= [3] %cy= [4] .\% B. P=97FV=PMT=PV=n= Press iytm= [5] % = [6] \% Exercise \#3: A 5-year 5\% ann BB-rated corporate bond's yield to maturity is 4%. Price = [7] The bond gets upgraded to AA-. It's yield is likely to be [8] than 4% and [9] than 5%, lower/higher lower/higher and the price is likely to [10] go up/go down Exercise \#4: Compute the coupon rate for a 3-year annual coupon bond assuming the price is 98 and the yield is 6.1%. Hint: We are solving for PMT (coupon) and expressing it as percent of par. =:=PressCoupon= % Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started